We Ran A Stock Scan For Earnings Growth And 1Spatial (LON:SPA) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like 1Spatial (LON:SPA). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide 1Spatial with the means to add long-term value to shareholders.

View our latest analysis for 1Spatial

How Fast Is 1Spatial Growing Its Earnings Per Share?

1Spatial has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, 1Spatial's EPS grew from UK£0.0035 to UK£0.0095, over the previous 12 months. It's a rarity to see 176% year-on-year growth like that.

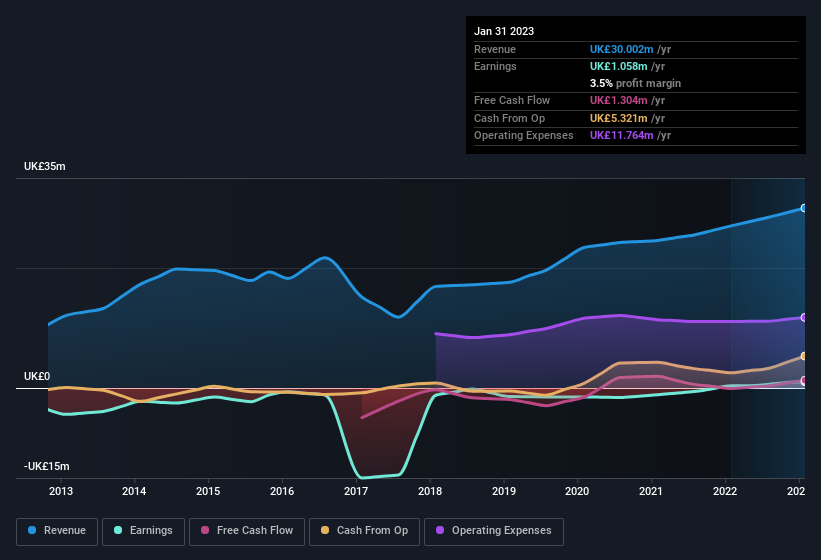

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. 1Spatial shareholders can take confidence from the fact that EBIT margins are up from 1.5% to 4.8%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for 1Spatial.

Are 1Spatial Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the real excitement comes from the UK£60k that CEO & Director Claire Milverton-Clark spent buying shares (at an average price of about UK£0.47). It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

It's reassuring that 1Spatial insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations under UK£165m, like 1Spatial, the median CEO pay is around UK£286k.

The 1Spatial CEO received UK£254k in compensation for the year ending January 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is 1Spatial Worth Keeping An Eye On?

1Spatial's earnings per share growth have been climbing higher at an appreciable rate. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. It could be that 1Spatial is at an inflection point, given the EPS growth. If so, then its potential for further gains probably merit a spot on your watchlist. It is worth noting though that we have found 1 warning sign for 1Spatial that you need to take into consideration.

Keen growth investors love to see insider buying. Thankfully, 1Spatial isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.