Realty Income (O) Tops Q2 FFO, Ups Acquisition Guidance

Realty Income Corporation’s O second-quarter 2022 adjusted funds from operations (AFFO) per share of 97 cents surpassed the Zacks Consensus Estimate of 95 cents. The reported figure also compared favorably with the prior-year quarter’s 88 cents. The normalized FFO per share came in at $1.02 for the second quarter, up from the 88 cents reported in the year-ago period.

Results reflect better-than-expected revenues for the quarter. The company benefited from expansionary effects and a healthy pipeline of opportunities globally. Moreover, with more than $3.2 billion invested in the first half of the year, Realty Income increased its 2022 acquisition guidance to more than $6 billion.

Total revenues for the reported quarter came in at $810.4 million, exceeding the Zacks Consensus Estimate of $808.5 million. The top line also jumped 74.5% year over year. Results reflect the impact of the merger with VEREIT, which occurred on Nov 1, 2021.

According to Sumit Roy, Realty Income's president and chief executive officer, "Our second quarter results demonstrate the stability of our business and the continued momentum in our global investment pipeline."

Quarter in Detail

In the second quarter of 2022, same-store rental revenues from 9,686 properties under lease increased 2.0% to $615.6 million from the prior-year period. The portfolio occupancy of 98.9%, as of Jun 30, 2022, expanded 30 basis points (bps) sequentially and 40 bps year over year. It also marked the highest occupancy rate in more than 10 years. The company achieved a rent recapture rate of 105.6% on re-leasing activity.

During the reported quarter, O invested $1.68 billion in 237 properties and properties under development or expansion, including $693.7 million in Europe.

Around 39% of rental revenues reaped from acquisitions during the June-end quarter came in from investment grade-rated tenants and their subsidiaries or affiliated companies.

The company sold 70 properties, generating net proceeds of $150.0 million, with a gain from sales of $40.6 million, during the April-June period.

Balance Sheet

Realty Income exited the second quarter with cash and cash equivalents of $172.8 million, down from the $258.6 million witnessed as of Dec 31, 2021.

As of Jun 30, 2022, the balance of borrowings outstanding under its revolving credit facility was $219.1 million. In April 2022, the company entered into a new $4.25-billion unsecured credit facility to amend and restate its previous $3.0-billion unsecured credit facility, which was due to expire in March 2023. Moreover, as of Jun 30, 2022, O had $950.0 million in commercial paper borrowings.

Net debt to annualized pro forma adjusted EBITDAre was 5.2X, while the fixed charge coverage ratio was 5.5.

In the second quarter, the company raised $1.1 billion from the sale of common stock at a weighted average price of $67.13 per share, mainly through its At-The-Market Program.

Guidance

Realty Income revised its 2022 guidance and now projects normalized FFO per share in the band of $3.92-$4.05 compared with the $3.88-$4.05 band projected earlier. AFFO per share is expected in the range of $3.84-$3.97, the same as guided earlier. The Zacks Consensus Estimate for the same is currently pegged at $3.90.

Management’s full-year 2022 projections assume same-store rent growth of 2.0%, up from the 1.5% guided earlier, and occupancy of more than 98% compared with the 98% projected earlier. Also, the full-year acquisition volume is projected to be more than $6 billion, up from the prior expectation of more than $5 billion.

Realty Income currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

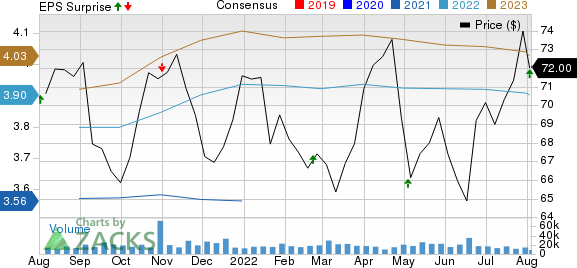

Realty Income Corporation Price, Consensus and EPS Surprise

Realty Income Corporation price-consensus-eps-surprise-chart | Realty Income Corporation Quote

Performance of Retail REITs

Simon Property Group, Inc.’s SPG second-quarter 2022 comparable FFO per share of $2.96 exceeded the Zacks Consensus Estimate of $2.91. The figure compared favorably with the year-ago quarter’s $2.92. Simon Property Group’s quarterly results reflected healthy operating performance and growth in occupancy levels. The retail REIT behemoth also raised the 2022 FFO per share outlook based on the quarterly results and also announced a hike in the quarterly dividend.

Kimco Realty Corp.’s KIM second-quarter 2022 FFO per diluted share came in at 40 cents, surpassing the Zacks Consensus Estimate of 38 cents. The figure grew 17.6% from the year-ago quarter’s 34 cents. Results reflected year-over-year growth in the top line. The rise in occupancy levels and rental rate growth aided Kimco’s performance. KIM also raised the 2022 FFO outlook.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research