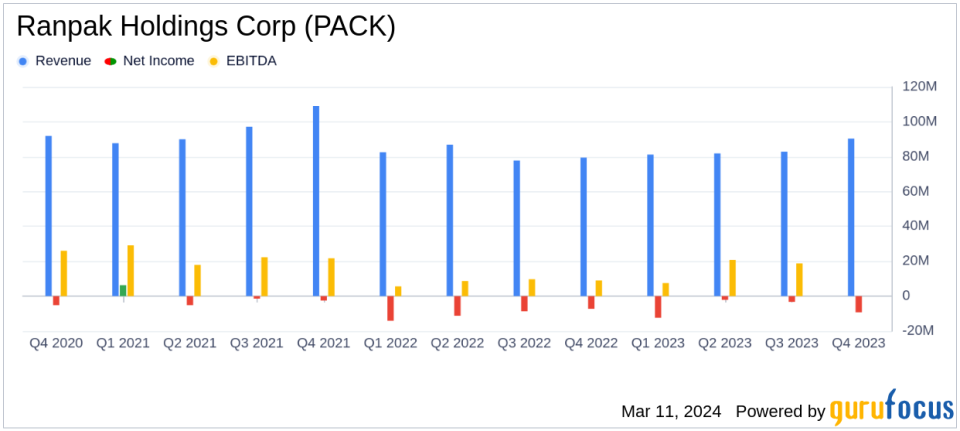

Ranpak Holdings Corp (PACK) Reports Solid Revenue Growth Amidst Net Loss in Q4 2023

Net Revenue Growth: Q4 net revenue increased by 13.9% year over year to $90.4 million.

Net Loss: The company reported a net loss of $9.3 million in Q4, compared to a net loss of $7.3 million in the same period last year.

Adjusted EBITDA Growth: Adjusted EBITDA on a constant currency basis rose significantly by 89.1% to $24.4 million.

Machine Placement: Packaging system placements grew by 1.5% year over year, reaching approximately 141,200 machines.

Full Year Performance: For the full year 2023, net revenue increased by 3.0% with a net loss of $27.1 million, showing improvement from a net loss of $41.4 million in 2022.

Liquidity and Debt: Ranpak ended the year with a strong liquidity position and a net debt to LTM Adjusted EBITDA ratio of 4.6x on a constant currency basis.

Ranpak Holdings Corp (NYSE:PACK) released its 8-K filing on March 11, 2024, detailing its financial performance for the fourth quarter of 2023. As a leading provider of environmentally sustainable, systems-based, product protection solutions for e-Commerce and industrial supply chains, PACK reported a year-over-year increase in net revenue for Q4 to $90.4 million, a 13.9% rise, and a 10.3% increase on a constant currency basis to $93.9 million.

Company Overview

Ranpak Holdings Corp is known for its full suite of protective packaging systems and paper consumables, with a significant portion of its revenue derived from Europe/Asia. The company's focus on sustainable packaging solutions positions it well in the growing e-Commerce and industrial sectors, where environmental considerations are increasingly important.

Performance and Challenges

Despite the revenue growth, PACK experienced a net loss of $9.3 million in Q4, a deterioration from the $7.3 million net loss in the prior year period. This performance reflects the challenges of scaling operations while managing costs. The company's profitability is crucial as it competes in the Packaging & Containers industry, where efficiency and cost control are key to maintaining margins.

Financial Achievements and Importance

The significant increase in Adjusted EBITDA to $24.4 million underscores PACK's ability to improve profitability through better volumes and favorable input costs. This achievement is particularly important for PACK as it demonstrates the potential of its business model to generate increased profits when operating at higher volumes.

Financial Metrics and Commentary

Key financial details from the earnings report include:

"We are pleased with our fourth quarter results as Ranpak finished the year on a positive note and built on the volume improvement momentum which began in the third quarter of 2023." - Omar Asali, Chairman and Chief Executive Officer

The company's balance sheet shows a cash balance of $62.0 million, with no borrowings on its $45 million Revolving Credit Facility. The net debt to LTM Adjusted EBITDA ratio of 4.6x indicates a leveraged position, but the company is committed to reducing this to less than 3.0x.

Analysis of Performance

Ranpak's performance in Q4 reflects a resilient business model capable of delivering revenue growth despite broader market challenges. The increase in packaging system placements suggests a growing customer base and market penetration. However, the net loss indicates ongoing challenges in achieving net profitability, a key focus area for the company moving forward.

For the full year 2023, the company's net revenue increase and reduced net loss compared to 2022 demonstrate progress in its operational efficiency and cost management strategies. The outlook for 2024, with expected net revenue growth of 6% 12% and AEBITDA growth of 5% 16%, suggests confidence in the company's strategic initiatives and market position.

Ranpak's focus on top-line growth, profitability, and deleveraging in 2024 will be critical as it seeks to capitalize on its investments in digital and physical infrastructure, product portfolio, and personnel.

The company will host a conference call and webcast to discuss the earnings report and provide further insights into its performance and strategies.

For a detailed understanding of Ranpak Holdings Corp's financials and strategic direction, investors and stakeholders are encouraged to review the full earnings report and participate in the upcoming conference call.

Explore the complete 8-K earnings release (here) from Ranpak Holdings Corp for further details.

This article first appeared on GuruFocus.