Get Ready for 5-Bagger Returns on These 7 Penny Stocks

With gold surging above $2,200 an ounce, it seems clear that rate cuts are likely in the coming quarters. While I am discussing penny stocks for 5-bagger returns, the likely policy stance was important to mention. The reason being expansionary monetary policies are good for equities and other risky asset classes. Therefore, as the fed prepares for potential rate cuts, it’s a good time to remain invested in growth and penny stocks.

Of course, blue-chip stocks should be a part of the core portfolio. However, when easy money policies are round the corner, I would increase portfolio weight towards high-beta stocks. The focus of this column is on penny stocks for 5-bagger returns in the next 36 months.

Besides the broad market factor, I believe that the penny stocks discussed are undervalued. Further, these stocks represent companies with good fundamentals and positive catalysts. The upside in these stories can therefore be significant.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Let’s discuss the reasons that make these penny stocks potential multibagger ideas.

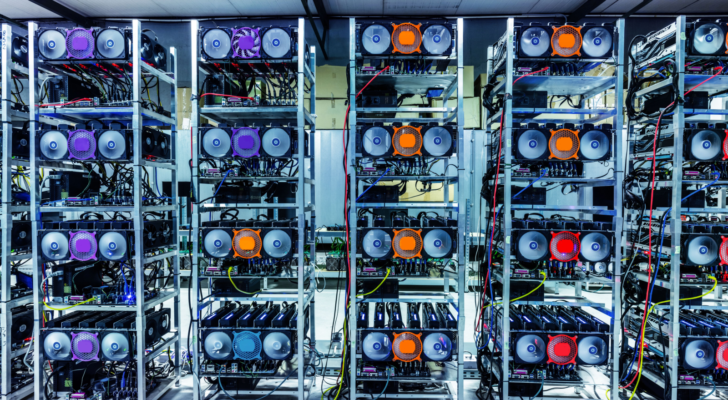

Bitfarms (BITF)

Source: PHOTOCREO Michal Bednarek / Shutterstock.com

Bitcoin (BTC-USD) has surged by 56% for year-to-date. During the same period, Bitfarms (NASDAQ:BITF) stock has declined by 22%. A major reason for this correction in BITF stock is the recent $375 million at-the-market equity offering program. Further, the stock seems to have discounted the fact that Bitcoin mining will be relatively difficult after the halving event.

I am however bullish at current levels of $2.3 and I believe that BITF stock will skyrocket in the next few quarters. An important point to note is that Bitfarms reported a liquidity buffer of $118 million as of Q4 2023. The recent fund raising has boosted the liquidity position to $493 million. Further, the Company has a zero-debt balance sheet. With high financial flexibility for expansion and upside in Bitcoin, the outlook is positive.

As of February, Bitfarms reported hash rate capacity of 6.5EH/s. The Company is targeting capacity expansion to 21EH/s by the second half of the year. With tripling of capacity, Bitfarms is positioned for robust revenue and cash flow growth.

Standard Lithium (SLI)

Source: Postmodern Studio / Shutterstock.com

Recently, Lithium Americas (NYSE:LAC) received conditional commitment for a $2.26 billion loan from the U.S. Department of Energy. As a result, LAC stock has surged by 42% in the last one month.

I believe that Standard Lithium (NYSE:SLI) is another name that’s likely to get funding for financing the construction of lithium assets. SLI stock looks massively undervalued at a current valuation of $203 million. Five-bagger returns from current levels seems like a cakewalk once lithium starts trending higher.

In terms of asset potential, the South West Arkansas asset has an after-tax net present value of $4.5 billion. The market valuation of the Company is minuscule just compared to one asset. It’s important to note that the development capex for the asset is estimated at $1.28 billion.

I must add here that the Lanxess asset has an after-tax net present value of $772 million. Once the Company secures development financing, SLI stock is likely to go ballistic.

Blink Charging (BLNK)

Source: David Tonelson/Shutterstock.com

Blink Charging (NASDAQ:BLNK) stock has declined by 62% in the last 12 months. However, the stock has been sideways in the last five months. I believe that a strong breakout on the upside is coming after this period of consolidation. My view is underscored by the point that fundamental developments are likely to be positive in the coming quarters.

Recently, Blink Charging announced Q4 2023 results with revenue increasing by 89% on a year-on-year basis to $42.7 million. Further, for 2023, revenue growth was stellar at 130% to $140.6 million. I believe that growth will remain robust on the back of impending penetration in EV charging infrastructure in U.S. and Europe.

