Reasons to Retain Fresenius Medical (FMS) in Your Portfolio Now

Fresenius Medical Care AG & Co. KGaA FMS is well-poised for growth on the back of a broad range of dialysis products and services and a solid global foothold. However, stiff competition remains a concern.

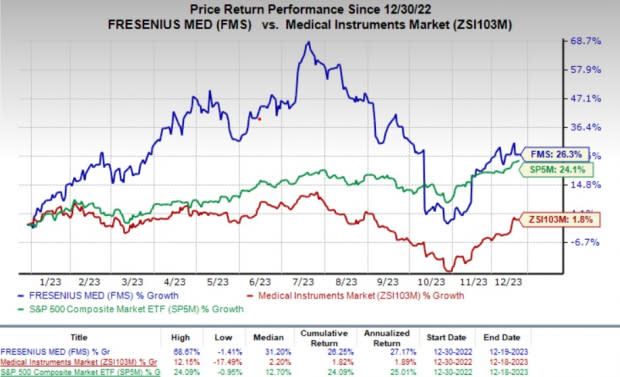

Shares of this Zacks Rank #3 (Hold) company have risen 26.3% year to date compared with the industry’s growth of 1.8%. The S&P 500 Index has gained 24.1% in the same time frame.

The company, with a market capitalization of $12.12 billion, is one of the largest integrated providers of products and services for individuals undergoing dialysis following chronic kidney failure. Its bottom line is anticipated to improve 26.8% in 2024 after declining in 2023. FMS’ earnings beat estimates in three of the trailing four quarters and missed the same once, delivering an average surprise of 43.17%.

Image Source: Zacks Investment Research

Key Catalysts

Fresenius Medical provides a wide range of dialysis products in its dialysis and third-party clinics. These include modular machine components, dialyzers, bloodline systems, HD (hemodialysis) solutions, concentrates and water treatment systems.

The company offers an extensive array of Hemodyalisis, Peritoneal dialysis and Acute Dialysis products. It is focused on further expanding its home dialysis offerings in order to further boost the quality of life for patients and increase their choice of available treatments.

In August, FMS received 510(k) clearance from the FDA for Versi HD with GuideMe Software — the next-generation portable automated peritoneal dialysis system with a completely reinvented self-guided interface. The software can help facilitate a smooth and safe switch from hospital to home with easier training experiences. The company has planned to launch the VersiHD with GuideMe Software in selected markets in 2023. Moreover, existing users of VersiHD are also eligible for an upgrade to the GuideMe Software.

Fresenius Medical has a solid market hold in the regions of North America, Europe (EMEA), the Asia Pacific and Latin America. To strengthen its market position, the company is resorting to various approaches like enhancing its organic growth and making strategic and suitable acquisitions. FMS also aims to align its business activities through public-private partnerships in the dialysis business. This way, it can tap into new markets in the coming quarters.

Although FMS exited the third quarter on a dismal note, its results reflected strong organic growth on the back of improving treatment volumes as well as a stabilizing labor environment in the United States. A potential continuation of improvement in these two key factors will be beneficial for the company in the rest of 2023. Overall price improvements also supported growth in the Care Enablement segment.

Meanwhile, FMS’ newly implemented operating model led to operational improvements. The bottom line was hurt by inflationary cost increases in energy, material and personnel. These headwinds are likely to improve going forward, which is also reflected in the company’s operating outlook.

What’s Hurting the Stock?

Fresenius Medical has numerous competitors in the fields of healthcare services and dialysis products. Intense competition in the niche markets is likely to hamper the company’s sales opportunities, which, in turn, can lead to a loss of market share.

Recently, positive data from a late-stage study evaluating Novo Nordisk’s new diabetes drug, Ozempic, has raised concerns about a potential rise in competition for Fresenius Medical. Clinical data suggests that the adoption of Ozempic may have an adverse impact on the dialysis of patients — a major source of FMS’ revenues — going forward.

A lower volume of dialysis led by a potential delay in chronic kidney disease (due to the use of Ozempic) can be detrimental for Fresenius Medical’s top line. Shares of the company plunged significantly following the announcement of the Ozempic study data last week.

U.S. revenues continued to be hurt by the FX impact. Moreover, the bottom line was hurt by inflationary cost increases in energy, material and personnel. However, FMS’ cost-saving initiatives have helped cushion the decline in operating margin. Meanwhile, planned divestitures, as part of the company’s transformational plan, will lead to a loss of revenues going forward.

Estimate Trend

The Zacks Consensus Estimate for 2023 revenues is pegged at $21.07 billion, indicating growth of 3.3% from the previous year’s reported number. The consensus mark for earnings is pinned at $1.26 per share, implying a decline of 23.2% from the year-ago level.

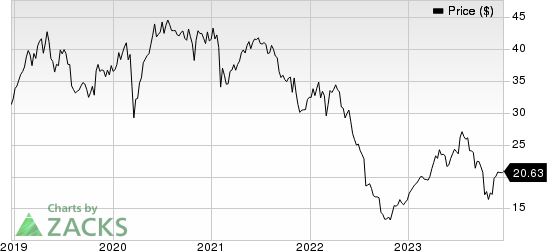

Fresenius Medical Care AG & Co. KGaA Price

Fresenius Medical Care AG & Co. KGaA price | Fresenius Medical Care AG & Co. KGaA Quote

Stocks to Consider

Some better-ranked stocks from the broader medical space are Integer Holdings ITGR, HealthEquity, Inc. HQY and Biodesix BDSX.

Integer Holdings, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 33.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.98%. The company’s shares have risen 42.5% year to date compared with the industry’s 1.7% growth.

HealthEquity, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 26.8%. HQY’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 16.5%.

The company’s shares have rallied 15% year to date against the industry’s 9.9% decline.

Biodesix, carrying a Zacks Rank #2 at present, has an estimated growth rate of 32.3% for 2024. BDSX’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 9.76%.

The stock has fallen 30.9% year to date compared with the industry’s 9.9% decline.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fresenius Medical Care AG & Co. KGaA (FMS) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Biodesix, Inc. (BDSX) : Free Stock Analysis Report