Reasons for the Outperformance of Novanta (NOVT)

Conestoga Capital Advisors, an asset management company, released its “Small Cap Strategy” second-quarter 2023 investor letter. A copy of the same can be downloaded here. The Small Cap Composite rose 4.93% net-of-fees in the second quarter, compared to the Russell 2000 Growth Index’s 7.05% return. The key source of underperformance was poor stock selection, with allocation effects providing little benefit. The underperformance was mostly concentrated in the Industrials sector with minor declines in the Technology and Basic Materials sectors. Gains in the Consumer Discretionary and Utilities sectors partially offset these losses. In addition, please check the fund’s top five holdings to know its best picks in 2023.

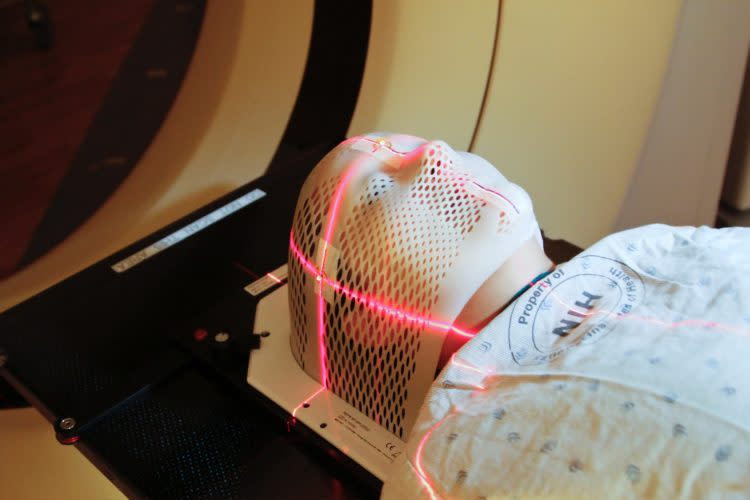

Conestoga Small Cap Strategy highlighted stocks like Novanta Inc. (NASDAQ:NOVT) in the second quarter 2023 investor letter. Headquartered in Bedford, Massachusetts, Novanta Inc. (NASDAQ:NOVT) designs and manufactures photonics, vision, and precision motion. On August 8, 2023, Novanta Inc. (NASDAQ:NOVT) stock closed at $153.00 per share. One-month return of Novanta Inc. (NASDAQ:NOVT) was -15.53%, and its shares gained 0.97% of their value over the last 52 weeks. Novanta Inc. (NASDAQ:NOVT) has a market capitalization of $5.478 billion.

Conestoga Small Cap Strategy made the following comment about Novanta Inc. (NASDAQ:NOVT) in its second quarter 2023 investor letter:

"Novanta Inc. (NASDAQ:NOVT)): NOVT designs and manufactures advanced photonics, vision and precision motion components and subsystems, primarily for the healthcare market. NOVT has now been a portfolio leader in two of the last three quarters as the company benefits from consistent and diversified revenue growth across numerous secular growth markets. NOVT is also the beneficiary of an improving supply chain, which has led to margin expansion and improving free cash flow conversion."

national-cancer-institute-Jg89tuvB1iQ-unsplash

Novanta Inc. (NASDAQ:NOVT) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 10 hedge fund portfolios held Novanta Inc. (NASDAQ:NOVT) at the end of first quarter which was 11 in the previous quarter.

We discussed Novanta Inc. (NASDAQ:NOVT) in another article and shared the list of top automation companies in the U.S. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

Disclosure: None. This article is originally published at Insider Monkey.