For 2024, Blink Charging is targeting revenue of $170 million (mid-range of guidance). Further, the Company expects gross margin of 33% and is targeting to achieving a positive adjusted EBITDA run rate by December 2024. Additionally, EBITDA margin expansion will sustain in 2025 on the back of operating leverage. With good times ahead for the Company, BLNK stock is poised for a big rally.

Archer Aviation (ACHR)

Source: T. Schneider / Shutterstock.com

Archer Aviation (NYSE:ACHR) stock has been in a correction mode and trades at $5. This seems like a good accumulation opportunity with the Company on-track to commercialize eVTOL aircraft by 2025. Considering the growth potential of flying cars, I expect ACHR stock to be a multibagger.

It’s worth noting that Archer has a strong order book of $3.5 billion. It’s likely that the order backlog for eVTOL will continue to swell. The Company already has orders from the United States, UAE, and India.

Further, Archer expects its manufacturing facility to be completed this year. The facility will have the capability to produce 650 aircraft annually. This will position Archer for growth in 2025 and beyond. From a financial perspective, Archer ended 2023 with cash and equivalents of $625 million. Therefore, there is ample flexibility for capital requirements this year. For now, the final certification from the Federal Aviation Authority in the coming quarters can send the stock skyrocketing.

Solid Power (SLDP)

Source: T. Schneider / Shutterstock.com

Solid Power (NASDAQ:SLDP) stock has underperformed for an extended period. However, I believe that the stock has finally bottomed out and a big rally is due in the coming quarters.

As an overview, Solid Power is working towards the commercialization of solid-state batteries for EVs. Given the industry potential, SLDP stock is likely to be a massive wealth creator if the Company achieves success.

There are multiple reasons to be optimistic. First, Solid Power has the backing of strong industry partners that include BMW (OTCMKTS:BMWYY), Ford (NYSE:F) and SK On. These partnerships boost the Company’s research and development efforts towards commercialization.

Further, Solid Power has made substantial progress in the last 12 to 18 months. In October 2023, the Company successfully delivered A-1 sample cells to BMW for automotive qualification. This year, the Company has shifted focus to A-2 sample cells. With a healthy liquidity buffer, Solid Power is well positioned to continue investing in research.

IAMGOLD (IAG)

Source: Misunseo / Shutterstock.com

Gold has managed to breakout above $2,000 an ounce after an extended period of consolidation. With expansionary policies likely in the coming quarters, I expect the positive momentum for gold to sustain. It’s therefore a good time to consider exposure to gold mining stocks. IAMGOLD (NYSE:IAG) is among the quality penny stocks for 5-bagger returns.

For 2023, IAMGOLD reported production of 465,000 ounces. For the current year, robust production growth is on the cards. The reason is commencement of production at Cote Gold, which is the third largest mine in Canada. On a 100% basis, the asset is likely to deliver production of 220,000 to 290,000 ounces for the year. Production bump-up coupled with higher realized prices would imply healthy cash flow growth.

It’s worth noting that IAMGOLD ended 2023 with a liquidity buffer of $754.1 million. Capital investments can therefore be aggressive at a time when gold is trending higher. With an attractive pipeline of projects that includes Côté, Gosselin, Nelligan, and Chibougamau district, there is visibility for sustained production growth.

Cronos (CRON)

After an extended period of correction, Cronos (NASDAQ:CRON) stock has returned 25% in the last 12 months. In my view, this might be the beginning of a sustained reversal for CRON stock, which is significantly undervalued.

With 2024 being the Presidential election year, there is likely to be discussions on the potential federal level legalization of cannabis. Recently, Kamala Harris called for rescheduling of marijuana to Schedule III under federal laws.

Another point to note is that even without legalization at the federal level, the U.S. cannabis industry is expected to be worth $71 billion by 2030. Therefore, there is ample headroom for growth. I must add that Germany recently legalized cannabis and Europe has a big addressable market for recreational and medicinal cannabis.

Specific to Cronos, a cash buffer of $862 million as of Q4 2023 is a big positive. The Company further expects to end the current year with positive net change in cash. Therefore, there is ample flexibility to pursue aggressive organic and acquisition driven growth. Cronos is already entering new markets like Germany and Australia in the medicinal cannabis segment.

On the date of publication, Faisal Humayun did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Faisal Humayun is a senior research analyst with 12 years of industry experience in the field of credit research, equity research and financial modeling. Faisal has authored over 1,500 stock specific articles with focus on the technology, energy and commodities sector.

More From InvestorPlace

The #1 AI Investment Might Be This Company You’ve Never Heard Of

Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

It doesn’t matter if you have $500 or $5 million. Do this now.

The post Get Ready for 5-Bagger Returns on These 7 Penny Stocks appeared first on InvestorPlace.