Reasons to Retain Danaher (DHR) Stock in Your Portfolio Now

Danaher Corporation DHR is benefiting from the Life Sciences segment & the Danaher Business System (DBS) initiatives despite weakness in the Biotechnology and Diagnostics segments and forex woes.

Let us discuss the reasons why investors should retain the stock for the time being.

Growth Catalysts

Business Strength: Improving supply chains and strong price realization are driving Danaher’s growth. Stable demand in the life science research and applied markets supports the Life Sciences segment. Revenues from the segment inched up 2.5% year over year in the first nine months of 2023.

Accretive Acquisition: The company aims to expand its market share, product offerings and customer base through strategic acquisitions. In December, DHR completed the acquisition of Cambridge, UK-based Abcam plc for $24.00 per share in cash. Abcam will be added to the company’s Life Sciences segment, thus boosting its capability to identify complex diseases and accelerate the drug discovery process.

DBS Initiative: The DBS initiative, which helps Danaher focus more on product innovation, superior product quality, efficient workforce building and shareholder value enhancement, is fostering the company’s growth. The company has been able to reduce the impact of supply-chain constraints and inflationary pressure through its DBS initiatives. As part of the DBS initiatives, disciplined cost management, enhanced productivity and pricing actions have supported the company’s margin performance.

Rewards to Shareholders: The company continues to increase shareholders’ value through dividend payments. In the first nine months of 2023, the company paid dividends of $621 million, up around 1% year over year. In February 2023, the company hiked its dividend by 8% to 27 cents per share.

In light of the above-mentioned positives, we believe investors should retain DHR stock for now, as suggested by its current Zacks Rank #3 (Hold).

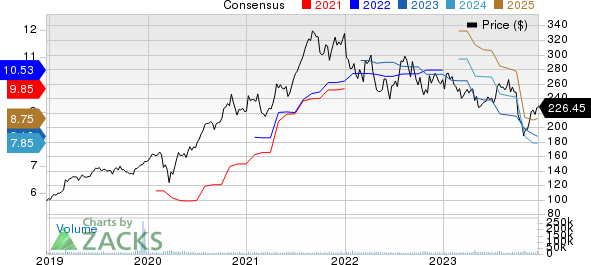

Danaher Corporation Price and Consensus

Danaher Corporation price-consensus-chart | Danaher Corporation Quote

Stocks to Consider

Some better-ranked companies have been discussed below.

Federal Signal Corporation FSS presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

FSS delivered a trailing four-quarter average earnings surprise of 8.1%. In the past 60 days, the Zacks Consensus Estimate for Federal Signal’s 2023 earnings has increased 3.3%. The stock has risen 66.2% in the past year.

ITT Inc. ITT presently carries a Zacks Rank of 2. It has a trailing four-quarter average earnings surprise of 8%.

The consensus estimate for ITT’s 2023 earnings has increased 2% in the past 60 days. Shares of ITT have soared 46.9% in the past year.

A. O. Smith Corporation AOS currently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 14%.

In the past 60 days, the consensus estimate for A. O. Smith’s 2023 earnings has improved 4.4%. The stock has risen 41% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Danaher Corporation (DHR) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Federal Signal Corporation (FSS) : Free Stock Analysis Report