Reasons to Add O-I Glass (OI) Stock to Your Portfolio

O-I Glass, Inc. OI has been recording year-over-year improvement in its top and bottom lines in the last five quarters, benefiting from higher prices and continued margin expansion initiatives. The company is expected to take this momentum forward, backed by the growing preference for glass as a healthy, premium and sustainable packaging option for food and beverage. OI’s investment in boosting its production capacity to capitalize on this trend will fuel growth. Acquisitions and product innovations are also likely to act as key catalysts.

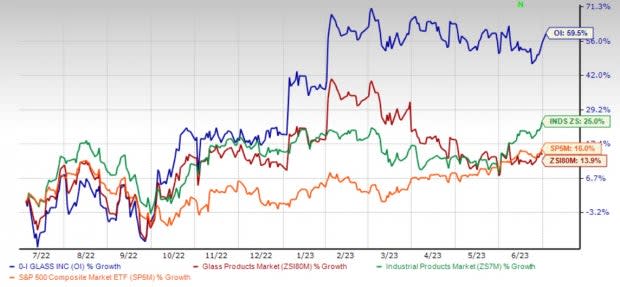

Top Zacks Rank & Upbeat Price Performance

The company currently carries a Zacks Rank #2 (Buy).

Shares of the company have gained 59.5% in a year’s time compared with the industry’s 13.9% growth. The Zacks Industrial Products sector has gained 25% and the S&P 500 composite has risen 16% in the same time frame.

Image Source: Zacks Investment Research

Positive Earnings Surprise History

O-I Glass’ earnings outpaced estimates in all four trailing quarters, the average surprise being 21.2%.

Upbeat Outlook for 2023

In the last reported quarter, the company delivered a solid 130% improvement in its earnings per share on strong net price realization, solid operating performance and benefits from the company’s ongoing margin expansion initiatives. Expecting these factors to continue, OI projects adjusted earnings per share to be in the range of $3.05 to $3.25 for 2023, the midpoint of which indicates year-over-year growth of 37%. The Zacks Consensus Estimate for 2023 earnings is $3.17 per share, which indicates year-over-year growth of 38%.

Upward Revision in Estimates

The Zacks Consensus Estimate for OI’s earnings for 2023 has moved up 5% over the past 60 days and is currently pegged at $3.17 per share. The consensus mark for 2024 earnings has also seen a northward revision of 1% to $3.09 per share.

Superior Return on Equity

O-I Glass’ trailing 12-month Return on Equity (ROE) supports its growth potential. The company’s ROE of 27.4% is much higher than the industry’s average ROE of 0.9%, reflecting its efficiency in utilizing shareholders’ funds.

Rising Glass Demand Bodes Well

Glass packaging is now been preferred by customers due to its recyclability and being a healthier and safer alternative to plastic packaging. O-I Glass is thus investing in incremental capacity, joint ventures and acquisitions in emerging geographies to capitalize on this trend. To this end, OI intends to invest up to $630 million in new capacity expansion over the next three-year period, which is expected to generate an average internal return rate of 20%.

MAGMA Expected to be a Key Catalyst

O-I Glass is firmly focused on driving innovation. Its glass melting technology, known as the MAGMA program, aids in reducing the amount of capital required to install, rebuild and operate OI’s furnaces. The MAGMA program is being implemented using a multi-generational development roadmap.

Riding on the Margin Expansion Initiative

O-I Glass is taking a few initiatives as part of its transformation plan from 2022 through 2024. It expects its margin expansion initiative to generate annual benefits of more than $100 million. The company successfully completed its $1.5 billion Portfolio Optimization program and the proceeds from the program have been utilized to repay debt, fund attractive expansion projects and improve financial strength.

Other Stocks to Consider

Some other top-ranked stocks in the Industrial Products sector are The Manitowoc Company, Inc. MTW, Allegion ALLE and AptarGroup ATR.

Manitowoc has an average trailing four-quarter earnings surprise of 256.3%. The Zacks Consensus Estimate for MTW’s 2023 earnings is pegged at $1.12 per share, which suggests year-over-year growth of 5.7%. The estimate has been revised upward by 32% over the past 60 days.

MTW’s shares have gained 78% in the past year. The stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allegion has an average trailing four-quarter earnings surprise of 12.5%. The Zacks Consensus Estimate for Allegion’s fiscal 2023 earnings has moved up 1% in the past 60 days to $6.63 per share. The consensus mark suggests year-over-year growth of 16.5%.

ALLE has an average trailing four-quarter earnings surprise of 12.5%. Its shares have gained 19% in the past year.

The consensus estimate for AptarGroup’s 2023 earnings per share is currently at $4.16. The estimate has moved up 3% in the past 60 days. The estimate projects year-over-year growth of 9.8%. ATR has a trailing four-quarter average earnings surprise of 6.4%. AptarGroup’s shares have gained 12% in a year’s time.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

O-I Glass, Inc. (OI) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report