Reasons to Retain Maximus (MMS) Stock in Your Portfolio Now

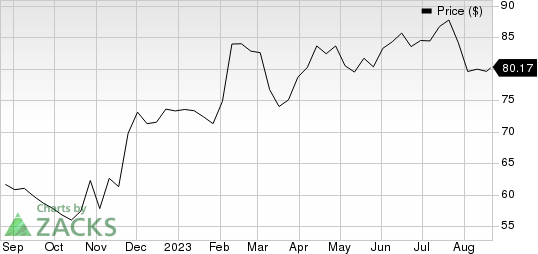

Maximus, Inc. MMS has had an impressive run over the past year. The stock has gained 28%, significantly outperforming the 18.8% rally of the industry it belongs to and the 6.2% rise of the Zacks S&P 500 composite.

The company’s revenues for fiscal 2023 and 2024 are expected to improve 6.2% and 5.1%, respectively, year over year.

Maximus, Inc. Price

Maximus, Inc. price | Maximus, Inc. Quote

Factors That Augur Well

With more than 40 years of experience, Maximus has grown to be a leading operator of government health and human services programs globally. The company’s business process management expertise, and ability to deliver cost-effective, efficient and high-scale solutions position it as a lucrative partner to governments.

Maximus maintains solid relationships and strong reputation with governments and long-term contracts provide it with a steady flow of revenues. The company remains focused on expanding its foothold in clinical services. Moreover, increased longevity and more complex health needs have increased the need for government social benefit and safety-net programs. This is likely to continue driving demand for its services.

The company has a solid track record of dividend payments. During fiscal 2022, 2021 and 2020, Maximus paid cash dividends of $68.7 million, $68.8 million and $70.2 million, respectively. Such moves indicate the company's commitment to creating value for shareholders and underline its confidence in its business.

Maximus has been active on the acquisition front to expand its business processes, knowledge and client relationships, enhance technical capabilities and gain additional skill sets. Strategic acquisitions also complement the company’s long-term organic growth strategy.

The 2022 acquisition of Stirling Institute of Australia has strengthened its employment services. Another acquisition, BZ Bodies, has strengthened Maximus’s services within the U.K. Both businesses are within Maximus’s Outside the U.S. segment.

Maximus banks on the subject matter expertise of its workforce in the critical aspects of the design, implementation and operation of government health and human services programs. The company has a healthy operating cash flow, driven by profitability and efficient management of receivables. Its expertise in government programs and ability to deliver defined, measurable outcomes differentiates Maximus. All these factors provide the company with a competitive advantage over its peers

Maximus' current ratio (a measure of liquidity) at the end of third-quarter fiscal 2023 was pegged at 1.46, higher than the prior quarter’s 1.4. A current ratio of more than 1 indicates that the company should not have problems meeting its short-term obligations.

A Hurdle to Counter

Maximus' adjusted earnings per share have been decreasing over the past years. The decrease has been mainly due to headwinds like paused Medicaid redetermination activity, incurring non-recurring costs and PACT act related investments. Adjusted EPS decreased 15.8% in 2022 and we expect EPS to reduce 10.8% in 2023.

Zacks Rank and Stocks to Consider

MMS currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following better-ranked stocks:

Aptiv APTV currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings for 2023 are expected to grow 37% while revenues are anticipated to gain 13.9% from the year-ago figure. APTV had an impressive earnings surprise of 13.35% in the past four quarters, having beaten the Zacks Consensus Estimate in all the four trailing quarters. APTV carries a VGM Score of A.

Clean Harbors CLH carries a Zacks Rank #2 at present. Earnings for 2023 are expected to be in line with the year-ago quarter while revenues are anticipated to rise 5.3% year over year. CLH had an impressive earnings surprise of 13% in the past four quarters, having beaten the Zacks Consensus Estimate in all four trailing quarters. CLH carries a VGM Score of B.

Verisk Analytics VRSK currently carries a Zacks Rank #2. Earnings for 2023 are expected to grow 14% while revenues are anticipated to fall 8.3% from the year-ago figure. VRSK has had an impressive earnings surprise of 9.85% in the past four quarters, having beaten the Zacks Consensus Estimate in three of the four trailing quarters and matching once.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report