Reasons to Add AeroVironment (AVAV) to Your Portfolio Now

AeroVironment Inc. AVAV, with its multi-domain robotic solutions, is well-positioned to benefit from the rising demand for unmanned systems. The company’s strong international presence, expanding product line and increasing product demand due to global tensions make it a strong candidate for investment in the defense space.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment.

Growth Projections & Surprise History

The Zacks Consensus Estimate for AVAV’s fiscal 2024 earnings per share is pegged at $2.80. The bottom-line estimates have moved up 0.4% in the past 60 days.

The Zacks Consensus Estimate for fiscal 2024 sales stands at $681.3 million, indicating growth of 26.1% from the fiscal 2023 reported figure.

AVAV delivered a trailing four-quarter average earnings surprise of 11.03%.

Debt Position

The total debt-to-capital of AVAV is 18.28%, better than 50.91% registered by the industry. This indicates that the company has less debt than its peers, which is a positive sign.

AVAV has a current ratio of 4.49, much better than the industry’s average of 1.52. This implies that the company has sufficient financial capability to pay its short-term debt obligations.

Increasing Demand and Strong Backlog

AVAV’s revenues for the first-quarter fiscal 2024 (ended Jul 29, 2023) were $152 million, compared with $108 million for the fiscal year (ended Jul 30, 2022), representing an increase of 40%. The revenue increase was due to strong demand for its market-leading AI-enabled intelligent unmanned systems.

Thanks to this solid demand for its products, AeroVironment’s total backlog was a solid $540 million as of Jul 29, 2023, up significantly from $424.1 million as of Apr 30, 2023.

Return on Equity (ROE)

ROE is a measure of a company’s financial performance and shows how it is utilizing its funds. AVAV’s current ROE is 10.16%, better than the industry’s average of 7.48%, which indicates that the company is utilizing its funds more efficiently than its peers.

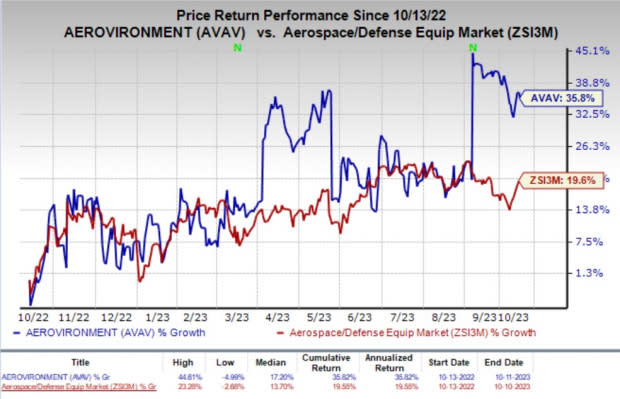

Price Performance

In the past year, AVAV’s shares have rallied 35.8% compared with the industry’s average growth of 19.6%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks in the same industry are BAE Systems PLC BAESY, CurtissWright Corp. CW and AAR Corp. AIR. BAE Systems sports a Zacks Rank #1 (Strong Buy), while CurtissWright and AAR carry a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

BAESY boasts a long-term earnings growth rate of 14%. The Zacks Consensus Estimate for 2023 sales indicates year-over-year growth of 33.6%.

The Zacks Consensus Estimate mark for CW’s 2023 sales indicates a year-over-year increase of 8.3%. It delivered an average earnings surprise of 4.08% in the past four quarters.

The Zacks Consensus Estimate mark for AIR’s 2023 sales indicates a year-over-year increase of 14.2%. It delivered an average earnings surprise of 6.23% in the past four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AAR Corp. (AIR) : Free Stock Analysis Report

Bae Systems PLC (BAESY) : Free Stock Analysis Report

AeroVironment, Inc. (AVAV) : Free Stock Analysis Report

Curtiss-Wright Corporation (CW) : Free Stock Analysis Report