RCI Hospitality Holdings Inc (RICK) Reports Mixed 1Q24 Results Amidst Operational Challenges

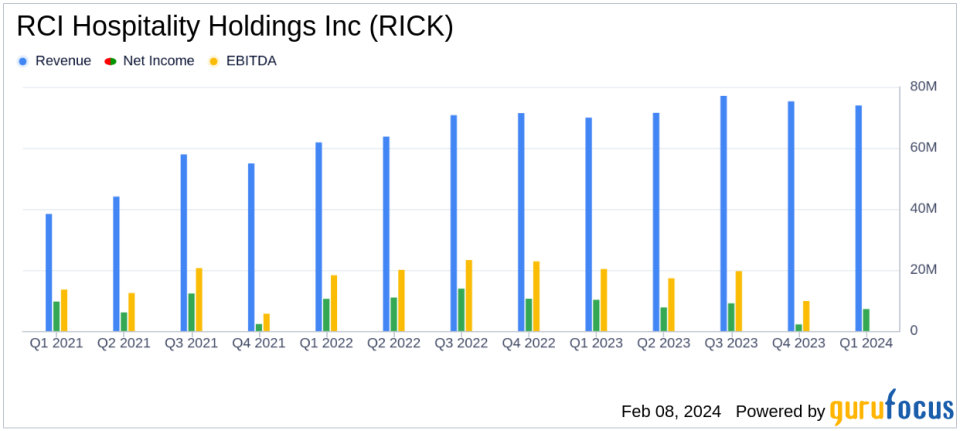

Revenue: Increased to $73.9 million in 1Q24 from $70.0 million in 1Q23.

Net Income: Decreased to $7.2 million in 1Q24 from $10.2 million in 1Q23.

Earnings Per Share (EPS): Dropped to $0.77 in 1Q24 from $1.11 in 1Q23.

Adjusted EBITDA: Fell to $17.5 million in 1Q24 from $20.5 million in 1Q23.

Free Cash Flow: Slightly decreased to $12.7 million in 1Q24 from $13.0 million in 1Q23.

Operating Cash Flow: Declined to $13.6 million in 1Q24 from $14.9 million in 1Q23.

Debt Reduction: Reduced to $234.1 million at the end of 1Q24 from $239.8 million at the end of the previous quarter.

On February 8, 2024, RCI Hospitality Holdings Inc (NASDAQ:RICK) released its 8-K filing, detailing the financial results for the first quarter of fiscal year 2024, which ended on December 31, 2023. The company, known for its adult nightclubs and sports bars-restaurants, reported an increase in total revenues but faced a decline in net income and earnings per share compared to the same quarter of the previous year.

RCI Hospitality Holdings Inc operates through its subsidiaries, owning establishments that offer live adult entertainment, restaurant, and bar operations, with a majority of its revenue derived from the Nightclubs segment. The company's brands include Rick's Cabaret, Vivid Cabaret, Tootsie's Cabaret, Club Onyx, and Jaguars Club, among others. The Bombshells segment, which includes a chain of restaurants and sports bars in Texas, did not perform as expected, leading to significant management changes.

Financial Performance and Challenges

RCI Hospitality Holdings Inc's Nightclubs segment showed resilience with revenues increasing to $61.0 million, primarily due to the benefit of newly acquired and remodeled clubs. However, the Bombshells segment experienced a decline in revenues to $12.7 million, attributed to lower same-store sales. The company's CEO, Eric Langan, commented on the challenges faced due to macro uncertainty affecting same-store sales and the underperformance of the Bombshells segment. Langan mentioned that the company is considering options to improve performance, including seeking an operational partner or selling the business.

"Net cash from operating activities and free cash flow held up well, declining only 8% and 3%, respectively, despite previously reported macro uncertainty that negatively affected same-store sales," said Eric Langan, President and CEO of RCI Hospitality Holdings Inc.

Financial Achievements and Importance

The company's financial achievements in the quarter include maintaining a relatively stable operating cash flow and free cash flow, despite the challenges faced. These metrics are crucial for the company's ability to invest in growth opportunities, such as opening new casinos, clubs, and restaurants, acquiring more clubs, and repurchasing shares. The company also reported progress in securing an approximately $20 million cash-out bank loan, leveraging its unencumbered real estate assets.

Key Financial Metrics

RCI Hospitality Holdings Inc reported a decrease in net income attributable to common stockholders to $7.2 million in 1Q24 from $10.2 million in 1Q23. The earnings per share (EPS) also decreased to $0.77 from $1.11 in the same period. The adjusted EBITDA, a key metric that reflects the company's operational performance, decreased to $17.5 million from $20.5 million. The company's effective tax rate was 19.9%, down from 22.8% in the previous year, reflecting the impact of state taxes, permanent differences, and tax credits.

RCI Hospitality Holdings Inc's balance sheet shows a reduction in debt, which is a positive sign for the company's financial health. The debt was reduced to $234.1 million at the end of 1Q24, down from $239.8 million at the end of the previous quarter. This reduction reflects the company's commitment to managing its leverage and improving its financial position.

Analysis of Company Performance

The company's performance in the first quarter of fiscal 2024 reflects a mixed picture. While total revenues increased, the decline in net income and EPS indicates that RCI Hospitality Holdings Inc is facing operational challenges that are impacting its profitability. The company's focus on structural management changes and potential strategic moves for the Bombshells segment suggests a proactive approach to addressing these challenges. Additionally, the company's efforts to strengthen its financial position through debt reduction and securing additional financing are positive steps towards ensuring long-term growth and stability.

Investors and stakeholders will be closely monitoring the company's progress in the coming quarters, particularly in improving the performance of the Bombshells segment and capitalizing on growth opportunities in its Nightclubs segment. The company's ability to navigate the macroeconomic uncertainty and execute its strategic initiatives will be critical in driving its financial performance and shareholder value.

For more detailed financial information and analysis, readers are encouraged to review the full earnings report and listen to the conference call hosted by RCI Hospitality Holdings Inc.

Media and investor contacts for RCI Hospitality Holdings Inc are available for further inquiries and clarifications regarding the company's financial results and strategic direction.

Explore the complete 8-K earnings release (here) from RCI Hospitality Holdings Inc for further details.

This article first appeared on GuruFocus.