We Ran A Stock Scan For Earnings Growth And Orion (NYSE:OEC) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Orion (NYSE:OEC), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Orion with the means to add long-term value to shareholders.

View our latest analysis for Orion

How Fast Is Orion Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that Orion has grown EPS by 60% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Orion's EBIT margins have actually improved by 2.9 percentage points in the last year, to reach 12%, but, on the flip side, revenue was down 3.8%. That falls short of ideal.

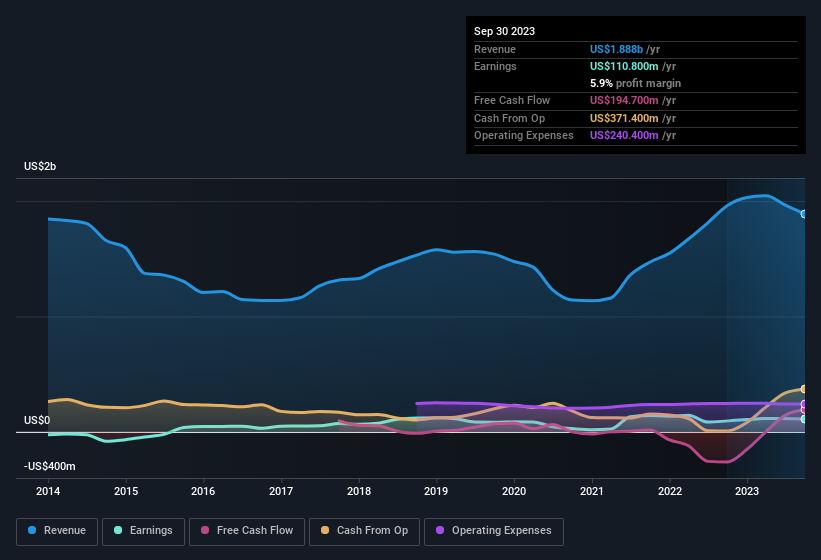

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Orion's future EPS 100% free.

Are Orion Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Even though some insiders sold down their holdings, their actions speak louder than words with US$586k more invested than sold by people who know they company best. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was CEO & Executive Director Corning Painter who made the biggest single purchase, worth US$324k, paying US$21.59 per share.

On top of the insider buying, it's good to see that Orion insiders have a valuable investment in the business. To be specific, they have US$39m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 2.9% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Orion Deserve A Spot On Your Watchlist?

Orion's earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Orion deserves timely attention. What about risks? Every company has them, and we've spotted 1 warning sign for Orion you should know about.

The good news is that Orion is not the only growth stock with insider buying. Here's a list of growth-focused companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.