Raymond James Financial Inc Reports Solid Growth Amidst Market Challenges

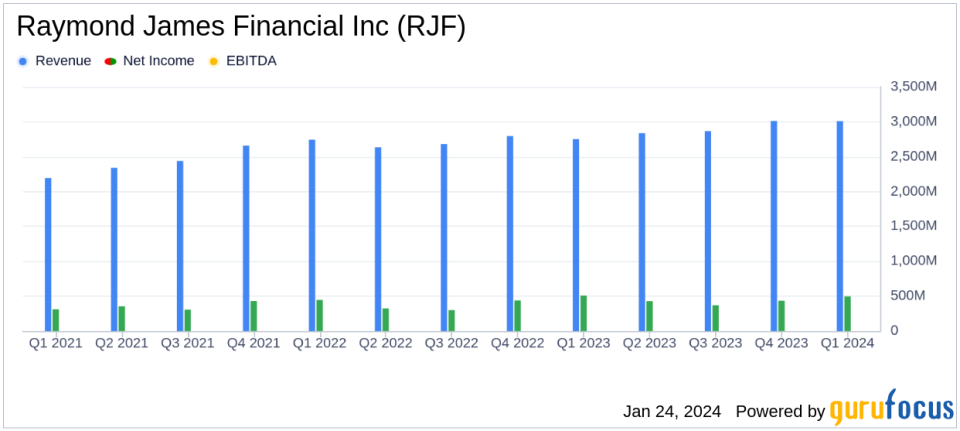

Net Revenues: $3.01 billion, an 8% increase year-over-year but a 1% decrease from the previous quarter.

Net Income: $497 million available to common shareholders, translating to $2.32 per diluted share.

Adjusted Net Income: Record $514 million, or $2.40 per diluted share after excluding acquisition-related expenses.

Client Assets: Record $1.37 trillion under administration and $215 billion under management, marking significant annual growth.

Return on Equity: Annualized return on common equity at 19.1% and adjusted return on tangible common equity at 23.8%.

Dividends and Repurchases: Quarterly cash dividend increased by 7% to $0.45 per share with a new $1.5 billion stock repurchase authorization.

On January 24, 2024, Raymond James Financial Inc (NYSE:RJF) released its 8-K filing, detailing its financial performance for the first fiscal quarter of 2024. The company, a leading financial holding company with operations in wealth management, investment banking, asset management, and commercial banking, supports a vast network of financial advisors and boasts over $1.2 trillion in assets under administration.

Financial Performance and Challenges

Raymond James Financial Inc reported an 8% increase in net revenues compared to the same quarter last year, reaching $3.01 billion. However, there was a slight 1% dip from the preceding quarter. The company's net income available to common shareholders was $497 million, or $2.32 per diluted share, with an adjusted net income of $514 million, or $2.40 per diluted share, after accounting for acquisition-related expenses.

Despite the positive revenue growth, the company faced challenges, including a 2% decline in net income compared to the prior-year quarter, primarily due to a one-time insurance settlement received in the previous year. Additionally, the company's bank segment experienced a decrease in net interest margin (NIM), which impacted revenue and pre-tax income.

Financial Achievements and Industry Significance

Raymond James Financial Inc's achievements, such as record client assets under administration and management, are significant in the capital markets industry. These metrics indicate the company's ability to attract and retain clients, which is crucial for sustained revenue growth. The firm's strong return on equity figures also demonstrate efficient use of shareholder capital, an important consideration for investors.

Income Statement and Balance Sheet Highlights

The company's income statement reflects robust asset management and related administrative fees, contributing to the year-over-year revenue growth. The balance sheet shows record client assets and a solid increase in net loans, suggesting healthy business expansion and lending activities.

"High satisfaction between clients and advisors, along with solid financial advisor retention and recruiting in the Private Client Group segment drove record quarterly earnings per share and strong net new asset annualized growth of 7.8% in the quarter," said Chair and CEO Paul Reilly.

Analysis of Company's Performance

Raymond James Financial Inc's performance in the first fiscal quarter of 2024 reflects a resilient business model capable of achieving growth despite market headwinds. The company's strategic focus on advisor recruitment and retention has paid off, as evidenced by the significant growth in net new assets. Furthermore, the firm's capital allocation strategies, including dividend increases and share repurchases, signal confidence in its financial stability and commitment to delivering shareholder value.

While the company's bank segment faced margin pressures, the overall health of the loan portfolio remained solid, with low levels of criticized loans. The effective tax rate for the quarter was 21.0%, benefiting from tax deductions related to share-based compensation.

As Raymond James Financial Inc navigates the complexities of the current financial landscape, its diversified services and robust advisor network position it well for continued success. Investors and stakeholders can look forward to the company's strategic initiatives bearing fruit in the coming quarters.

For a more detailed analysis and additional information on Raymond James Financial Inc's fiscal first quarter of 2024 performance, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Raymond James Financial Inc for further details.

This article first appeared on GuruFocus.