Reasons You Should Hold Sonoco (SON) in Your Portfolio Now

Sonoco Products Company SON is poised to benefit from its focus on optimizing businesses through productivity improvement, standardization and cost control. Recent acquisitions and further investments will boost growth in the upcoming quarters.

Let us delve deeper and analyze the factors that make this stock worth holding on to at present.

Effective Strategic Actions: Sonoco’s consumer packaging businesses have been benefiting from the Metal Packaging acquisition and pricing efforts. The company is implementing aggressive price actions across its businesses to counter higher raw material and non-material inflation.

Continued strong recovery in price and costs across most of its businesses, benefits from the Ball Metalpack (now Sonoco Metal Packaging) acquisition, and solid demand are likely to contribute to the 2023 results.

Focus on Growth & Innovation: Sonoco’s focus on optimizing businesses through productivity improvement, standardization and cost control will also aid results in the near term. The company is implementing several synergy opportunities, including optimizing raw material purchases, leveraging indirect expenses and coordinating supply-chain logistics. These factors will help meet Sonoco’s cost-saving target.

Sonoco is focused on increasing investment in its core consumer and industrial businesses, and achieving an annual EBITDA of $1 billion by 2026.

The company has been emphasizing on capital allocation and expects to be able to increase dividends while maintaining an investment-grade balance sheet. It intends to increase returns on invested capital in the coming years through organic investments in core accretive acquisitions and portfolio rationalization.

Moreover, Sonoco is focused on growing in the niche food markets and launching new products. Investment in these markets will add pouch-making capacity for the company and help it expand its presence in the pouch market.

Impressive Acquisitions: On Jan 22, 2022, Sonoco completed the acquisition of Ball Metalpack for a cash payment of $1.35 billion. Ball Metalpack is a foremost producer of sustainable metal packaging for food and household products, and the largest manufacturer of aerosol products in North America.

The deal supported Sonoco’s focus on investing in the core business that strengthens its global Paper Cans and Closures business, while bolstering its sustainable packaging portfolio with metal packaging.

Notably, metal packaging is preferable by U.S. customers due to its inherent attributes of recyclability and sustainability. Sonoco expects to realize tax benefits of $180 million from the deal. It expects to generate annual synergies of at least $20 million from procurement and SG&A savings within three years of the transaction.

In fourth-quarter 2022, Sonoco acquired Denmark-based Skjern, a privately owned manufacturer of paper, for $88 million in cash. The acquisition expanded SON’s production capacity. It helps Sonoco capitalize on the growing market for sustainable paper and packaging products in Europe.

Near-Term Concerns

In the third quarter of 2023, the company faced lower volumes due to inventory destocking. This is likely to have continued throughout the remainder of the year and kept denting margins.

Moreover, Sonoco will continue to bear the brunt of raw material, energy and freight cost pressures, and the impacts of supply-chain disruptions. These factors are likely to have hurt the company’s performance in 2023.

Price Performance

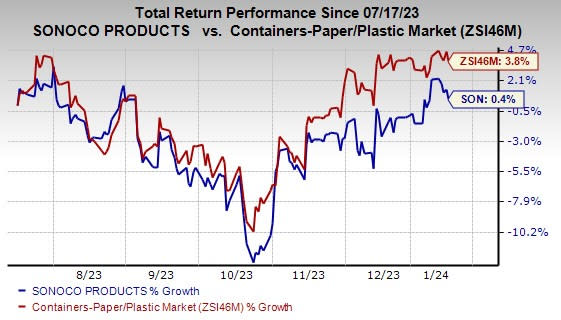

Shares of the company gained 0.4% in the last six months compared with the industry’s growth of 3.8%.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

Sonoco currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are AZZ Inc. AZZ, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS. AZZ currently sports a Zacks Rank #1 (Strong Buy), and AIT and AOS carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AZZ’s fiscal 2024 earnings per share is pegged at $4.19. The consensus estimate for 2024 earnings has moved north by 2% in the past 60 days. The company has a trailing four-quarter average earnings surprise of 37.6%. AZZ shares have rallied 33.7% in the past six months.

Applied Industrial has an average trailing four-quarter earnings surprise of 13.9%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 2% in the past 60 days. The company’s shares gained 17.3% in the last six months.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 1% north in the past 60 days and suggests year-over-year growth of 20.4%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 9.1% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sonoco Products Company (SON) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

AZZ Inc. (AZZ) : Free Stock Analysis Report