Reasons to Retain Stanley Black (SWK) Stock in Your Portfolio

Stanley Black & Decker, Inc. SWK is benefiting from solid momentum in the engineered fastening business despite lower consumer outdoor and DIY market demand, and escalating expenses.

Let us discuss the factors why investors should retain the stock for the time being.

Growth Catalysts

Business Strength: Solid momentum in the engineered fastening business, driven by strength in aerospace and auto end markets is aiding the engineered fastening business. The company’s global cost-reduction program is expected to aid its bottom line and drive margin performance in the quarters ahead. Stanley Black is making efforts to eliminate and reduce overlapping capabilities and functions. It is resizing operations to ensure that resources better serve core businesses.

In 2023, it generated pre-tax run rate savings of $835 million from a global cost-reduction program. The company expects to generate run rate savings of $1.5 billion by the end of 2024. By 2025, it envisions run rate savings of $2 billion. Supply-chain optimization programs and inventory reduction efforts are also expected to boost margins. In 2023, the company reduced its inventory by $1.1 billion. Benefiting from supply-chain transformation and inventory reductions, Stanley Black expects to achieve adjusted gross margins of more than 30% in 2024.

Focus on Core Operations: Stanley Black has been divesting non-core operations to drive growth. In December 2023, Stanley Black inked a deal to divest its STANLEY Infrastructure (Infrastructure) business to Epiroc AB for a cash amount of $760 million. The divestment will help Stanley Black focus on the core businesses while supporting its capital-allocation priorities. The company expects to use the cash proceeds of the transaction, net of modest taxes, to reduce its debt. The completion of the deal is conditioned on regulatory approvals and customary closing conditions.

In July 2022, the company sold its Security Business to Securitas AB for $3.2 billion cash. It funded its debt reduction from the net proceeds of this sale. In the same month, it divested its Automatic Doors business to Allegion for $900 million in cash. The divestitures reinforce Stanley Black's strategic focus on its core businesses. In June 2022, the company inked a deal to sell its STANLEY oil & gas division to Pipeline Technique Limited. The divestiture enables Stanley Black to better focus and efficiently direct its resources to the Industrial, and Tools & Outdoor segments.

Rewards to Shareholders: The company’s measures to reward its shareholders through dividend payments are noteworthy. In 2023, the company paid dividends of $482.6 million, up 3.6% year over year. It also bought back shares worth $16.1 million in the same period. In July 2023, the company hiked its dividend by a penny to 81 cents per share (annually: $3.24 per share).

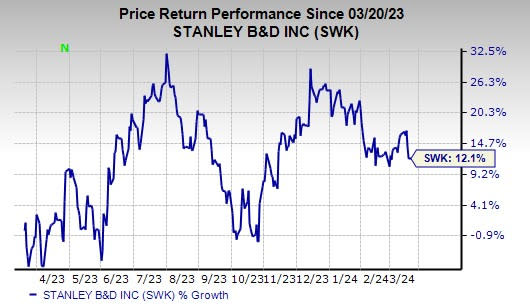

In light of the above-mentioned positives, we believe, investors should retain SWK stock for now, as suggested by its current Zacks Rank #3 (Hold). In the past year, shares of the company have gained 12.1%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below:

Atmus Filtration Technologies Inc. ATMU presently sports a Zacks Rank #1 (Strong Buy) and a trailing four-quarter earnings surprise of 20.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

ATMU’s earnings estimates have increased 2.9% for 2024 in the past 60 days. Shares of Atmus Filtration have risen 20.7% in the past year.

Tetra Tech, Inc. TTEK currently carries a Zacks Rank #2 (Buy). It delivered a trailing four-quarter average earnings surprise of 14.4%.

In the past 60 days, the Zacks Consensus Estimate for TTEK’s fiscal 2024 earnings has increased 2.9%. The stock has soared 26.8% in the past year.

Applied Industrial Technologies, Inc. AIT presently has a Zacks Rank of 2. It has a trailing four-quarter average earnings surprise of 10.4%.

The Zacks Consensus Estimate for AIT’s fiscal 2024 earnings has increased 1.7% in the past 60 days. The stock has gained 41.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tetra Tech, Inc. (TTEK) : Free Stock Analysis Report

Stanley Black & Decker, Inc. (SWK) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Atmus Filtration Technologies Inc. (ATMU) : Free Stock Analysis Report