Reasons to Add Integer Holdings (ITGR) to Your Portfolio Now

Integer Holdings Corporation ITGR has been gaining from its research and product development activities. The optimism, led by a solid third-quarter 2023 performance and its solid foothold in the broader MedTech space, is expected to contribute further. However, volatility in energy markets and global climate change-related concerns are a hurdle.

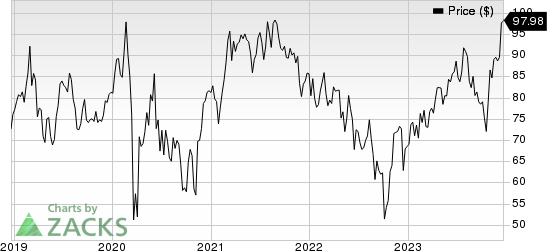

In the year to date period, this currently Zacks Rank #1 (Strong Buy) company’s shares have risen 43.1% compared with the industry’s 3.3% growth. The S&P 500 has witnessed 24.8% growth in the said time frame.

The renowned medical device manufacturer has a market capitalization of $3.33 billion. ITGR projects 15.8% growth over the next five years and expects to maintain its strong performance going forward. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 11.9%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strong Q3 Results: Integer Holdings’ robust third-quarter 2023 results raise our optimism. The company registered year-over-year top and bottom-line growth. The Medical segment recorded robust results owing to strength in the majority of its product lines. The expansion of both margins bodes well.

Research and Product Development: We are optimistic about Integer Holdings’ position as a leading developer and manufacturer of medical devices and components. The company is focused on developing new products, improving and enhancing existing products and expanding the use of its products in new or tangential applications.

In addition to ITGR’s internal technology and capability development efforts aimed at providing its customers with differentiated solutions, the company engages outside research institutions for unique technology projects.

Solid Foothold in the Broader MedTech Space: We are optimistic about Integer Holdings’ stable position in the cardiac, neuromodulation, orthopedics, vascular and advanced surgical markets. Its primary customers include large, multi-national original equipment manufacturers and their affiliated subsidiaries.

ITGR is focused on sales efforts to increase its market penetration in the Cardio & Vascular, Neuromodulation and Non-Medical Electrochem markets. The company is undertaking strategic initiatives to maintain its leadership position in the cardiac rhythm management market.

Downsides

Global Climate Change: Customer, investor and employee expectations related to environmental, social and governance (ESG) have been rapidly evolving and increasing. Also, government organizations are enhancing or advancing legal and regulatory requirements specific to ESG matters.

The heightened stakeholders’ focus on ESG issues related to ITGR’s business requires the continuous monitoring of various and evolving laws, regulations, standards and expectations and the associated reporting requirements. A failure to adequately meet stakeholders’ expectations may result in non-compliance, loss of business and reduced demand for Integer Holdings’ shares, among others.

Volatility in Energy Markets: Thesale of Integer Holdings’ products to the energy market depends upon the condition of the oil and gas industry. Currently, oil and natural gas prices have been subject to significant fluctuation. Per management, a change in the oil and gas exploration and production industry or a reduction in the exploration and production expenditures of oil and gas companies could cause ITGR’s energy market revenues to decline.

Estimate Trend

Integer Holdings is witnessing a positive estimate revision trend for 2023. In the past 90 days, the Zacks Consensus Estimate for earnings has moved north 6.2% to $4.60 per share.

The Zacks Consensus Estimate for the company’s fourth-quarter 2023 revenues is pegged at $397.7 million, indicating a 6.8% improvement from the year-ago quarter’s reported number.

Integer Holdings Corporation Price

Integer Holdings Corporation price | Integer Holdings Corporation Quote

Other Key Picks

Some other top-ranked stocks from the broader medical space are Mesa Laboratories MLAB, HealthEquity, Inc. HQY and Biodesix BDSX.

Mesa Laboratories, sporting a Zacks Rank #1 at present, has an estimated earnings growth rate of 19% for fiscal 2025. You can see the complete list of today’s Zacks #1 Rank stocks here.

MESA’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 7.91%. The company’s shares have lost 37.4% year to date against the industry’s 16% growth.

HealthEquity, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 26.8%. HQY’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 16.5%.

The company’s shares have rallied 15% year to date against the industry’s 9.9% decline.

Biodesix, carrying a Zacks Rank #2 at present, has an estimated growth rate of 32.3% for 2024. BDSX’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 9.76%.

The stock has fallen 30.9% year to date compared with the industry’s 9.9% decline.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mesa Laboratories, Inc. (MLAB) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Biodesix, Inc. (BDSX) : Free Stock Analysis Report