The Rare Metal Keeping Xi and Biden Up At Night

The ground beneath Case Lake in northeastern Ontario houses a critical mineral that may form the heart of one of the most pressing North American security issues of the century.

The critical mineral is cesium (Cs), and its discovery and potential for development has become a battleground between Canada and the U.S. on one hand, and China on the other.

At stake is nothing less than potential global technological dominance. North America has no cesium of its own. Those known cesium deposits around the world have either been depleted or the mines have been rendered inoperable—and when they were operable, China maintained control of them all, one way or another.

Without cesium, the U.S. likely cannot win the 5G race—a race that may be the determining factor for technological superiority.

Without cesium, there might be no aircraft guidance systems. No global positioning satellites. No internet or cellular telephone transmissions. Everything from the IT industry and health care to the military-industrial complex is severely impacted, making this a critical national security issue. And China maintains its ambitions, with help from Huawei, to win the 5G race.

This makes Case Lake one of the most closely watched exploration venues in the world. Fully owned by Power Metals Corp (TSXV:PWM,OTC:PWRMF), the Case Lake property is the only new potential cesium play in existence, and its significance has recently led the Canadian government to kick Chinese investors out, replacing them with lower-risk Western faces from Australia. Now, with several discoveries that include intersections of three critical metals--cesium, lithium and tantalum—what lies ahead could end up being the development of the first North American critical metals mine of its kind. And it would mean a lot to the West.

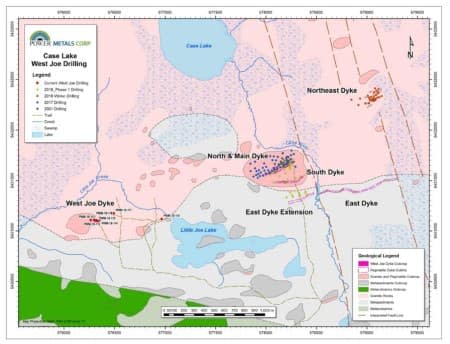

Case Lake: A ‘Geologist’s Dream’?The Case Lake pegmatite swarm consists of six spodumene dykes: North, Main, South, East and Northeast Dykes on the Henry Dome and the West Joe Dyke on a new tonalite dome. The property has a 10-kilometer-long mineral trend consisting of 475 cell claims, 100% owned by Power Metals.

Power Metals’ Chairman, Johnathan More, describes the property as a “geologist’s dream” and the equivalent of “prime real estate on Park Avenue” for a number of reasons.

First, it’s accessible year-round by well-maintained roads, with all infrastructure in place. While this may sound like a necessary given to investors who are not well-versed in the mining sector, that is rarely the case. Nearly all discoveries in Canada’s critical metals market are made in extremely remote areas. But at Case Lake, not only is all the road and electrical infrastructure already in place, but it even boasts cell phone signals. That added benefit is often unheard of in mining venues. One such example is the James Bay region of Quebec, where Patriot Battery Metals (OTCMKTS: PMETF) and Australia’s Winsome Resources (OTCMKTS: WRSLF) (ASX: WR1), have made major lithium discoveries in the past year. These discoveries have created a mining boom that has led to an intense rush on land bigger than anything Quebec has ever seen. But the region is as remote as they come, requiring helicopter support for access, which means that drilling isn’t only challenging—it’s expensive.

That’s what could help make Case Lake a geologist’s dream. According to Power Metals (TSXV:PWM,OTC:PWRMF), it’s one of the most inexpensive properties to drill in Canada—not just because of its easy access, either. The cesium, lithium and tantalum intersections here are in pegmatite that is exposed on the surface and running so shallow that it is less than 50 meters deep in various areas.

