Reasons to Hold FTI Consulting (FCN) Stock in Your Portfolio

FTI Consulting, Inc. FCN has had an impressive run in the year-to-date period. The stock has gained 19%, outperforming the 14.1% rise of the industry it belongs to and the 14% rally of the Zacks S&P 500 composite.

FCN has an impressive Growth Score of B. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

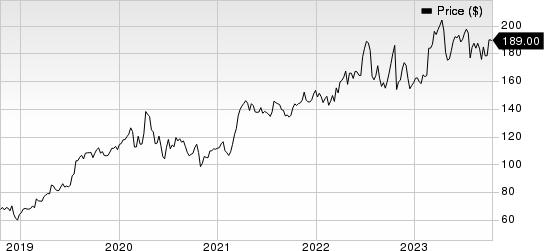

FTI Consulting, Inc. Price

FTI Consulting, Inc. price | FTI Consulting, Inc. Quote

Factors That Augur Well

FTI Consulting has a unique potential to bring together diverse issues like damage assessment, accounting, economics, finance and the industry on a single platform. This makes it an excellent partner for global clients, thereby generating continued revenue growth from the existing international operations. Global operations help the company to expand its geographic footprint. FCN’s revenues rose 14.5% on a year-over-year basis in the second quarter of 2023.

Increased regulatory scrutiny and a proliferation of corporate litigation are likely to increase the demandfor FTI Consulting’s products.Additionally, structural change has become necessary in the rapidly evolving global markets as management teams look to fend off rivals, protect intellectual property rights and transform businesses via M&A, divestiture and other restructuring activities. These developments call for FTI Consulting’s specialized skill sets and will likely boost its revenues.

A Risk

FTI Consulting's current ratio (a measure of liquidity) stood at 2.30 at the end of second-quarter 2023, lower than the 2.51 recorded at the end of the prior quarter. A decline in the current ratio does not bode well for the company.

Zacks Rank and Stocks to Consider

FTI Consulting currently carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Business Services sector can consider the following better-ranked stocks:

Verisk Analytics VRSK beat the Zacks Consensus Estimate in three of the last four quarters and matched on one instance, with an average surprise of 9.9%. The consensus mark for 2023 revenues is pegged at $2.66 billion, suggesting a decrease of 8.2% from the year-ago figure. The consensus estimate for 2023 earnings is pegged at $5.72 per share, indicating a 14% rise from the year-ago figure. VRSK currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Automatic Data ADP currently has a Zacks Rank of 2. It outpaced the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 3.1%. The consensus estimate for fiscal 2023 revenues and earnings implies growth of 6.3% and 11.1%, respectively.

Broadridge BR currently carries a Zacks Rank of 2. It surpassed the Zacks Consensus Estimate in two of the trailing four quarters, missed once and matched on one instance, the average surprise being 0.5%. The consensus estimates for fiscal 2024 revenues and earnings suggest growth of 7.2% and 8.8%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report