Reasons to Add Alliant Energy (LNT) to Your Portfolio Now

Alliant Energy’s LNT investment in regulated natural gas and renewable energy assets and expanding customer base will further boost its bottom line. Given its growth opportunities and strong dividend history, LNT makes for a solid investment option in the utility sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) company a strong investment pick at the moment.

Growth Projections

The Zacks Consensus Estimate for LNT’s 2023 earnings per share (EPS) is pegged at $2.88, indicating a year-over-year increase of 2.9%.

The same for sales is pinned at $4.54 billion, indicating a year-over-year improvement of 8.04%.

LNT’s long-term (three- to five-year) earnings growth rate is 6.47%.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing its funds to generate higher returns. Currently, Alliant Energy’s ROE is 10.74%, higher than the industry’s average of 4.91%. This indicates that the company has been utilizing its funds more constructively than its peers in the electric power utility industry.

Dividend History

The regulated nature of Alliant Energy's operation boosts its earnings potential. This has enabled the company to increase its annual dividend rate for more than a decade. LNT has paid out dividends since 1946 without fail. Currently, its quarterly dividend is 45.25 cents per share, resulting in an annualized dividend of $1.81. The company’s current dividend yield is 3.34%, better than the Zacks S&P 500 Composite's average of 1.42%.

Business Growth

Alliant Energy plans to invest substantially over the next four years to strengthen the electric and gas distribution network as well as add natural gas and renewable assets to the generation portfolio. It plans to invest $8.5 billion during 2023-2026.

LNT is successfully completing major construction projects on time and at or below budget. Constructive regulatory environment will enable the company to recover capital expenditures. Its strong and flexible investment plans will support an 8% base CAGR between 2022 and 2026.

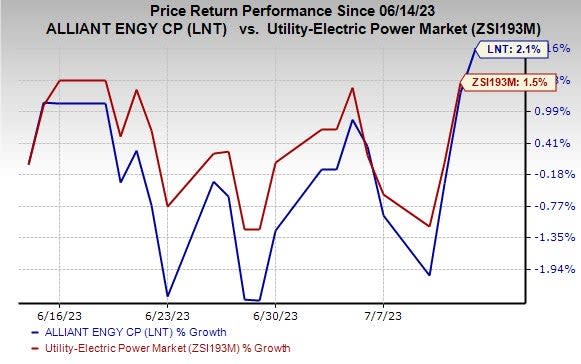

Price Performance

In the past month, Alliant Energy’s shares have rallied 2.1% compared with the industry’s average growth of 1.5%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are FirstEnergy Corp. FE, Exelon Corporation EXC and NextEra Energy, Inc. NEE, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

FirstEnergy’s long-term earnings growth rate is 6.45%. The Zacks Consensus Estimate for the company’s 2023 EPS is pegged at $2.51, implying a year-over-year increase of 4.2%.

Exelon’s long-term earnings growth rate is 6.68%. The consensus estimate for the company’s 2023 EPS is pinned at $2.36, indicating year-over-year growth of 4%.

NextEra Energy’s long-term earnings growth rate is 8.38%. The consensus mark for the company’s 2023 EPS is pegged at $3.11, indicating a year-over-year improvement of 7.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelon Corporation (EXC) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report