Reasons to Retain OPKO Health (OPK) Stock in Your Portfolio

OPKO Health, Inc. OPK is well-poised for growth in the coming quarters, courtesy of its potential in RAYALDEE. The optimism led by solid second-quarter 2023 performance and few notable partnerships are expected to contribute further. However, stiff competition and concerns regarding overdependence on RAYALDEE persist.

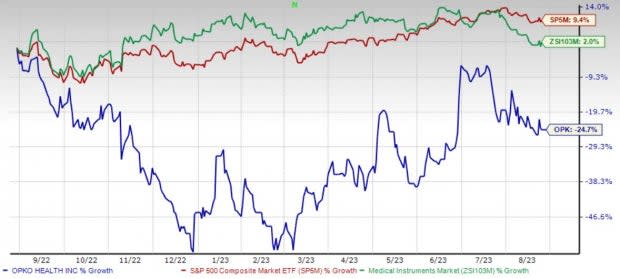

Over the past year, this Zacks Rank #3 (Hold) stock has lost 24.8% against the 1.9% rise of the industry and 9.3% growth of the S&P 500.

The renowned multinational biopharmaceutical and diagnostics company has a market capitalization of $1.34 billion. It projects 44.4% growth for 2023 and expects to maintain its strong performance. OPKO Health’s earnings surpassed the Zacks Consensus Estimate in two of the trailing four quarters, missed once and broke even in the other, the average surprise being 29.6%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Potential in RAYALDEE: We are upbeat about OPKO Health’s RAYALDEE business. Rayaldee is the first and only therapy approved by the FDA for the treatment of secondary hyperparathyroidism in adults with stage three or four chronic kidney disease and vitamin D insufficiency. Revenues from sales of RAYALDEE in the second quarter of 2023 were up 24.2% from the prior-year period.

Strategic Agreements: OPKO Health has entered into a slew of agreements over the past few months. On the second-quarter 2023 earnings call, management stated having a partnership with the National Institutes of Health to develop a tri-specific candidate to both prevent and treat HIV. Management also confirmed working on a COVID multi-specific antibody program to address the emergence of resistant variants on a global basis.

Strong Q2 Results: OPKO Health’s better-than-expected second-quarter 2023 results buoy our optimism. Its confirmation that NGENLA (somatrogon) has been approved in 44 markets, including the United States, Japan, EU Member States, Canada and Australia, looks promising. Also, its continued sales by Pfizer in more than 18 countries with expectations to launch in all priority international markets by the year-end raises our optimism about OPKO Health.

Downsides

Stiff Competition: The pharmaceutical, diagnostic and laboratory testing industries are highly competitive and require an ongoing, extensive search for technological innovation. Numerous companies, including major pharmaceutical companies, specialty pharmaceutical companies and specialized biotechnology companies, are engaged in the development, manufacture and marketing of pharmaceutical products competitive with those that OPKO Health intends to commercialize itself and through its partners.

Overdependence on RAYALDEE: OPKO Health’s RAYALDEE is the company’s only pharmaceutical product approved for marketing in the United States. The company’s ability to generate revenues from product sales and achieve profitability substantially depends on its ability to effectively commercialize RAYALDEE. The failure to successfully commercialize RAYALDEE would have a material adverse effect on the company’s business.

Estimate Trend

OPKO Health is witnessing a positive estimate revision trend for 2023. In the past 90 days, the Zacks Consensus Estimate for its loss per share has narrowed from 28 cents to 20 cents.

The Zacks Consensus Estimate for the company’s third-quarter 2023 revenues is pegged at $174.9 million, suggesting a 2.7% fall from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Patterson Companies, Inc. PDCO, HealthEquity, Inc. HQY and McKesson Corporation MCK.

Patterson Companies, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 9.2%. PDCO’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 4.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Patterson Companies has gained 17.7% compared with the industry’s 14.9% rise over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 22%. HQY’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average of 9.1%.

HealthEquity has gained 5.4% against the industry’s 13.6% decline over the past year.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 8.1%.

McKesson has gained 16.9% compared with the industry’s 14.9% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

OPKO Health, Inc. (OPK) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report