Potential World-Class Discoveries

To date, Power Metals has drilled 80 drill holes over some 15,000 meters at Case Lake, making a significant world-class, high-grade (over 4%) lithium discovery at a very shallow, open depth. Just a preview of the highlights from this discovery include:

1.94% Lithium and 323.75pp Tantalum over 26 meters

2.07% Lithium and 213.96pp Tantalum over 18 meters

4.75 % Lithium and 396.00pp Tantalum over 2 meters

1.71 % Lithium and 240.77pp Tantalum over 12 meters

1.20 % Lithium and 218.68pp Tantalum over 19 meters

The lithium discoveries were exciting enough, but then the unexpected happened.

In the summer of 2018, Power Metals made a surprise discovery of rare cesium while drilling for lithium and tantalum at Case Lake’s West Joe Dyke.

This is some of the highest-grade cesium found in decades, with grades as high as 24% over good intervals. According to Power Metals, the venue houses high-grade cesium that is similar to Australia’s famous Sinclair Mine. Highlights from that discovery include:

24.07% Cesium over 1 meter

20.36% Cesium over 1 meter

22.22% Cesium over 2 meters

7.65% Cesium over 7.09 meters

When this cesium discovery came to light, China-based Sinomine Resource Group—one of the largest in the world—immediately contacted Power Metals and ended up acquiring a 5.7% stake through private placement funding. [if !supportLineBreakNewLine][endif]

Power Metals continued to drill in 2022 with the investment from Sinomine, announcing some high-grade lithium and cesium results. But by then, cesium (and lithium, too) had become a national security issue for the Canadian government. In November last year, the Canadian Federal Government took decisive action against Chinese companies with ownership in any of Canada’s lithium reserves. Not only that, but the government moved swiftly to root out any Chinese involvement in Canadian lithium companies globally.

Due to national security concerns, Ottawa demanded that Sinomine divest from Power Metals, establishing Case Lake as a venue of urgent importance to Canada’s future.

While some initial reactions to this were a concern for investors, for Power Metals, it was viewed as a major opportunity.

“While we are surprised by Canada’s stance towards Chinese investment into Canada’s critical minerals industry, it clearly shows that they see the opportunity and assets of Power Metals as too valuable for such foreign investment,” Power Metals’ Chairman More said in a statement.

“Power Metals has made a substantial discovery of cesium, lithium and tantalum and this political gamesmanship demonstrates the extreme value of Power Metals assets,” More continued.

It didn't take long for a well-established Australian-based lithium company, Winsome Resources Limited, to step in and acquire Sinomine’s shares.

Winsome’s interest is not without context. The Australian mining company had made another major lithium discovery in James Bay Quebec earlier last year. But Winsome didn’t just take over the Chinese stake …

Its Managing Director, Chris Evans, joined the board of Power Metals.

Opportunity gathered momentum from there.

After digging deeper into Power Metals lithium and cesium discoveries, Winsome doubled its stake to 10.13% at a premium to the current share price.. Things continued to snowball when one of Winsome’s biggest shareholders, Waratah Capital (one of the largest lithium funds in the world) moved to invest in Power Metals, too.

Following this litany of victories for Power Metals that came out of Canada’s eviction of the Chinese, Waratah sweetened the deal further, purchasing a 2% royalty on future Case Lake lithium production for $1.5 million through Lithium Royalty Corp.

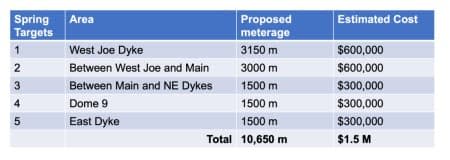

The current situation is that Power Metals has approximately C$10 million in cash and cash equivalents. It’s fully funded for the next two years of exploration plans. Those plans include another 15,000 meters of drilling, which is set to begin this summer.

