Reasons to Retain PacBio (PACB) Stock in Your Portfolio Now

Pacific Biosciences of California, Inc. PACB, popularly known as PacBio, has been gaining from its slew of strategic deals over the past few months. The optimism, led by a solid second-quarter 2023 performance and its product development activities, is expected to contribute further. However, stiff competition and macroeconomic concerns persist.

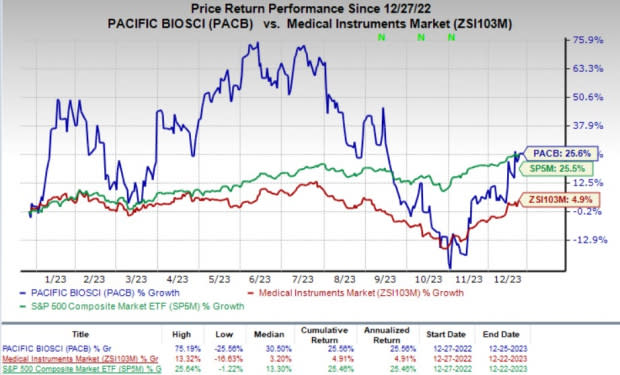

Over the past year, this currently Zacks Rank #3 (Hold) stock has gained 25.6% compared with 4.9% growth of the industry.The S&P 500 rose 25.5% in the same time frame.

The renowned global provider of sequencing systems has a market capitalization of $2.69 billion. The company projects 10.4% growth for 2024 and expects to maintain a strong performance going forward. PacBio’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and met once, delivering an average surprise of 9.9%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strategic Deals: We are optimistic about PacBio’s robust growth opportunities, thanks to its slew of strategic deals over the past few months. In November, the company announced the addition of two tertiary analysis partners to PacBio Compatible. Geneyx and Golden Helix will enable PacBio customers to leverage PacBio HiFi data for disease research with the Revio, Sequel II and IIe sequencing systems.

In August, PACB and GeneDx announced a research collaboration with the University of Washington to study the capabilities of HiFi long-read whole genome sequencing to increase diagnostic rates in pediatric patients with genetic conditions. PacBio also entered into an agreement to acquire Apton Biosystems.

This agreement with plans to integrate its Sequencing by Binding short-read chemistry with Apton's high throughput instrument (announced in August) also raised optimism about the stock.

Product Development Activities: We are optimistic about PacBio's solid potential in the RNA-sequencing market, which has been fortifying the company’s footprint worldwide. In August, PacBio announced the commencement of customer shipments of Onso short-read sequencing instruments.

In October, the company announced the availability of PacBio WGS Variant Pipeline — a complete, standardized computational method for HiFi WGS data analysis.

Strong Q3 Results: PacBio saw a robust increase in its overall top line, including strong Product revenues. Solid Consumables and Instrument revenues and strong geographical performances were also encouraging. Continued strong prospects in the Revio and Onso systems, with customers placing orders for these, looked promising for the stock.

Downsides

Macroeconomic Concerns: Macroeconomic dynamics, including rising inflation and global supply-chain constraints, have adversely impacted PacBio’s customers and lengthened customer sales cycles. These factors could impact its revenues and operations throughout 2023.

Stiff Competition: PacBio operates in a highly competitive market where its competitors offer nucleic acid sequencing equipment or consumables. Many of these companies currently have greater resources and may be able to respond more quickly and effectively than PacBio to new or changing opportunities, technologies, standards or customer requirements.

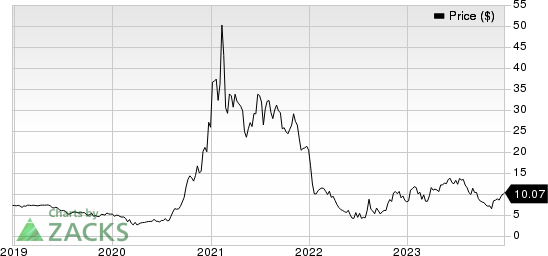

Pacific Biosciences of California, Inc. Price

Pacific Biosciences of California, Inc. price | Pacific Biosciences of California, Inc. Quote

Estimate Trend

PacBio has been witnessing a positive estimate revision trend for 2023. Over the past 60 days, the Zacks Consensus Estimate for its adjusted loss per share has narrowed from $1.18 to $1.17.

The Zacks Consensus Estimate for the company’s fourth-quarter 2023 revenues is pegged at $54.1 million, indicating a 97.8% increase from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks from the broader medical space are Integer Holdings ITGR, HealthEquity, Inc. HQY and Biodesix BDSX.

Integer Holdings, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 33.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.98%. The company’s shares have risen 42.5% year to date compared with the industry’s 1.7% growth.

HealthEquity, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 26.8%. HQY’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 16.5%.

The company’s shares have rallied 15% year to date against the industry’s 9.9% decline.

Biodesix, carrying a Zacks Rank #2 at present, has an estimated growth rate of 32.3% for 2024. BDSX’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 9.76%.

The stock has fallen 30.9% year to date compared with the industry’s 9.9% decline.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pacific Biosciences of California, Inc. (PACB) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Biodesix, Inc. (BDSX) : Free Stock Analysis Report