Read This Before Buying Jernigan Capital Inc (NYSE:JCAP) For Its Upcoming $0.35 Dividend

On the 12 January 2018, Jernigan Capital Inc (NYSE:JCAP) will be paying shareholders an upcoming dividend amount of $0.35 per share. However, investors must have bought the company’s stock before 29 December 2017 in order to qualify for the payment. That means you have only 3 days left! What does this mean for current shareholders and potential investors? Below, I will explain how holding Jernigan Capital can impact your portfolio income stream, by analysing the stock’s most recent financial data and dividend attributes. View our latest analysis for Jernigan Capital

How I analyze a dividend stock

When researching a dividend stock, I always follow the following screening criteria:

Is its annual yield among the top 25% of dividend-paying companies?

Has its dividend been stable over the past (i.e. no missed payments or significant payout cuts)?

Has it increased its dividend per share amount over the past?

Is is able to pay the current rate of dividends from its earnings?

Will it be able to continue to payout at the current rate in the future?

How does Jernigan Capital fare?

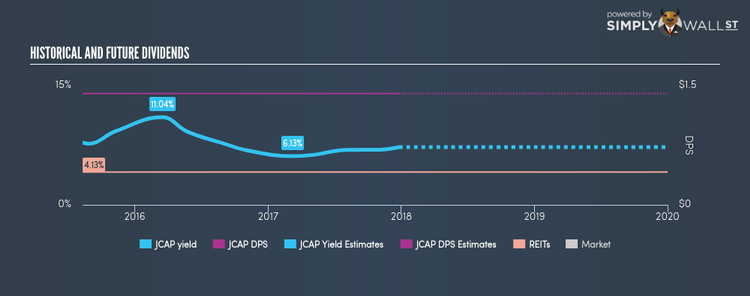

Jernigan Capital has a payout ratio of 100.48%, meaning the dividend is not sufficiently covered by its earnings. In the near future, analysts are predicting a more sensible payout ratio of 50.06%, leading to a dividend yield of around 7.26%. In addition to this, EPS should increase to $2.5, meaning that the lower payout ratio does not necessarily implicate a lower dividend payment. If there’s one type of stock you want to be reliable, it’s dividend stocks and their stable income-generating ability. The reality is that it is too early to consider Jernigan Capital as a dividend investment. It has only been consistently paying dividends for 2 years, however, standard practice for reliable payers is to look for a 10-year minimum track record. In terms of its peers, Jernigan Capital produces a yield of 7.26%, which is high for reits stocks.

What this means for you:

Are you a shareholder? If Jernigan Capital is in your portfolio for cash-generating reasons, there may be better alternatives out there. It may be beneficial exploring other income stocks as alternatives to Jernigan Capital or even look at high-growth stocks to supplement your steady income stocks. I encourage you to continue your research by taking a look at my interactive free list of dividend rockstars as well as high-growth stocks to potentially add to your holdings.

Are you a potential investor? If you are building an income portfolio, then Jernigan Capital is a complicated choice since it has some positive aspects as well as negative ones. However, if you are not strictly just a dividend investor, the stock could still offer some interesting investment opportunities. As with all investments, you should always research extensively before deciding whether or not a stock is an appropriate investment for you. I always recommend analysing the company’s fundamentals and underlying business before making an investment decision. Dig deeping in our latest free fundmental analysis to explore other aspects of Jernigan Capital.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.