Reasons to Retain DexCom (DXCM) Stock in Your Portfolio for Now

DexCom, Inc. DXCM is well poised for growth in the coming quarters, backed by its strong product portfolio. A robust third-quarter 2023 performance, along with a series of favorable coverage decisions, is expected to contribute further. However, risks related to stiff competition persist.

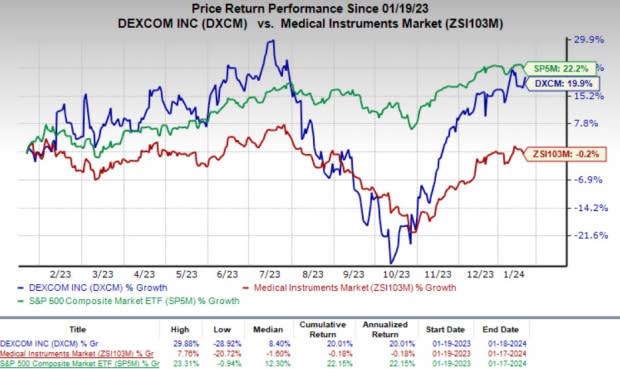

This currently Zacks Rank #3 (Hold) company’s shares have risen 19.9% in the past year against the industry’s 0.2% decline. The S&P 500 Index has increased 22.2% in the same time frame.

DXCM, a renowned medical device company and provider of continuous glucose monitoring (CGM) systems, has a market capitalization of $48.47 billion. It projects 29.9% growth over the next five years and expects to maintain the strong performance going forward.

Image Source: Zacks Investment Research

DexCom’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 36.43%.

Let’s delve deeper.

Strong Product Demand: We are upbeat about DexCom's continued strength in its CGM products.

The company continues to expand its product portfolio with the addition of new products like DexCom One and G7 sensor. This has helped accelerate its growth. Sales of these products have reflected strong demand since their launch late last year.

Moreover, the expansion of coverage for CGM systems during the quarter supported growth. This trend is likely to continue in 2024. The availability of new sensors like G6 and G7 in new international markets is also boosting revenue growth. DXCM launched its latest sensor, G7, in more than 15 countries during 2023. Moreover, DexCom is focusing on connecting its CGM sensors with automated insulin delivery systems worldwide that may boost the sensors’ demand going forward.

Additionally, the glucose monitoring market presents significant commercial opportunities for the company. DexCom’s prospects in alternative markets such as non-intensive diabetes management, hospital, gestational, pre-diabetes and obesity are likely to provide it with a competitive edge in the MedTech space.

New Product Launch: During the fourth quarter of 2023, DexCom submitted its new glucose sensor, Stelo, to the FDA for review. The new sensor is designed specifically for people with type II diabetes who do not use insulin. The company expects to launch the sensor in the U.S. market during the summer of 2024. This is the first sensor from DXCM targeting type II diabetes and is likely to be a key growth driver for the company in 2024.

Positive Coverages: DXCM’s products have been receiving increasing coverage over the past few months, raising our optimism. The company’s G7 CGM System is already covered by all major pharmacy benefit managers in the United States, following its launch late last year.

In 2022, the company expanded public coverage for type 1 and type 2 diabetic patients (aged two years and above) who are on multiple daily injections of insulin (three or more) or who use an insulin pump leveraging its G6 CGM System via Prince Edward Island’s Diabetes Glucose Sensor Program.

DexCom ended the third quarter with new patient additions. The Ontario government began coverage for the Dexcom G6 CGM System through the province’s Assistive Devices Program. This program has been designed for provincial people with type 1 diabetes, who are above the age of two and meet the coverage criteria.

Strong Q4 Preliminary Results: DXCM’s strong preliminary fourth-quarter 2023 revenues buoy optimism. The company achieved the largest expansion of coverage for its sensors in 2023. The expanded coverage made its sensors more accessible to patients, thereby driving revenues. Dexcom expects total revenues in the band of $4.15-$4.35 billion for 2024, implying organic growth of 16-21% year over year.

Impressive contributions from the Sensor segment, and domestic and international revenue growth were the key catalysts. Additionally, the glucose monitoring market presents significant commercial opportunities for DXCM.

Downsides

Rising Costs: The company’s gross margin contracted 30 basis points during the third quarter to 62.7%, reflecting the rising cost of sales. It expects an adjusted gross margin of approximately 64% for 2023, indicating persisting cost pressure.

Stiff Competition: The market for blood glucose monitoring devices is highly competitive, subject to rapid changes and new product introductions. DXCM’s competitors manufacture and market products for the single-point finger stick device market and collectively account for the worldwide sales of self-monitored glucose testing systems at present.

Estimate Trend

DexCom is witnessing an improving estimate revision trend for 2023 and 2024. In the past 60 days, the Zacks Consensus Estimate for earnings has increased from $1.43 per share to $1.44 for 2023 and from $1.68 to $1.71 for 2024.

The consensus mark for the company’s fourth-quarter 2023 revenues is pegged at $1.03 billion, indicating a 26.4% improvement from the year-ago quarter’s reported number. The same for earnings is pinned at 43 cents per share, implying growth of 26.5% year over year.

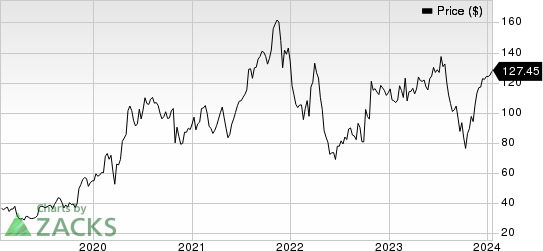

DexCom, Inc. Price

DexCom, Inc. price | DexCom, Inc. Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Merit Medical Systems, Inc. MMSI and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 17.3%. DVA’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have risen 38% compared with the industry’s 9% growth in the past year.

Merit Medical, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 11.5%. MMSI’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 14.4%.

Merit Medical’s shares have risen 12.3% compared with the industry’s 9.5% growth in the past year.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.9%.

Integer Holdings’ shares have risen 40.4% compared with the industry’s 0.3% growth in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report