Reasons to Add California Water (CWT) to Your Portfolio

California Water Service Group’s CWT investments in infrastructure and efficient services are expected to help expand its customer base. The company is expanding its operations through acquisitions and regulated and non-regulated activities that will further drive its performance. Given its strong dividend history and growth opportunities, CWT makes for a solid investment option in the utility sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) company a strong investment pick at the moment.

Growth Projections

The Zacks Consensus Estimate for 2023 earnings per share (EPS) has moved up 0.5% in the past 90 days to $1.85. This implies a year-over-year increase of 4.5%.

The Zacks Consensus Estimate for 2024 EPS has moved up 1.4% in the past 90 days to $2.11. This implies a year-over-year improvement of 13.9%.

Debt Position

Currently, CWT’s total debt to capital is 45.93%, much better than the industry’s average of 55.14%.

The time to interest earned ratio at the end of second-quarter 2023 was 2.2. The ratio, being greater than one, reflects California Water’s ability to meet future debt obligations without difficulties.

Dividend History

The utility company has been consistently paying dividends to its shareholders. It has been increasing dividends every year since the inception of the payment. In July 2023, CWT’s board of directors declared a quarterly dividend of 26 cents per share, marking the utility’s 314th consecutive quarterly dividend. This resulted in an annualized dividend of $1.04 per share. California Water’s current dividend yield is 2%, better than the Zacks S&P 500 Composite’s yield of 1.42%.

Systematic Investments

The company’s systematic investment plans in infrastructure will help it further provide customers with efficient water and wastewater services. It had invested approximately $328 million in 2022. CWT expects capital investments of $360 million and $365 million in 2023 and 2024, respectively. It has invested approximately $177 million year to date.

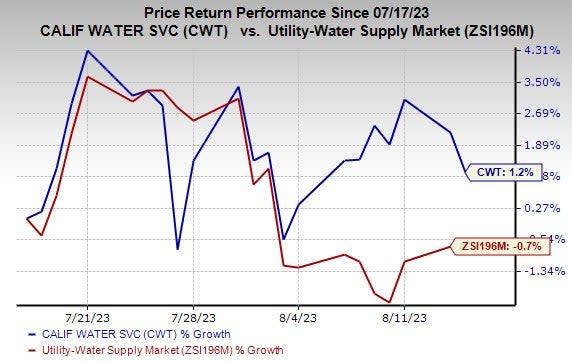

Price Performance

In the past month, CWT returned 1.2% against the industry’s average 0.7% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are Consolidated Water Co. Ltd. CWCO, American Water Works AWK and Essential Utilities WTRG, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CWCO’s long-term (three to five years) earnings growth rate is 8%. The consensus estimate for 2023 EPS is pinned at 98 cents, indicating year-over-year growth of 81.5%.

AWK’s long-term earnings growth rate is 8.18%. The consensus estimate for 2023 EPS is pegged at $4.79, implying a year-over-year increase of 6.2%.

WTRG’s long-term earnings growth rate is 5.6%. The consensus estimate for 2023 EPS is pinned at $1.86, implying a year-over-year improvement of 5.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

California Water Service Group (CWT) : Free Stock Analysis Report

Consolidated Water Co. Ltd. (CWCO) : Free Stock Analysis Report

Essential Utilities Inc. (WTRG) : Free Stock Analysis Report