Reasons to Retain West Pharmaceutical (WST) Stock for Now

West Pharmaceutical Services, Inc. WST is well-poised for growth in the coming quarters, courtesy of its robust proprietary products business. The optimism led by a solid second-quarter 2023 performance and its continued strength in research and development (R&D) also buoy optimism. However, information security breaches and macroeconomic challenges are major downsides.

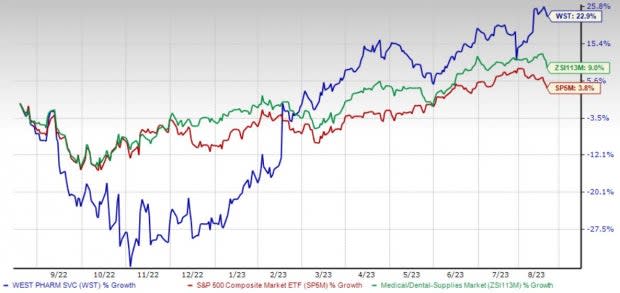

Over the past year, the Zacks Rank #3 (Hold) stock has gained 22.9% compared with 8.9% growth of the industry and a 3.8% rise of the S&P 500.

The renowned global provider of innovative solutions for injectable drug administration has a market capitalization of $29.17 billion. The company projects 4.6% growth for the next five years and expects to witness continued improvements in its business. West Pharmaceutical surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 12.5%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Proprietary Products Segment: We are upbeat about West Pharmaceutical’s proprietary products business, which continues to exhibit sustained strength and is an important contributor to the company’s top line. In the second quarter of 2023, high-value products or HVP (components and devices) represented more than 70% of segment sales, led by customer demand for Westar components and HVP devices. The Generics market unit had high-single-digit organic net sales growth and the Pharma market unit had mid-single-digit organic net sales growth during the same time.

Continued Strength in R&D: West Pharmaceutical maintains its research-scale production facilities and laboratories for creating new products and provides contract engineering design and development services to help customers with new product development. These raise our optimism. In second-quarter 2023, the company’s R&D expenses increased from the prior-year quarter. WST continues to invest in elastomeric packaging components, formulation development, drug containment systems, self-injection systems and drug administration consumables.

Strong Q2 Results: West Pharmaceutical’s organic growth in second-quarter 2023 buoys optimism. The company expects business performance in the second half of 2023 to be better than the first half, reflecting higher top-line and bottom-line outlooks. This also looks promising for the stock.

Downsides

Information Security Breaches: West Pharmaceutical’s systems and networks, along with that of its customers and other stakeholders, might have become the target of cyberattacks and information security breaches in the future. This can lead to unauthorized release and misuse of confidential or proprietary information about the company and its employees or customers and can also hamper or damage its operations or that of third parties. Failure to comply with regulations or prevent the unauthorized access can result in financial losses and hurt the company’s reputation.

Macroeconomic Challenges: Uncertainty in the global economy, which includes recession or slow economic growth in the United States, Europe or emerging markets in Asia and South America, can have adverse effects on the company’s operating results. If there is a weakness in economic conditions in the country or Europe, or emerging markets, the company’s operations might be negatively impacted.

Estimate Trend

West Pharmaceutical has been witnessing an upward estimate revision trend for 2023. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 2.6% north to $7.83.

The Zacks Consensus Estimate for third-quarter 2023 revenues is pegged at $746.9 million, suggesting an 8.7% rise from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Patterson Companies, Inc. PDCO, HealthEquity, Inc. HQY and McKesson Corporation MCK.

Patterson Companies, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 9.2%. PDCO’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 4.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Patterson Companies has gained 12.9% compared with the industry’s 8.9% rise over the past year.

HealthEquity, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 22%. HQY’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average of 9.1%.

HealthEquity has gained 8.8% against the industry’s 16.3% decline over the past year.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 8.1%.

McKesson has gained 12.4% compared with the industry’s 8.9% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report