Reasons for Trane Technologies' (TT) 12.5% Gain in 6 Months

Trane Technologies plc.’s TT stock has had an impressive run on the bourses over the past six months. The stock prices surged 12.5% compared with the industry’s 2.3% increase and S&P 500’s 9.2% increase in the same time frame.

Let’s unearth the factors that are likely to have contributed to the company’s impressive performance.

Earnings and Revenue Surprise

Trane Technologies has an impressive earnings surprise history with earnings surpassing the Zacks Consensus Estimate in the four trailing quarters with an average surprise of 8.2%. The company has a consistent surprise history on the revenue front as well, with an average surprise of 3.8%.

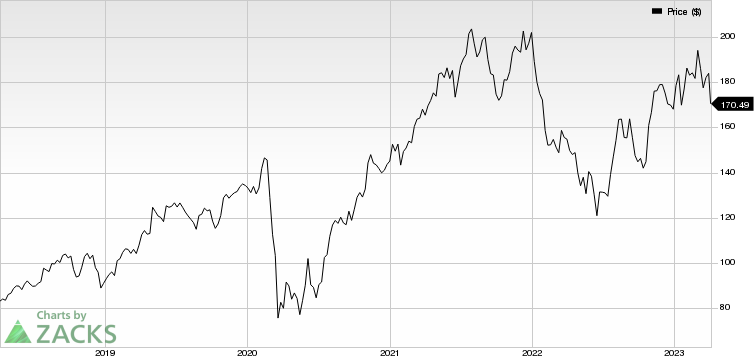

Trane Technologies plc Price

Trane Technologies plc price | Trane Technologies plc Quote

Consistent Increase in Revenues and Earnings

Trane Technologies’ earnings and revenues have been growing year over year. The fourth-quarter earnings and revenues indicated growth of 33.8% and 14.1% on a year-over-year basis. The consensus estimate for first-quarter 2023 earnings is pegged at $1.3 which is 16.7% growth from the year-ago reported figure. The consensus mark for revenues is $3.63 billion which indicates 8.3% growth year over year.

Trane Technologies has been putting continuous efforts to increase revenue streams and operating efficiency. The growing demand for the company’s products is another factor which bolsters growth.

Consistent Dividend Payer

TT has taken noteworthy efforts to gratify its shareholders on a regular basis. The company’s consistent dividend payment is an indicator of the same. The company paid $620 million, $561.1 million, $507.3 million and $510.1 million in dividends in 2022, 2021, 2020 and 2019, respectively.Share repurchases are also used to reward shareholders.

In 2022, 2021, 2020 and 2019, the company had repurchased shares worth $1.2 billion, $1.10 billion, $250 million and $750.1 million, respectively. On Feb 9, the company raised the dividend by 12% to 75 cents. The dividend was paid out on Mar 31 to shareholders as of Mar 3.

Strong 2023 Outlook

The company has an impressive outlook for 2023. Revenues are expected to grow 7-9% on a reported basis and 6-8% on an organic basis. Adjusted EPS is expected to be in a band of $8.2-$8.5, which is more than a 10% increase from the 2022 reported figure. TT ended 2022 with a historic backlog figure of $6.9 billion.

Zacks Rank and Other Stocks to Consider

Trane Technologies currently carries a Zacks Rank #2 (Buy).

Some better-ranked stocks in the Zacks Business Services sector are ICF International ICFI, Maximus MMS and Gartner, Inc. IT.

For first-quarter 2023, ICF International’s earnings are expected to increase 7.6% year over year to $1.41 per share. In 2023, the company’s bottom line is expected to increase 9.2% on a year-over-year basis.

The Zacks Consensus Estimate for the company’s first-quarter 2023 earnings has been revised upward 6% in the past 60 days. The consensus estimate for ICFI’s full-year earnings is pegged at $6.3 per share, which has been revised upward 7.3% in the past 60 days. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Maximus’sfirst-quarter 2023 and full-year earnings is pegged at 81 cents per share and $4.15, respectively. The first-quarter consensus mark has been revised 12% downward in the past 60 days. The consensus estimate for full-year 2023 has been revised 7.2% upward in the past 60 days. The company currently sports a Zacks Rank of 1.

The Zacks Consensus Estimate for Gartner’s first-quarter 2023 earnings is pegged at $2.04 per share. The bottom line has been revised 3% upward in the past 60 days. The consensus estimate for full-year 2023 is pegged at $9.49 per share, which has been revised slightly upward in the past 60 days. The company currently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gartner, Inc. (IT) : Free Stock Analysis Report

ICF International, Inc. (ICFI) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report

Trane Technologies plc (TT) : Free Stock Analysis Report