What we have now is a junior explorer that has some important players in the lithium game among its shareholders. For starters, Power Metals (TSXV:PWM,OTC:PWRMF) now has access to Winsome’s world-class geologists, keeping in mind that Australia holds specific expertise in cesium as the home of one of only three cesium mines that have ever operated in the world. Newly appointed Power Metals CEO Gerry Brockelsby, a Toronto-based international mining financier, and newly appointed VP of Exploration Amanuel Bein, with a string of exploration successes under his belt, will team up with Winsome’s geologists to move what could be one of North America’s most exciting critical metals plays forward faster. Canada’s mission to secure its critical metals supply chain has set in motion a series of events that may present high-level opportunities for investors. Now that the Chinese exit has de-risked Case Lake from a national security perspective and major new shareholders have jumped on board, this cesium-lithium opportunity is one of our most urgent to watch in the coming months. Other resource companies to keep an eye on:

FMC Corporation (NYSE: FMC), based in Philadelphia, Pennsylvania, is a global agricultural sciences company that delivers innovative solutions to growers around the world. While not a mining company in the traditional sense, FMC has a significant stake in lithium, a critical component in rechargeable batteries and other high-tech applications.

FMC's commitment to innovation and sustainability is noteworthy, and the company's agricultural products contribute to increased crop yield and quality, making it a significant player in addressing global food security issues. In recent years, FMC has benefited from robust demand for its crop protection products, driven by higher commodity prices and strong agricultural market fundamentals.

FMC spun off its lithium business into a separate publicly-traded company, Livent Corporation, in 2018. Still, FMC remains a robust and diversified company with strong growth prospects, though investors specifically seeking exposure to lithium would need to look at Livent or other lithium-focused companies.

Livent Corporation (NYSE: LTHM), a spin-off from FMC Corporation, is a global leader in lithium technology, powering the electric vehicle revolution. The Philadelphia-based company supplies lithium used in batteries for hybrid and electric vehicles, mobile devices, and other consumer electronics.

Livent's position in the high-growth lithium market, driven by increasing demand for electric vehicles, makes it a compelling option for investors seeking exposure to the green energy transition. The company's unique process technology also provides a competitive advantage, with a focus on high-purity lithium compounds.

Livent's business is largely dependent on the lithium market, which has been volatile in recent years due to fluctuations in supply and demand dynamics. Potential investors should also consider that while Livent operates globally, it has significant operations in Argentina, which presents certain geopolitical risks.

Freeport-McMoRan Inc. (NYSE: FCX), based in Phoenix, Arizona, is one of the world's leading mining companies, with significant reserves of copper, gold, and molybdenum. The company's sizeable asset base includes the Grasberg minerals district in Indonesia, one of the world's largest copper and gold deposits, and significant mining operations in the Americas.

With copper being a critical material in renewable energy and electric vehicle technologies, Freeport-McMoRan stands to benefit from the global push towards greener economies. The company's strong operational performance and commitment to debt reduction also add to its investment appeal.

Freeport-McMoRan's operations in certain regions have faced regulatory and political challenges. For example, the company's Indonesian operations have faced regulatory changes and environmental controversies. While Freeport-McMoRan has made efforts to manage these issues, they highlight the geopolitical risks associated with global mining operations.

Turquoise Hill Resources (NYSE: TRQ), headquartered in Vancouver, Canada, is an international mining company focused on the operation and further development of the Oyu Tolgoi copper-gold mine in southern Mongolia. The mine is one of the world's largest known copper and gold deposits, and Turquoise Hill holds a 66% interest in the project, with the remaining stake held by the Government of Mongolia.

The Oyu Tolgoi mine offers significant growth potential, with an anticipated ramp-up in production over the coming years. The company has also worked towards strengthening its balance sheet and advancing operational performance, which could support long-term value creation.

Turquoise Hill's reliance on its Mongolia mine presents a concentrated risk profile. Potential investors should consider the company's ongoing disputes with its largest shareholder, Rio Tinto, and the Mongolian government, as these could impact future performance.

Compass Minerals International (NYSE: CMP), based in Overland Park, Kansas, is a leading provider of essential minerals, including salt, sulfate of potash, and magnesium chloride. The company's diversified product mix serves a wide range of markets, including agriculture, consumer deicing, water conditioning, and various industrial applications.

