The RealReal Inc (REAL) Navigates Market Challenges with Improved Financials in Q4 and FY 2023

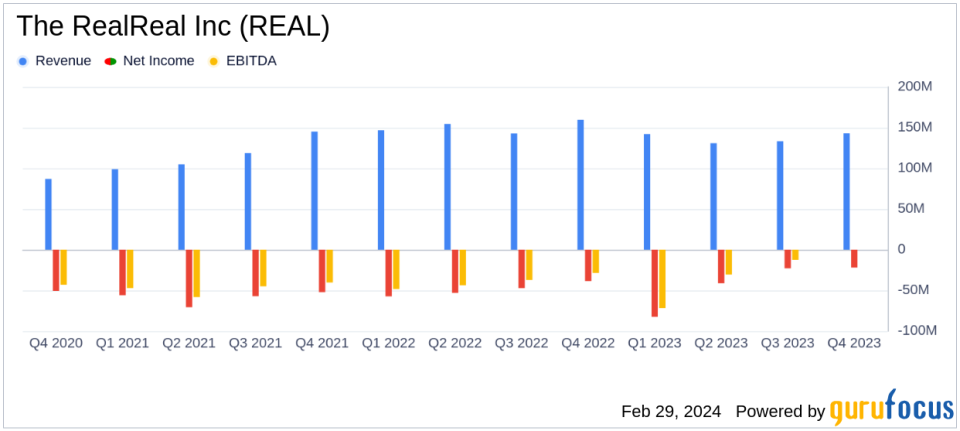

Net Loss Improvement: Q4 net loss decreased to $22 million from $39 million YOY; FY net loss improved by $28 million.

Adjusted EBITDA: Achieved positive $1.4 million in Q4, a $22 million improvement YOY; FY Adjusted EBITDA improved to $(55) million from $(112) million.

Revenue: Q4 revenue fell by 10% YOY to $143 million; FY revenue decreased by 9% to $549 million.

Debt Management: Debt exchange transactions reduced total indebtedness by over $17 million and extended maturities.

GMV: Q4 GMV declined by 9% YOY; FY GMV down by 5%.

Cash Position: Ended 2023 with $191 million in cash, cash equivalents, and restricted cash.

On February 29, 2024, The RealReal Inc (NASDAQ:REAL), the world's largest online marketplace for authenticated, resale luxury goods, released its 8-K filing, revealing its financial results for the fourth quarter and full year ended December 31, 2023. The company reported a significant reduction in net loss and a positive Adjusted EBITDA for Q4, marking historic milestones since its IPO in 2019.

The RealReal is renowned for its luxury resale platform, which generated $1.8 billion in 2022 gross merchandise volume. The company has carved out a niche in personal luxury resale, traditionally dominated by upscale boutiques and pawn shops. Revenue is generated through consignment and first-party sales on its online marketplace and direct sales in its physical stores. The RealReal's authentication process allows for higher take rates than peers, averaging around 35% of net merchandise value.

The company's Q4 performance showcased a net loss of $22 million, a notable improvement from the $39 million loss in the same quarter the previous year. The full year net loss also improved, decreasing from $196 million in 2022 to $168 million in 2023. Adjusted EBITDA for Q4 was a positive $1.4 million, a $22 million year-over-year improvement, while the full year Adjusted EBITDA was $(55) million, better than the $(112) million in 2022.

Despite these improvements, The RealReal faced challenges, including a 9% decrease in Gross Merchandise Volume (GMV) for Q4 and a 5% decrease for the full year. Total revenue also declined by 10% in Q4 and 9% for the full year, reflecting the broader market conditions and strategic shifts in the company's business model.

CEO John Koryl highlighted the company's strategic focus on the consignment business, which has led to improved margin structure and significant progress in financial results. He also noted the completion of debt exchange transactions, which reduced total indebtedness by more than $17 million and extended the maturity of significant portions of its 2025 debt.

For the upcoming year, The RealReal provided guidance for GMV, total revenue, and Adjusted EBITDA, anticipating profitable growth in 2024. The company's strong brand recognition and growing technology and data capabilities are expected to support this growth.

Looking at the financial statements, the balance sheet shows a healthy cash position with $191 million in cash, cash equivalents, and restricted cash at the end of 2023. However, the company's total liabilities still exceed its assets, leading to a stockholders' deficit of $(303) million.

The income statement reflects the challenges in revenue generation, with a decrease in both consignment and direct revenue. Nonetheless, the reduction in operating expenses and improved gross profit margin are positive signs of the company's cost management efforts.

The cash flow statement indicates a net cash used in operating activities of $(61) million for the year, which is an area for potential improvement. The company's free cash flow, a critical indicator of business performance, turned positive in Q4, demonstrating the company's ability to generate cash.

In conclusion, The RealReal Inc (NASDAQ:REAL) has made commendable strides in improving its financial health despite a challenging market. The company's focus on consignment and margin improvement, coupled with effective debt management, positions it for potential profitable growth in the coming year. Investors and potential GuruFocus.com members should monitor The RealReal's execution of its strategic vision and its ability to capitalize on its strong brand and technological capabilities.

Explore the complete 8-K earnings release (here) from The RealReal Inc for further details.

This article first appeared on GuruFocus.