Reasons to Retain Cardinal Health (CAH) in Your Portfolio

Cardinal Health Inc. CAH is well poised for growth, given its acquisition-driven strategy, a diversified product portfolio and a robust pharmaceutical segment. However, margin contraction remains a concern.

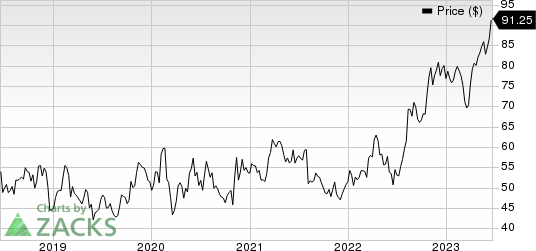

Shares of this Zacks Rank #3 (Hold) company have risen 18.7% year to date compared with the industry's 12.1% growth. The S&P 500 Index increased 15.9% in the same time frame.

CAH, with a market capitalization of $23.23 billion, is a nationwide drug distributor and service provider to pharmacies, healthcare providers and manufacturers. The company has an earnings yield of 6.3% compared with the industry's 4.5%. It anticipates earnings to improve 13.2% over the next five years.

Image Source: Zacks Investment Research

What's Driving the Performance?

Cardinal Health's Medical and Pharmaceutical contributions provide it with a competitive edge in its niche area of operations. The company offers industry expertise through an expanding portfolio of safe and effective pharmaceuticals and medical products.

In order to gain market traction and bolster profits, CAH pursues an acquisition-driven strategy and remains committed to investing in its key growth businesses.

The company's Pharmaceutical segment is one of the leading pharmaceutical distributors in the United States. Its products and services include pharmaceutical distribution, manufacturer and specialty solutions, and nuclear and pharmacy offerings. Cardinal Health is expected to draw strength from this segmentin the future.

In the third quarter of fiscal 2023, Pharmaceutical revenues totaled $46.8 billion, up 14% on a year-over-year basis. The performance suggests branded pharmaceutical sales growth from Pharmaceutical Distribution and Specialty Solutions customers.

On its fiscal third-quarter 2023 earnings call, Cardinal Health raised its adjusted earnings per share (EPS) guidance to $5.60-$5.80 from $5.20-$5.50.

Notable Developments

CAH continues to expand its distribution centers. Earlier this month, the company announced its plans to build a new distribution center in Greenville, SC. The facility will support CAH’s supply of healthcare medical supplies at home, especially to those with chronic and serious health conditions.

In May, the company divulged its plans to open a new distribution center in Ontario, Canada, expanding its presence in nine strategic locations. The csenter will use state-of-the-art robotics technology to drive efficiencies and accuracy, which will help meet the medical and surgical product demands of Canada’s healthcare system.

In April, Cardinal Health opened a new distribution center in Ohio to focus on its U.S. Medical Products and Distribution, and at-Home Solutions businesses.

In March, the company collaborated with Signify Health to offer in-home clinical and medication management services. The collaboration has been inked to address interventions recommended for Medicare Advantage members of joint clients, and may expand into additional services (such as population health programs) and clinical interventions.

What's Weighing on the Stock?

In the third quarter of fiscal 2023, gross margin contracted 20 basis points year over year, suggesting rising costs. The inflationary pressure is likely to continue in the next few quarters.

In the Medical segment, revenues declined 5% to $3.7 billion due to the divestiture of the Cordis business. CAH continues to face inflationary impacts and global supply-chain restrictions in terms of products and distribution. These macro headwinds are expected to continue for the rest of the financial year.

Estimates Trend

The Zacks Consensus Estimate for 2023 revenues is pegged at $203.97 billion, indicating a 12.5% improvement from the previous year’s level.

The same for adjusted EPS is pinned at $5.68, indicating a 12.3% increase from the year-ago reported number.

Cardinal Health, Inc. Price

Cardinal Health, Inc. price | Cardinal Health, Inc. Quote

Stocks to Consider

Some better-ranked stocks from the same industry are Merit Medical Systems MMSI, West Pharmaceutical Services WST and CONMED CNMD, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Merit Medical Systems has an estimated long-term growth rate of 11%. The company’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 20.22%.

MMSI’s shares haverisen 18.9% year to date.

West Pharmaceutical Services has an estimated long-term growth rate of 6.3%. Its earnings surpassed estimates in three of the trailing four quarters and missed the same once, delivering an average surprise of 13.61%.

WST’s shares have rallied 47.7% year to date.

CONMED has an estimated long-term growth rate of 19.4%. CNMD’s earnings surpassed estimates in two of the trailing four quarters, missed once and met the same in another, delivering an average negative surprise of 10.54%.

CONMED has risen 33.8% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CONMED Corporation (CNMD) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report