Reasons to Retain ShockWave Medical (SWAV) in Your Portfolio

ShockWave Medical, Inc. SWAV is well poised for growth, backed by its research and development (R&D) efforts and focus on clinical studies.

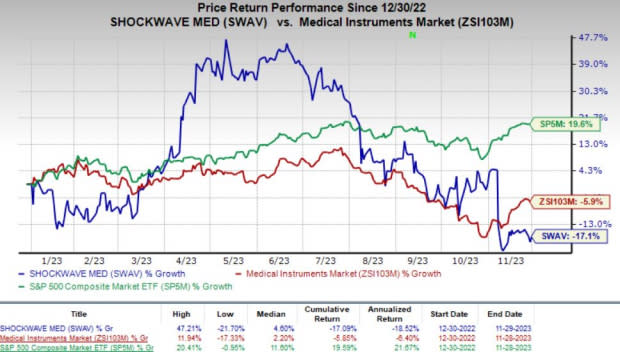

Shares of this Zacks Rank #3 (Hold) company have risen 17.1% compared with the industry’s 5.9% growth so far this year. The S&P 500 Index has soared 19.6% in the same time frame.

With a market capitalization of $6.16 billion, this medical device company is committed to developing and commercializing products that can change the way calcified cardiovascular disease is treated.

Image Source: Zacks Investment Research

ShockWave Medical’s earnings yield of 2.2% compares favorably with the industry’s (7.9%). Its earnings beat estimates in three of the trailing four quarters and missed the same in one, with the average surprise being 75.71%.

What’s Driving the Company’s Performance?

SWAV invests in R&D efforts to accelerate its Intravascular Lithotripsy (IVL)Technology, thereby broadening and enhancing its existing product offerings. In the first quarter of 2023, the company incurred R&D expenses of $39.5 million, up 95.9% from the prior-year quarter’s level.

For 2023, the company expects revenues in the $725-$730 million range, implying growth of 48-49% from the previous year’s number.

ShockWave Medical believes in its ability to rapidly develop innovative products, owing to a dynamic product innovation process. The versatility and leveraging ability of its core technology and management philosophy continue to improve its R&D process. Last month, SWAV announced favorable and consistent outcomes with coronary IVL in both nodular and eccentric calcium.

Management is optimistic about the continued clinical acceptance and penetration of IVL. Considering the fact that the C2+ device holds a strong demand in the international market, the launch of the same in the United States looks promising. This is due to the technology’s strong results in the quarter under review, as well as a higher outlook for 2023 revenues.

In August, the Centers for Medicare & Medicaid Services (“CMS”) created new Medicare Severity Diagnosis Related Group (MS-DRG) codes and payments for coronary IVL in the hospital inpatient setting. Per the codes, new coronary IVL-specific MS-DRGs are associated with higher payments than the MS-DRG payments for other Percutaneous Coronary Intervention procedures.

Again, the CMS established a Category I Current Procedural Terminology add-on code for procedures involving coronary earlier this month. Under this new category, physicians will get a 20-30% increase in remuneration for the additional work associated with performing coronary IVL.

The higher pay rates for physicians for IVL procedure is likely to benefit the adoption of ShockWave Medical’s products, thereby boosting its top-line growth.

What’s the Downside?

Limited commercialization expertise and approved or cleared products pose a challenge in evaluating SWAV’s current business and determining future financial growth.

Estimate Trend

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $727.2 million, indicating an improvement of 48.5% from the previous year’s reported figure. The same for adjusted earnings per share stands at $3.62.

ShockWave Medical, Inc. Price

ShockWave Medical, Inc. price | ShockWave Medical, Inc. Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Biodesix BDSX and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 18.3%. DVA’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 36.55%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have risen 33.1% year to date compared with the industry’s 2.7% growth.

Biodesix, carrying a Zacks Rank of 2 (Buy) at present, has an estimated growth rate of 32.3% for 2024. BDSX’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 9.76%.

Biodesix’s shares have lost 36.5% year to date compared with the industry’s 10.7% decline.

Integer Holdings, sporting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 11.9%.

Integer Holdings’ shares have rallied 31.7% year to date against the industry’s 4.7% decline.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

Biodesix, Inc. (BDSX) : Free Stock Analysis Report