Reasons to Add Sempra Energy (SRE) to Your Portfolio Now

Sempra Energy’s SRE earnings estimates have been revised upward over the past 90 days, reflecting analysts’ optimism surrounding the stock. The Zacks Consensus Estimate for 2023 and 2024 earnings has moved up 1.3% and 0.4%, respectively, during the same period.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a good investment option at the moment.

Strong Investment Plan

Sempra Energy has well-chalked-out plans to invest $40 billion in different projects within the 2023-2027 time period. These investments will be directed toward modernizing and strengthening the company’s existing infrastructure. More than 85% of the planned capital expenditure will be used to strengthen its U.S. utilities.

Return on Equity (ROE)

Return on Equity indicates how efficiently the company is utilizing the funds to generate returns. The company’s ROE is 9.88% compared with the industry’s average of 9.21%. This indicates that SRE is more efficient in utilizing shareholders’ funds than its industry peers.

Price Movement

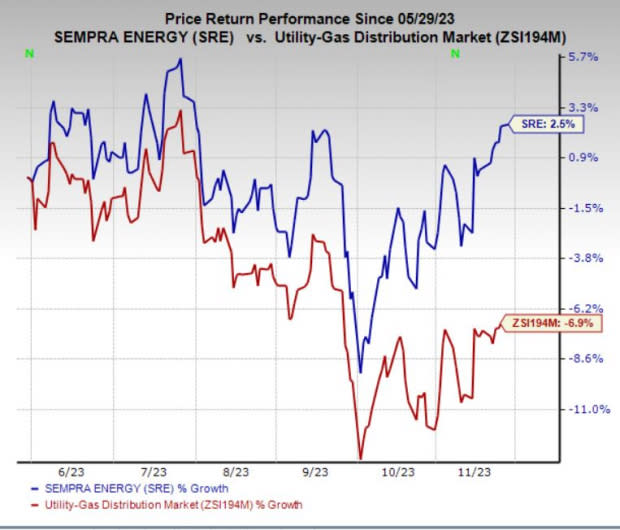

In the past six months, Sempra Energy’s shares have gained 2.5% against the industry’s decline of 6.9%.

Image Source: Zacks Investment Research

Long-Term Growth and Dividend Yield

The company’s long-term (three- to five-year) earnings growth is projected at 4.95%, courtesy of its capital investment plans to strengthen electric and natural gas operations.

Its current dividend yield is 3.23% compared with the Zacks S&P 500 composite’s average of 1.69%.

Other Key Picks

Other top-ranked stocks from the same sector include CenterPoint Energy CNP, OGE Energy Corp. OGE and Southwest Gas SWX, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth of CenterPoint Energy, OGE Energy and Southwest Gas is projected at 7.5%, 3.7% and 5%, respectively.

The Zacks Consensus Estimate for 2023 earnings for CenterPoint Energy, OGE Energy and Southwest Gas has moved up by 0.7%, 0.5% and 3.3%, respectively, in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sempra Energy (SRE) : Free Stock Analysis Report

OGE Energy Corporation (OGE) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Southwest Gas Corporation (SWX) : Free Stock Analysis Report