Rayonier (RYN) Q3 Earnings Beat Estimates, Revenues Lag

Rayonier Inc. RYN reported third-quarter 2023 pro-forma net income per share of 13 cents, beating the Zacks Consensus Estimate by a penny. However, the figure declined 13.3% from the prior-year quarter’s 15 cents.

Rayonier’s New Zealand Timber and Real Estate segments displayed solid results. However, weakness in the Southern Timber and Pacific Northwest Timber segments was noticed.

Quarterly revenues came in at $201.6 million, which missed the Zacks Consensus Estimate of $208.7 million. On a year-over-year basis, revenues rose 3.2%.

According to David Nunes, CEO of Rayonier, “We generated strong third-quarter results, particularly in light of the macroeconomic challenges that continue to adversely impact our timber businesses. Adjusted EBITDA improved 22% versus the prior year quarter, primarily driven by a stronger contribution from our Real Estate segment and increased carbon credit sales in our New Zealand Timber segment. Total Adjusted EBITDA for our collective timber segments increased 7% versus the prior year period, as favorable results in our Southern Timber and New Zealand Timber segments more than offset lower Adjusted EBITDA in our Pacific Northwest Timber segment.”

Segmental Performance

In the third quarter, the pro-forma operating income at the company’s Southern Timber segment came in at $18.6 million, which decreased 17.3% from the prior-year quarter’s $22.5 million. Our estimate for the metric was $12.8 million. The decline was due to a fall in net stumpage realizations, higher depletion rates, and higher overhead and other costs, partially offset by higher volumes and higher non-timber income.

The Pacific Northwest Timber segment reported a pro-forma operating loss of $0.6 million against an income of $3.3 million a year ago. Our estimate for the metric was the same as the reported number. The decline was attributable to lower net stumpage realizations, decreased volumes, higher costs and lower timber income, partially offset by lesser depletion rates.

The New Zealand Timber segment recorded pro-forma operating income of $17.6 million, up from the year-earlier quarter’s $9.3 million. This was due to high carbon credit sales, partially offset by lower volumes and lower net stumpage realizations.

Real Estate’s pro-forma operating income was $9.2 million, higher than the year-ago period of $4.3 million. The higher number of acres sold and the increase in weighted average prices led to the rise.

The Trading segment reported a $0.1 million pro-forma operating loss in the third quarter against an income of $0.2 million in the prior-year quarter. Our estimate for the metric was $0.2 million.

Balance Sheet

Rayonier exited the third quarter of 2023 with $107.8 million in cash and cash equivalents, down from $114.3 million as of Dec 31, 2022.

2023 Guidance

For 2023, Rayonier expects adjusted EBITDA to be at the higher end of the prior guidance of $275-$300 million.

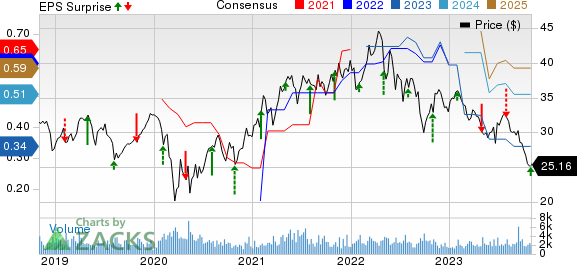

Rayonier Inc. Price, Consensus and EPS Surprise

Rayonier Inc. price-consensus-eps-surprise-chart | Rayonier Inc. Quote

Currently, Rayonier carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other REITs

Healthpeak Properties, Inc. PEAK reported third-quarter 2023 funds from operations (FFO) as adjusted per share of 45 cents, beating the Zacks Consensus Estimate by a whisker. The reported figure rose 4.6% from the prior-year quarter.

Results reflect better-than-anticipated revenues. Moreover, growth in same-store portfolio cash (adjusted) net operating income (NOI) was witnessed across the portfolio. The company raised its outlook for the current year.

Digital Realty Trust DLR reported a third-quarter 2023 core FFO per share of $1.62, in line with the Zacks Consensus Estimate.

Results reflected better-than-anticipated revenues, aided by strong enterprise leasing activity. The company registered operating revenues of $1.402 billion in the third quarter, surpassing the Zacks Consensus Estimate marginally. DLR also reported "same-capital" cash NOI growth of 9.4% in the third quarter.

Prologis, Inc. PLD reported a third-quarter 2023 core FFO per share of $1.30, beating the Zacks Consensus Estimate of $1.26. The figure, however, declined 24.9% from the year-ago quarter.

The results of this industrial REIT reflect healthy rent growth. However, lower occupancy and higher interest expenses were undermining factors. PLD also raised the midpoint of its 2023 core FFO per share guidance by a cent.

Note- Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prologis, Inc. (PLD) : Free Stock Analysis Report

Rayonier Inc. (RYN) : Free Stock Analysis Report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

Healthpeak Properties, Inc. (PEAK) : Free Stock Analysis Report