RBC Bearings Inc (RBC) Reports Solid Growth in Fiscal 2024 Third Quarter Results

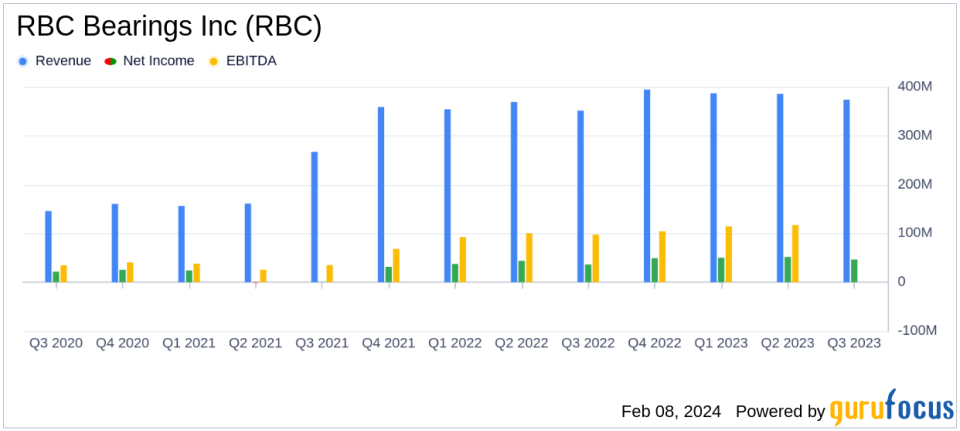

Net Sales: Increased by 6.3% to $373.9 million in Q3 fiscal 2024 compared to $351.6 million in Q3 fiscal 2023.

Gross Margin: Improved to $158.0 million, up 8.2% from the previous year's quarter.

Operating Income: Rose by 7.0% to $75.2 million in Q3 fiscal 2024.

Net Income: Grew by 28.4% to $46.6 million in Q3 fiscal 2024.

Diluted EPS: Increased to $1.39 in Q3 fiscal 2024, up from $1.05 in Q3 fiscal 2023.

Backlog: As of December 30, 2023, the backlog stood at $652.1 million, an increase from $641.3 million as of September 30, 2023.

Q4 Outlook: Anticipates net sales between $405.0 million to $415.0 million, marking a growth rate of 2.7% to 5.2%.

RBC Bearings Inc (NYSE:RBC), a leading international manufacturer of highly engineered precision bearings and components, released its 8-K filing on February 8, 2024, detailing the financial results for the third quarter of fiscal year 2024. The company, which serves industrial and aerospace markets, including applications in construction, mining, and aircraft engines, reported a 6.3% increase in net sales, rising from $351.6 million in the third quarter of fiscal 2023 to $373.9 million in the same quarter of fiscal 2024.

Financial Performance and Challenges

The company's gross margin saw an 8.2% increase to $158.0 million, with gross margin percentage climbing to 42.3% from 41.5% in the prior year's quarter. Operating income also improved by 7.0% to $75.2 million, while net income saw a significant jump of 28.4% to $46.6 million. Diluted earnings per share (EPS) attributable to common stockholders rose to $1.39 from $1.05 in the third quarter of fiscal 2023.

Despite these positive results, RBC Bearings Inc faces challenges such as increased selling, general, and administrative (SG&A) expenses, which rose to $63.9 million from $56.8 million in the previous year. This increase in SG&A expenses, as a percentage of net sales, could impact profit margins if not managed effectively. Additionally, the company's backlog, although growing, includes a significant portion of orders expected to be fulfilled beyond 12 months, which could affect short-term revenue recognition.

Strategic Insights and Commentary

Dr. Michael J. Hartnett, Chairman and Chief Executive Officer, commented on the results, stating,

As expected, third quarter results showed a 6.3% increase in net sales during the quarter compared to the previous year. Our aerospace and defense segment has continued to produce strong results as we continue to see an acceleration in volume, especially from major aircraft manufacturers and their supply chains."

This commentary highlights the strength of RBC Bearings Inc's aerospace and defense segment, which is a key driver of the company's growth.

Looking Ahead

For the fourth quarter of fiscal 2024, RBC Bearings Inc anticipates net sales to range between $405.0 million to $415.0 million, which would represent a growth rate of 2.7% to 5.2% compared to the same quarter last year. This outlook suggests continued growth momentum for the company.

In conclusion, RBC Bearings Inc's fiscal 2024 third quarter results demonstrate solid growth in key financial metrics, reflecting the company's ability to navigate market challenges and capitalize on opportunities within its industrial and aerospace segments. The company's performance is a testament to its strategic focus and operational efficiency, making it a noteworthy entity for value investors and industry observers alike.

Explore the complete 8-K earnings release (here) from RBC Bearings Inc for further details.

This article first appeared on GuruFocus.