Reasons to Add Paychex (PAYX) Stock to Your Portfolio Now

Paychex, Inc. PAYX has grown meaningfully over the years by providing industry-leading service and technology solutions to its clients and their employees. Its solid business model, diversified products and services, and strategic acquisitions have boosted its top-line growth.

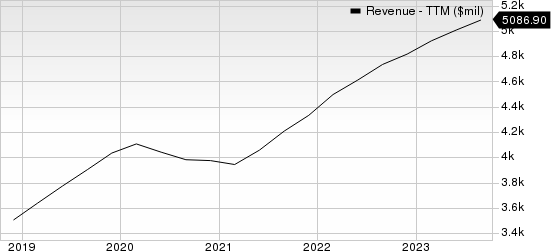

Revenues witnessed a five-year (2018-2023) CAGR of 8.2%. Higher revenues are likely to expand margins and increase profitability in the long run.

Paychex, Inc. Revenue (TTM)

Paychex, Inc. revenue-ttm | Paychex, Inc. Quote

Paychex puts consistent efforts into rewarding its shareholders through dividends and share repurchases. The company paid dividends of $1.17 billion, $999.6 million and $908.7 million in fiscal years 2023, 2022 and 2021, respectively. It repurchased shares worth $145.2 million, $155.7 million and $171.9, respectively, in fiscal 2022, 2021 and 2020. Such initiatives instill investors’ confidence and positively impact earnings per share.

Let’s take a look at some other factors that make PAYX an attractive pick:

Solid Rank: Paychex carries a Zacks Rank #2 (Buy) and has a Value Growth Momentum Score (VGM Score) of B. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities. Thus, PAYX is a compelling investment proposition at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions: The direction of estimate revisions serves as an important pointer when it comes to the price of a stock. Nine estimates for fiscal 2024 have moved north over the past 30 days versus no southward revision, reflecting analysts’ confidence in the stock. Over the same period, the Zacks Consensus Estimate for fiscal 2024 earnings has moved 0.4% north.

Positive Earnings Surprise History: Paychex has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in three of the trailing four quarters and missed once, delivering an average beat of 2.3%.

Strong Growth Prospects: The Zacks Consensus Estimate for Paychex’s fiscal 2024 earnings of $4.7 per share implies year-over-year growth of 10.1%. Earnings are expected to register 6.6% growth in fiscal 2025. The stock has a long-term expected earnings per share growth rate of 7.8%.

Other Stocks to Consider

Investors interested in the Zacks Business Services sector can also consider the following stocks.

Verisk Analytics VRSK beat the Zacks Consensus Estimate in three of the last four quarters and matched on one instance, with the average surprise being 9.9%. The consensus mark for 2023 revenues is pegged at $2.66 billion, suggesting a decrease of 8.2% from the year-ago figure. The consensus estimate for 2023 earnings is pegged at $5.71 per share, indicating a 14% rise from the year-ago figure. VRSK currently carries a Zacks Rank #2 (Buy).

Automatic Data ADP currently has a Zacks Rank of 2. It outpaced the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 3.1%. The consensus estimate for fiscal 2023 revenues and earnings implies growth of 8.4% and 11.1%, respectively.

Broadridge BR currently carries a Zacks Rank of 2. It surpassed the Zacks Consensus Estimate in two of the trailing four quarters, missed once and matched on one instance, the average surprise being 0.5%. The consensus estimate for fiscal 2024 revenues and earnings predicts growth of 9.3% and 8.8%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report