Reasons to Retain Patterson Companies (PDCO) in Your Portfolio

Patterson Companies, Inc. PDCO is well poised for growth in the coming quarters, courtesy of its broad product line. The optimism, led by a solid first-quarter fiscal 2024 performance and a few notable acquisitions, is expected to contribute further. Integration risks and stiff competitive forces persist.

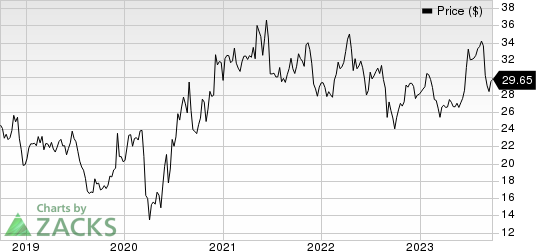

Shares of this Zacks Rank #3 (Hold) company have risen 5.8% year to date compared with the industry’s 10.5% growth. The S&P 500 Index has gained 13.7% during the same time frame.

The renowned global dental and animal health company has a market capitalization of $2.83 billion. It projects 9.2% growth for the next five years and expects to maintain its strong performance going forward. Patterson Companies’ earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and met once, delivering an average surprise of 8.47%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Broad Product Spectrum: We are optimistic about Patterson Companies’ wide range of consumable supplies, equipment and software, and value-added services. A notable offering from PDCO is a private-label brand named Pivotal, while it continues adding stock keeping units to its broader private-label portfolio. Patterson Companies’ NaVetor is an integrated cloud-based veterinary practice management software for its Animal Health segment.

Acquisitions: We are upbeat about PDCO’s strategy of expanding its business via strategic acquisitions. In January, it announced that it had, through subsidiaries, completed the previously-announced acquisition of substantially all the assets of Relief Services for Veterinary Practitioners and Animal Care Technologies.

During fiscal 2023, Patterson Companies completed its acquisition of the Texas-based companies — Veterinary Practitioners and Animal Care Technologies (RSVP and ACT) — that provide innovative solutions to veterinary practices through data extraction and conversion, staffing and video-based training services. In 2022, PDCO announced the acquisition of substantially all the assets of Dairy Tech, Inc., providing pasteurizing equipment and single-use bags.

Fulfillment Facility Modernization to Optimize Supply: Patterson Companies started implementing strategic modernization of its existing fulfillment facilities and capabilities. The company is adding new technologies such as robots to automate order picking and enhance fulfillment pace. PDCO is also focusing on expanding its fulfillment capacity by opening next-generation centers across several countries that will help build a sustainable and more efficient channel capabilities. The company’s strategic investments in fulfillment centers should help alleviate capacity constraints, boost distribution capabilities and enhance growth. PDCO has allocated $17.1 million in capital spending during the first quarter of fiscal 2024 to support its facility modernization and expansion, which was 17% higher than the year-ago period’s level.

Strong Q1 Results: Patterson Companies’ better-than-expected revenues in first-quarter fiscal 2024 buoy optimism. Both the Dental and the Animal Health segments showed signs of improvement. Sales at both the segments were hurt by unfavorable currency movement. A prudent cost-savings approach and solid sales execution worked in favor of the stock, expanding adjusted operating margin. Sustained momentum in the Animal Health business bodes well.

Downsides

Stiff Competition: The U.S. dental products distribution industry is highly competitive and consists chiefly of national, regional and local full-service and mail-order distributors. Patterson Companies needs to continue to introduce newer products in the market to withstand competitive pressures. Failure to do so can dilute the company’s market share.

Integration Risks: Patterson Companies has been on an acquisition spree, which is improving its revenue opportunities but aggravating integration risks. Regular acquisitions are also a distraction for management that is likely to impact organic growth. This may limit Patterson Companies’ future expansion and worsen its risk profile.

Estimate Trend

Patterson Companies is witnessing a stable estimate revision trend for fiscal 2024. In the past 60 days, the Zacks Consensus Estimate for earnings was pegged at $2.50 per share.

The Zacks Consensus Estimate for second-quarter fiscal 2024 revenues is pegged at $1.71 billion, indicating a 5.1% improvement from the year-ago quarter’s reported number.

Patterson Companies, Inc. Price

Patterson Companies, Inc. price | Patterson Companies, Inc. Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space are Align Technology ALGN, HealthEquity, Inc. HQY and McKesson Corporation MCK.

Align Technology, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 17.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ALGN’s earnings surpassed estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 1.76%. The company’s shares have risen 53.1% year to date compared with the industry’s 11.5% growth.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 22%. HQY’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 9.1%.

The company’s shares have rallied 13.8% year to date against the industry’s 10.3% decline.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 8.1%.

The stock has rallied 12.1% year to date compared with the industry’s 11.5% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report