Reasons to Add NRG Energy (NRG) to Your Portfolio Right Now

NRG Energy, Inc. NRG continues to expand through organic and inorganic initiatives. Its diverse customer base and long-term customer retention policy further boost its performance. Given its growth opportunities, NRG makes for a solid investment option in the utility sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) company a strong investment pick at the moment.

Growth Projections

The Zacks Consensus Estimate for fourth-quarter 2023 earnings per share (EPS) has moved up 64.7% in the past 30 days to 84 cents.

NRG Energy’s long-term (three to five years) earnings growth rate is 13.75%. It delivered an average earnings surprise of 4.7% in the last four quarters.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing the funds to generate higher returns. Currently, NRG’s ROE is 41.72%, higher than the industry’s average of 7%. This indicates that the company has been utilizing the funds more constructively than its peers in the utility electric power industry.

Dividend Growth & Repurchase Program

NRG Energy increases shareholders’ value through share repurchases and dividend payments. Currently, its quarterly dividend is 37.75 cents per share, resulting in an annualized dividend of $1.51 per share. NRG’s current dividend yield is 3.34%, better than the Zacks S&P 500 Composite’s 1.43%.

In June 2023, the company revised its long-term capital allocation policy to allocate approximately 80% of cash available for allocation after debt reduction to be returned to shareholders. It announced an increase in its share repurchase authorization to $2.7 billion, set to be executed through 2025. During the three months ended Sep 30, 2023, NRG completed $50 million of share repurchases at an average price of $37.82 under the $2.7-billion authorization. The company will further repurchase shares through a $950-million accelerated share repurchase program, which will further enhance shareholders’ value.

Diverse Customer Base

In the past few years, NRG Energy has made a significant progress in its transformation to an integrated power company through its focus on customers. It sells electricity to a wide variety of customers and none of them contributed more than 10% to the company’s revenues as of Dec 31, 2022. Courtesy of its high-quality services, NRG has been able to retain customers. The company does not depend on a single customer to generate revenues, which adds stability and predictability to customer bills and its earnings.

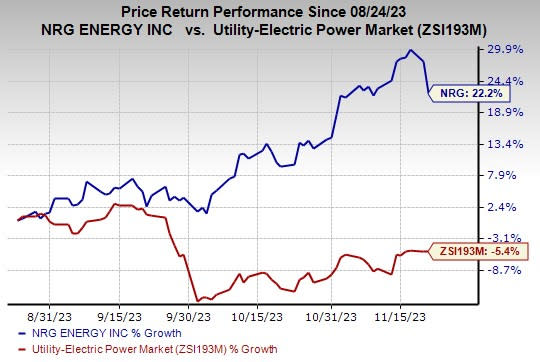

Price Performance

In the last three months, the stock returned 22.2% against the industry’s average decline of 5.4%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are Consolidated Edison ED, PPL Corporation PPL and NiSource Inc NI, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Consolidated Edison’s long-term earnings growth rate is 2%. The Zacks Consensus Estimate for the company’s 2023 EPS is pinned at $4.94, implying a year-over-year increase of 8.6%.

PPL’s long-term earnings growth rate is 7.42%. The consensus estimate for the company’s 2023 EPS is pegged at $1.58, indicating a year-over-year improvement of 12.1%.

NiSource’s long-term earnings growth rate is 7.15%. The consensus estimate for the company’s 2023 EPS is pinned at $1.60, indicating year-over-year growth of 8.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPL Corporation (PPL) : Free Stock Analysis Report

NiSource, Inc (NI) : Free Stock Analysis Report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report