RCL, WH, LVS: Which Travel Stock is the Best Buy?

Travel and leisure stocks have come a long way since their darkest depths of 2022. Still, many such plays remain a country mile away from their peak levels. Though the 2023 summer season saw glimmers of hope for discretionary travel, questions linger as to what’s in store for 2024.

Undoubtedly, a potential economic downturn could curb the appetite for travel and leisure. But the million-dollar question remains: just how much-anticipated weakness is already baked into the share prices of travel and leisure bets with newfound momentum?

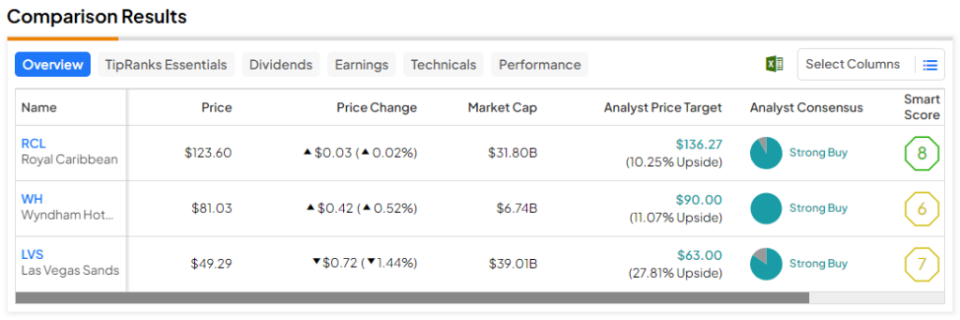

Looking at Wall Street, analysts think the top plays in travel still have room for upside. Indeed, it would be nice if the bout of travel strength experienced last summer is more than just a short-lived glimmer. Therefore, let’s tune into TipRanks’ Comparison Tool to have a look at three Strong-Buy-rated travel names — RCL, WH, and LVS — that still have a decent amount of upside for the year ahead.

Royal Caribbean Cruise Lines (NYSE:RCL)

At the start of 2023, few folks would have thought that Royal Caribbean Cruise Lines would be flirting with pre-pandemic highs again. The cruise line industry was a wreck that struggled to climb out of the hole that the pandemic kicked it into. Fast forward to today, and RCL stock goes for around $123, 9% away from its January 2020 all-time high.

Helping fuel last year’s incredible surge has been an impressive pick-up in bookings. For 2024, numerous analysts don’t expect booking demand to reverse course suddenly. If anything, booking strength could beget more strength even in the face of this year’s economic unknowns. So, just like the analyst community, I’m staying bullish on RCL stock as it looks for a long-awaited breakout.

Indeed, the cruise lines received a one-two punch to the chin during COVID lockdowns, as fuel prices soared while demand plummeted. With the “accelerating demand environment” (quoting the company) and the potential relief in fuel prices in 2024, it may be tough to stop the well-run cruise line as it looks to sail even higher.

CEO Jason Liberty also highlighted the “strength” of his firm’s brands as a contributor behind the firm’s latest quarterly earnings blowout. Indeed, Royal Caribbean is definitely known to be one of the more luxurious cruisers on the scene, and its premium nature is likely why it’s been leaving its peers at the port.

What is the Price Target of RCL Stock?

Royal Caribbean stock is a Strong Buy, according to analysts, with 11 Buys and one Hold assigned in the past three months. The average RCL stock price target of $136.27 implies 10.3% upside potential.

Wyndham Hotels & Resorts (NYSE:WH)

Wyndham Hotels & Resorts stock is up 15% over the past year but still down around 14% from its late 2021 all-time high, near $94 per share. To close off a decent 2023, competitor Choice Hotels (NYSE:CHH) started its hostile takeover bid for Wyndham. Management rejected the offer, but Choice is moving forward with regulatory proceedings. Indeed, the matter will make for a rather eventful 2024.

In any case, I believe Choice’s interest shines a bright light on the value to be had in the mid-cap ($6.7 billion market cap) firm behind budget hotel chains such as Travelodge, Super 8, and Ramada. More affordable hotels and motels could be key to traveling on a tight budget as the threat of recession looms around the corner. As WH stock looks to continue its share price recovery in 2024, I can’t help but be bullish, especially at today’s modest valuations.

At writing, shares of WH trade at 19.5 times forward price-to-earnings, well below the lodging industry average of 23.57. The discount to rivals, I believe, is unwarranted, given that Wyndham’s brands have been resonating with travelers.

What is the Price Target of WH Stock?

Wyndham stock is a Strong Buy, according to analysts, with seven unanimous Buys assigned in the past three months. The average WH stock price target of $90.00 implies 11.1% upside potential.

Las Vegas Sands (NYSE:LVS)

Despite the name, Las Vegas Sands is a casino and resort that’s a play on Macau, China’s gambling hotspot. Given how horrid the Chinese economy has been, it’s not a mystery to see shares of LVS in the gutter. Though the stock is still down 15% over the past 10 years, shares are up nearly 60% from their multi-year lows hit back in early 2022. The latest dip off 52-week highs may be discouraging, but plenty of analysts see value in the casino underdog as China looks to get back on its feet again.

Once China does get going again, the gains could come fast and furious for LVS. As such, I remain bullish on LVS stock. Like it or not, Las Vegas Sands remains one of the “leaders in Asia,” so says its CEO Robert Goldstein. Though a recovery in Asia may still be a few years off, it’s hard not to be enticed by the price of admission.

At 17.7 times forward price-to-earnings, shares trade at a slight discount to the resorts & casinos industry average of 18.3 times.

What is the Price Target of LVS Stock?

Las Vegas Sands stock is a Strong Buy, according to analysts, with 11 Buys and two Holds assigned in the past three months. The average LVS stock price target of $63.00 implies 27.8% upside potential.

Conclusion

Travel and leisure plays are still running strong going into the new year. Though a few bumps in the road are to be expected, as recession jitters linger, the path of least resistance seems to be higher, at least according to most analysts. Of the trio, analysts expect the most upside (~28%) from LVS for the year ahead.