Reasons to Retain West Pharmaceutical (WST) in Your Portfolio

West Pharmaceutical Services, Inc. WST is well poised for growth, backed by the robust Proprietary Products segment and sustained strength in research and development (R&D). However, foreign exchange volatility is a concern.

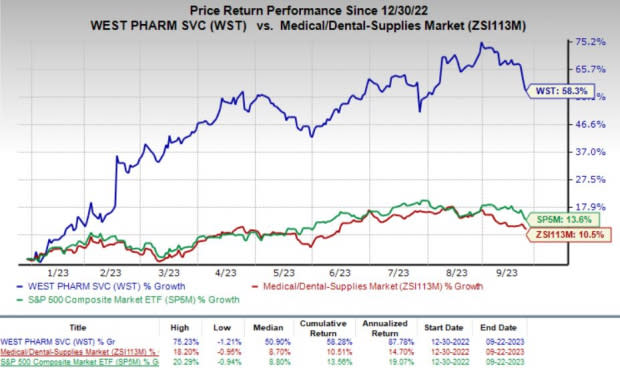

Shares of this Zacks Rank #3 (Hold) company have risen 58.3% year to date compared with the industry's 10.5% growth. The S&P 500 Index has increased 13.6% in the same period.

Let’s delve deeper.

Image Source: Zacks Investment Research

Key Catalysts

The Proprietary Products business continues to exhibit sustained strength and is an important contributor to WST's top line. This segment's customers primarily comprise of several major biologic, generic and pharmaceutical drug companies globally that incorporate its components and other offerings in their injectable products.

Sales improved 2.5% organically in the second quarter of 2023. High-value products (components and devices) accounted for more than 70% of segment sales and delivered mid-single digit organic sales growth.

Growth in demand, especially from biologic customers, and strong performances in Generics and Pharma market units, buoy optimism. West Pharmaceutical also continues to expand its high-value product manufacturing capacity for supporting rising customer demand from recent launches and anticipates drug programs in the coming years.

Robust organic growth of Proprietary Products’ Generics and Pharma market units is another quarterly highlight.

WST maintains its research-scale production facilities and laboratories for creating new products. It also provides contract engineering design and development services to help customers with new product developments.

The company continues to pursue innovative strategic platforms in prefillable syringes, injectable containers, advanced injections, and safety and administration systems. In the second quarter, the company's R&D expenses increased 14.9% from the prior-year period’s level.

West Pharmaceutical remains committed to seeking innovative opportunities for the acquisition, licensing, partnering or development of products, services and technologies. The company is focused on its objective of connecting dots throughout science and technology for potential value creation.

Factors Hurting the Stock

The growing exposure to international markets makes WST susceptible to adverse foreign exchange volatility. Unfavorable fluctuations in currency exchange rates can affect the company’s international sales.

Contraction in gross and operating margins does not bode well. West Pharmaceutical’s pandemic-related sales are also likely to experience a downtrend in the rest of 2023, thereby hurtingProprietary Products’ revenue growth.

Estimates Trend

The company has been witnessing an upward estimate revision trend in 2023. In the past 60 days, the Zacks Consensus Estimate for earnings has improved 1.6% to $7.85 per share.

The same for revenues is pegged at $2.98 billion, indicating a 3.3% increase from the 2022 level.

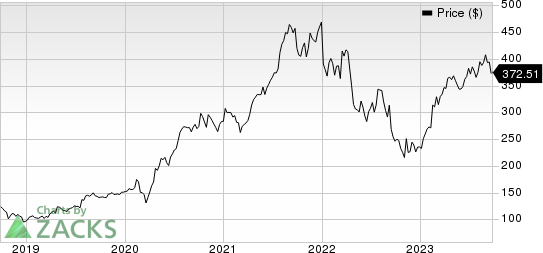

West Pharmaceutical Services, Inc. Price

West Pharmaceutical Services, Inc. price | West Pharmaceutical Services, Inc. Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space are Align Technology ALGN, McKesson Corporation MCK and Medpace MEDP.

Align Technology, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 17.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ALGN’s earnings surpassed estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 1.76%. The company’s shares have risen 41.6% year to date compared with the industry’s 10.5% growth.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 8.1%.

The stock has rallied 16.9% year to date compared with the industry’s 10.5% growth.

Medpace, carrying a Zacks Rank #2 at present, has an estimated growth rate of 16.2% for 2024. MEDP’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 22.28%.

The company’s shares have rallied 14.3% year to date against the industry’s 11.7% decline.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report