RBB Bancorp (RBB) Reports Increased Earnings and Strategic Initiatives in Q4 and Fiscal Year 2023

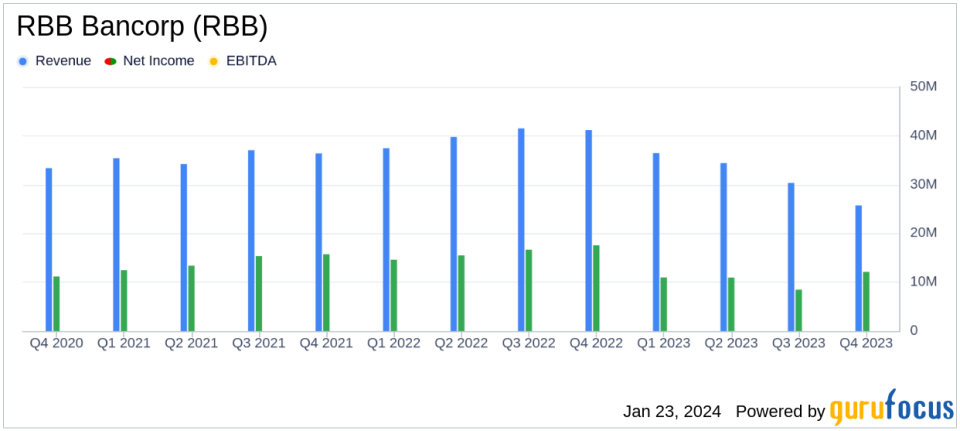

Net Income: RBB Bancorp (NASDAQ:RBB) reported a rise to $12.1 million in Q4, with $42.5 million for the fiscal year.

Earnings Per Share: Diluted earnings per share increased to $0.64 in Q4, up from $0.45 in Q3.

Net Interest Income: Experienced a decrease to $25.7 million in Q4 from $27.6 million in Q3.

Noninterest Income: Increased to $7.4 million in Q4, primarily due to a $5.0 million CDFI ERP award.

Asset Quality: Nonperforming loans decreased to $31.6 million at the end of Q4.

Capital Actions: Repurchased 396,374 shares for $6.7 million and redeemed $55.0 million of subordinated notes.

Balance Sheet: Total assets stood at $4.03 billion, a slight decrease from the previous quarter.

RBB Bancorp (NASDAQ:RBB) released its 8-K filing on January 23, 2024, detailing its financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, which operates as a bank holding company providing a range of banking products and services, reported a net income increase to $12.1 million for Q4, up from $8.5 million in Q3. This performance reflects a strategic focus on positioning the company for future growth and addressing regulatory concerns.

Financial Performance Overview

RBB Bancorp's net interest income for Q4 was $25.7 million, a decrease from the previous quarter, primarily due to higher interest expenses and lower interest income. Despite this, the bank's net interest margin decreased by 14 basis points to 2.73% in Q4. The bank also saw a significant increase in noninterest income to $7.4 million, largely thanks to a $5.0 million CDFI ERP award. Noninterest expenses slightly decreased to $16.4 million.

Strategic Initiatives and Challenges

CEO David Morris highlighted several initiatives undertaken in 2023 to position RBB Bancorp for the future, including strengthening the management team, restructuring operations, and increasing liquidity. These actions, while impacting short-term results, are expected to drive long-term shareholder value and improve profitability in various economic environments. Chairman Dr. James Kao expressed appreciation for the efforts of all RBB employees in their commitment to serving the Asian-American community.

Balance Sheet and Asset Quality

As of December 31, 2023, RBB Bancorp's total assets were $4.03 billion, a slight decrease from the previous quarter. Loans held for investment decreased by $89.1 million, and nonperforming assets decreased to $31.6 million, or 0.79% of total assets. The allowance for loan losses as a percentage of loans held for investment increased to 1.38%.

Capital Actions and Shareholder Returns

The bank redeemed all $55.0 million of its outstanding 6.18% subordinated notes and repurchased 396,374 shares for $6.7 million during Q4. The book value per share increased to $27.47, and the tangible book value per share increased to $23.48. A common stock cash dividend of $0.16 per share was declared, payable on February 9, 2024.

Corporate Governance and Regulatory Updates

RBB Bancorp continues to evaluate and enhance its corporate governance and oversight to align with business operations, regulatory, and investor expectations. The Board of Directors remains committed to these efforts.

For a detailed analysis of RBB Bancorp's financial performance, including income statements and balance sheets, interested readers and investors are encouraged to review the full 8-K filing. The company will also hold a conference call to discuss the Q4 and fiscal year 2023 financial results.

Value investors looking for comprehensive financial analysis and insights on RBB Bancorp (NASDAQ:RBB) and other companies can find in-depth reports and tools at GuruFocus.com.

Explore the complete 8-K earnings release (here) from RBB Bancorp for further details.

This article first appeared on GuruFocus.