Compass Minerals' balanced and diversified portfolio, strong market position, and steady cash flows make it an interesting consideration for potential investors. The company's commitment to sustainability and operational excellence further enhance its appeal.

The company's performance can be influenced by weather conditions and commodity price volatility. For instance, milder winters can impact the demand for its deicing products. These factors highlight the need for potential investors to consider broader market and environmental conditions when evaluating Compass Minerals.

Rio Tinto (NYSE: RIO), a global leader in the mining and metals sector, is known for its operational efficiency and commitment to sustainable development. The UK-Australian multinational corporation operates in around 35 countries worldwide and has significant assets across several commodities including aluminum, copper, diamonds, coal, iron ore, and uranium. Rio Tinto's robust portfolio of world-class assets is further reinforced by strong market fundamentals, especially in the copper and iron ore markets, making it an interesting proposition for potential investors.

In recent news, Rio Tinto has accelerated its push into the green energy sector. The company is investing heavily in technology to lower carbon emissions and is actively involved in producing materials essential for the renewable energy industry, like copper and lithium. Furthermore, the company’s strong financial performance, underscored by solid profit margins and an attractive dividend yield, could make Rio Tinto an appealing choice for income-focused investors.

The company has faced criticism over environmental and indigenous rights issues, most notably the destruction of the Juukan Gorge caves in Western Australia. These incidents underscore the importance of considering ESG (Environmental, Social, and Governance) factors alongside financial factors when evaluating investment opportunities.

Glencore (OTC: GLNCY), based in Switzerland, is one of the world's largest globally diversified natural resource companies, known for its integrated value chain that includes mining, processing, refining, transporting, financing, and marketing operations. Its extensive product portfolio spans metals, minerals, energy products, and agricultural products, making it a compelling choice for those seeking exposure to a broad swath of the commodity market.

In an interesting recent development, Glencore has been navigating its transition to a low-carbon economy with significant investments in cobalt and copper, two essential metals for electric vehicle batteries. The company is also engaging in ambitious carbon reduction efforts and plans to be carbon-neutral by 2050. However, potential investors should also consider that Glencore, like many large mining corporations, has faced controversies related to environmental impact and governance.

While Glencore's stock is traded over-the-counter in the U.S., it maintains primary listings on the London Stock Exchange and the Johannesburg Stock Exchange. Potential investors should understand the unique risks associated with over-the-counter trading, such as lower liquidity and less stringent reporting requirements.

ArcelorMittal (NYSE: MT), based in Luxembourg, is the world's leading steel and mining company, with a presence in 60 countries and an industrial footprint in 18 countries. It is a leading supplier of quality steel in major global markets including automotive, construction, household appliances, and packaging.

The company has shown strong recovery following the COVID-19 pandemic and has benefited from strong global steel demand and price recovery. In recent news, ArcelorMittal has made commitments to carbon-neutral steelmaking in Europe by 2050 and has launched XCarb™, an initiative to progress towards carbon-neutral steel. This innovative step to meet the growing demand for green steel positions ArcelorMittal attractively to potential investors seeking sustainability-focused holdings.

The cyclical nature of the steel industry and sensitivity to global economic conditions should be factored into any investment decision. While ArcelorMittal's growth plans and commitment to sustainability are positive indicators, the inherent volatility of the steel market necessitates careful consideration.

Vale S.A. (NYSE: VALE), a Brazil-based multinational corporation, is one of the world's leading producers of iron ore and nickel. The company's extensive operations also span manganese, ferroalloys, copper, bauxite, potash, kaolin, and cobalt. As the largest logistics operator in Brazil, Vale also has a strong infrastructure for the distribution of its products.

