Reasons to Retain Merit Medical (MMSI) Stock in Your Portfolio

Merit Medical Systems, Inc. MMSI is well-poised for growth in the coming quarters, courtesy of its strong product portfolio. The optimism led by solid second-quarter 2023 performance and international exposure are expected to contribute further. However, headwinds due to forex volatility and stiff competition persist.

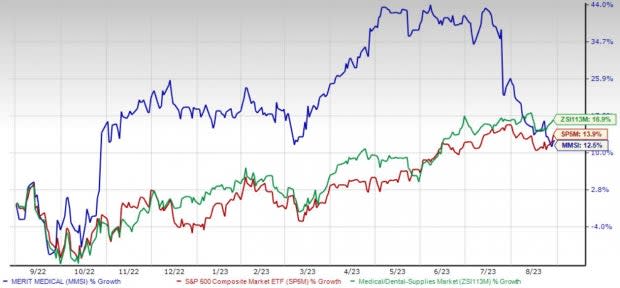

Over the past year, this Zacks Rank #3 (Hold) stock has gained 12.4% compared with a 16.9% rise of the industry and 13.8% growth of the S&P 500.

The renowned medical devices provider has a market capitalization of $3.84 billion. The company projects 11.5% growth for the next five years and expects to maintain its strong performance. It has delivered an earnings surprise of 15.8% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strong Product Portfolio: Merit Medical has continued to gain significant momentum on the back of new products. The company is upbeat about the product pipeline, including radio and electrophysiology products, raising investors’ optimism. It has several electrophysiology products that are either on track for release or in several other stages of development.

In June, Merit Medical completed the acquisition of a portfolio of dialysis catheter products and the BioSentry Biopsy Tract Sealant System from AngioDynamics. This follows Merit Medical’s acquisition of the Surfacer Inside-Out Access Catheter System from Bluegrass Vascular Technologies, Inc.

International Exposure: We are optimistic about Merit Medical’s worldwide product distribution network, which includes territories in Europe, the Middle East, Africa (EMEA) and Asia, among others. On the second quarter of 2023 earnings call, Merit Medical confirmed that growth in U.S. and international sales drove its overall top line.

Per management, Asia Pacific (APAC) was the primary driver of better-than-expected results, although both the EMEA and Rest of World regions were at the upper end of Merit Medical’s growth expectations in the second quarter. APAC growth was driven by sales in China, which increased year over year as the improving trends in March continued into the second quarter.

Strong Q2 Results: Merit Medical’s robust second-quarter 2023 results buoy optimism. The company witnessed a year-over-year uptick in the top and bottom lines. The company also saw revenue growth in both its segments and across all the product categories within its Cardiovascular unit. Robust performances in the United States and outside were also seen. The expansion of gross margin bodes well for the stock.

Downsides

Forex Volatility: Merit Medical has been expanding its operations outside the United States. This has led to the company becoming increasingly subject to market risk relating to foreign currency, which could have a negative impact on its margins and financial results. If the rate of exchange between foreign currencies declines against the U.S. dollar, Merit Medical may not be able to increase the prices charged from its customers for products whose prices are denominated in those respective foreign currencies.

Stiff Competition: Merit Medical operates in highly competitive markets, where it faces competition from many companies with greater resources. The company competes globally in several market areas, including radiology and interventional cardiology. Such resources and market presence may enable the competitors to market competing products more efficiently or at reduced prices to gain market share.

Estimate Trend

Merit Medical is witnessing a negative estimate revision trend for 2023. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved a penny south to $2.88.

The Zacks Consensus Estimate for the company’s third-quarter 2023 revenues is pegged at $306.3 million, suggesting a 6.6% rise from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Patterson Companies, Inc. PDCO, HealthEquity, Inc. HQY and McKesson Corporation MCK.

Patterson Companies, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 9.2%. PDCO’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 4.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Patterson Companies has gained 11.8% compared with the industry’s 16.9% rise over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 22%. HQY’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average of 9.1%.

HealthEquity has gained 3.3% against the industry’s 11.9% decline over the past year.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 8.1%.

McKesson has gained 15% compared with the industry’s 16.9% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report