Reasons to Retain Quest Diagnostics (DGX) Stock for Now

Quest Diagnostics Inc. DGX is likely to grow in the coming quarters, backed by strength in the legacy base business. The company is gaining from collaborations with health plans, hospitals and physicians amid a broad return to care. However, a high debt level on the balance sheet and intense competition also raise concerns.

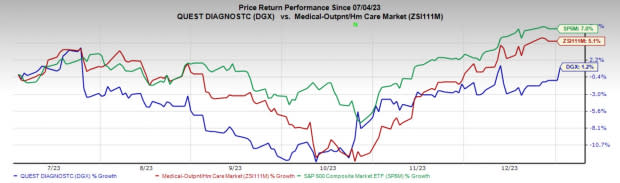

In the past year, this Zacks Rank #3 (Hold) stock has declined 8.9% against the industry’s 9% growth and a 24.5% rise of the S&P 500 composite.

The renowned provider of diagnostic information services has a market capitalization of $15.83 billion. The company’s earnings surpassed estimates in all the trailing four quarters, delivering an average surprise of 3.07%.

Let’s delve deeper.

Tailwinds

Volume Rebound in the Base Business: Quest Diagnostics is benefiting from strong volume growth across its base business (which refers to testing volumes, excluding COVID-19 testing). Collaborations with health plans, hospitals and physicians have increased demand for its services. The business is also benefiting from the continued return to care. The company boasts a robust pipeline of professional lab services and M&A opportunities, which, along with business strength, will help in the continued growth of base volume.

Image Source: Zacks Investment Research

For 2023, Quest Diagnostics completed negotiations for all scheduled strategic health plan renewals, allowing it to focus on expanding its client base. As a result, its profitability is also on the rise. Base business increased nearly 5% in the third quarter of 2023, primarily driven by growth in the physician and hospital channels, while the consumer channel continued to produce solid base business revenue growth.

Accelerate Growth Strategy Bodes Well: Quest Diagnostics continues to make progress in terms of its two-point business strategy, the first of which is promoting growth.

The acquisition of Haystack Oncology places the company in a strong position to enter the high-growth area of minimal residual disease or MRD testing. The post-acquisition integration remains on track. The company expects to introduce the first MRD test in early 2024 from the Oncology Center of Excellence in Lewisville, TX — where the solid tumor expanded panel for tumor sequencing and therapy monitoring was introduced. The Haystack acquisition will be modestly dilutive to earnings over the next three years and accretive by 2026.

Strong Potential of Advanced Diagnostics: Quest Diagnostics’ highly specialized Advanced Diagnostics services include molecular genomics and oncology tests such as germline testing to assess prenatal and hereditary genetic risks and somatic testing for tumor sequencing.

During the third quarter, the company posted double-digit revenue growth across multiple clinical areas, including neurology, women's and reproductive health, cardiometabolic and infectious disease and immunology. Upside within the Alzheimer's disease portfolio, which features the AD-Detect blood testing services, was particularly encouraging.

Downsides

Escalating Debt Level: The company’s solvency level is a concern. As of Sep 30, 2023, the long-term debt was $3.95 billion, while the cash and cash equivalent balance was only $143 million. The current portion of the debt also stood much higher at $304 million. A higher debt level induces higher interest payments, which comes along with the risk of failure to pay the same.

Competitive Landscape: Quest Diagnostics faces intense competition, primarily from LabCorp, other commercial laboratories and hospitals. While pricing is an important factor in choosing a testing lab, hospital-affiliated physicians expect a high level of service, including accurate and rapid turnaround of testing results. As a result, Quest Diagnostics and other commercial labs compete with hospital-affiliated labs primarily based on the quality of service.

Estimate Trend

The Zacks Consensus Estimate for Quest Diagnostics’ 2023 earnings per share (EPS) has moved up from $8.70 to $8.71 in the past 90 days.

The consensus estimate for the company’s 2023 revenues is pegged at $9.21 billion. The projection suggests a 6.8% decline from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 17.3%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 38.5% compared with the industry’s 9% rise in the past year.

HealthEquity, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 27.5%. HQY’s earnings surpassed estimates in each of the trailing four quarters, with the average being 16.5%.

HealthEquity’s shares have increased 9.7% against the industry’s 2.8% decline in the past year.

Integer Holdings, carrying a Zacks Rank of 2, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 11.9%.

Integer Holdings’ shares have rallied 44.1% compared with the industry’s 1.7% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report