In the backdrop of surging global demand for iron ore, particularly from China, Vale's vast reserves and efficient production make it a compelling choice for investors interested in commodities. The company is also looking ahead with investments in renewable energy projects and a stated goal of becoming carbon neutral by 2050.

Potential investors should be mindful of the risks associated with investing in Vale. The company's stock has shown volatility in recent years due to disruptions in its mining operations, most notably the tragic dam collapse in Brumadinho, Brazil in 2019. While Vale has made significant efforts to address safety and improve dam management, these incidents underline the potential risks associated with mining operations.

Southern Copper Corporation (NYSE: SCCO), one of the largest integrated copper producers in the world, is based in Phoenix, Arizona, and is a subsidiary of Grupo Mexico. The company's assets include valuable reserves of copper, molybdenum, zinc, silver, lead, and gold, making it a strong choice for investors seeking to tap into the potential of the copper market.

Southern Copper's production growth and operational efficiency are impressive, and the company has demonstrated a consistent commitment to dividend payouts, making it an attractive choice for income investors. Additionally, with a robust project pipeline and increasing demand for copper in the renewable energy and electric vehicle sectors, Southern Copper's long-term outlook appears promising.

That said, like all mining companies, Southern Copper faces risks related to environmental impact, operational disruptions, and commodity price volatility. The company has faced criticism and legal challenges related to environmental concerns in the past, emphasizing the importance of considering these factors in investment decisions.By. Tom Kool [if !supportLineBreakNewLine][endif]

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the Canadian mining sector will continue to protect its supply of critical minerals without involvement of China; that cesium and other metals will remain as critical minerals will continue as a national security issue for Western countries; that access to rare metals, and in particular cesium, will be essential to gaining technical superiority, including the development of 5G networks; that cesium and other rare earth metals will continue to be critical for use in various technologies, including the 5G cellular and wireless technologies; that cesium will continue to be a critical mineral and considered as matter of national security for Western countries; that Power Metals Corp. (the “Company”) and its investors will be in control of the only cesium mine that China does not own; that the Company’s properties will be able to commercially produce cesium, lithium, tantalum and/or other critical minerals; that the Company will be able to finance and operationally establish mines on its properties to viably and commercially extract the critical minerals; that Australian shareholders and investors in the Company will provide development and other expertise to assist the Company; that Winsome Resources will continue to own a significant stake in the Company; that the Company’s property will one day have one of the only potential mines in the world that is producing cesium; that the Company can finance ongoing operations and development; that the Company can achieve its business plans and objectives as anticipated. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include the development of alternative technologies that do not require the use of minerals and resources currently considered as critical; that other resources are utilized in future in favour of rare earth metals such as cesium; that alternative technologies utilize other resources or that cesium, lithium, and tantalum are not utilized; that other companies discover resources of cesium and other battery metals that are more favorable or more easily developed into commercial production that the Company’s property; that the Company’s properties are unable to produce commercial amounts of cesium, lithium, tantalum or other critical metals; that the Company will be unable to finance or operationally establish mines on its properties for commercial extraction of any critical minerals; that the Company’s Australian investors will not be able to provide development and other expertise to meaningful assist the Company; that Winsome Resources may for various reasons divest its stake in the Company in future; that the Company’s properties may fail to develop mines producing cesium; that the Company may be unable to finance its ongoing operations and development; that the business of the Company may be unsuccessful for various reasons. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Power Metals Corp. for this article but may in the future be compensated to conduct investor awareness advertising and marketing for Power Metals Corp. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct. The content of this article is based solely on our opinions which are based on very limited analysis and we are not professional analysts or advisors.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of Power Metals Corp. and therefore has an incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of Power Metals Corp. in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we are biased in our views and opinions in this article and why we stress that you should conduct your own extensive due diligence regarding the Company as well as seek the advice of your professional financial advisor or a registered broker-dealer before you consider investing in any securities of the Company or otherwise.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making any investment. This communication should not be used as a basis for making any investment in any securities.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.