Read This Before Buying Strategic Education, Inc. (NASDAQ:STRA) For Its Dividend

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Dividend paying stocks like Strategic Education, Inc. (NASDAQ:STRA) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

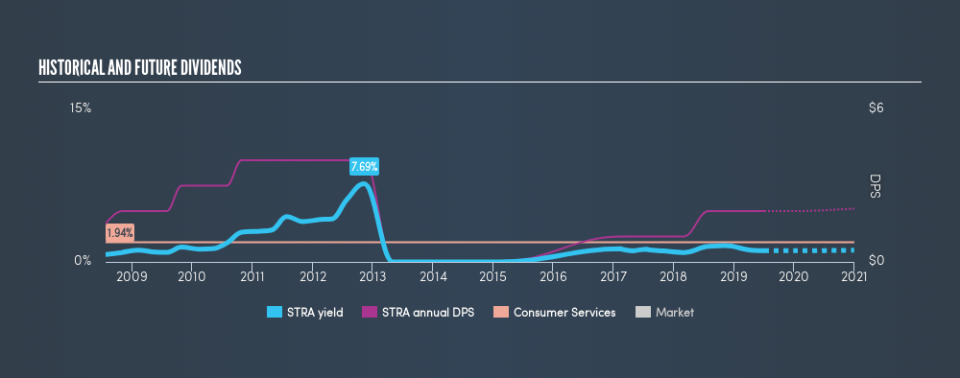

While Strategic Education's 1.1% dividend yield is not the highest, we think its lengthy payment history is quite interesting. Remember though, due to the recent spike in its share price, Strategic Education's yield will look lower, even though the market may now be factoring in an improvement in its long-term prospects. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Strategic Education!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. While Strategic Education pays a dividend, it reported a loss over the last year. This is medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

Strategic Education paid out 64% of its cash flow as dividends last year, which is within a reasonable range for the average corporation.

Consider getting our latest analysis on Strategic Education's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Strategic Education's dividend payments. During the past ten-year period, the first annual payment was US$1.50 in 2009, compared to US$2.00 last year. This works out to be a compound annual growth rate (CAGR) of approximately 2.9% a year over that time.

Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. It's not great to see that Strategic Education's have fallen at approximately 24% over the past five years. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're not keen on the fact that Strategic Education paid dividends despite reporting a loss over the past year, although fortunately its dividend was covered by cash flow. Earnings per share are down, and Strategic Education's dividend has been cut at least once in the past, which is disappointing. There are a few too many issues for us to get comfortable with Strategic Education from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from costs or inflation. Very few businesses see earnings consistently shrink year after year in perpetuity though, and so it might be worth seeing what the 4 analysts we track are forecasting for the future.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.