Reasons Why You Should Avoid Betting on Crown Holdings (CCK)

Crown Holdings CCK has failed to impress investors considering that it has been witnessing a decline in adjusted earnings over the past five quarters. This mainly reflects the downtrend in volumes, which is bearing the brunt of a demand decline, as customer spending remains muted amid inflationary pressures and high interest rates.

CCK’s results have also been negatively impacted by unfavorable foreign currency translation and higher input costs.

The Zacks Rank #4 (Sell) company has a market capitalization of $11.3 billion.

Let’s discuss the factors that are taking a toll on the company.

Crown Holdings’ net sales in the second quarter of 2023 totaled $3.1 billion. Sales were down 11% from the year-ago quarter mainly due to lower volumes across most businesses. Adjusted earnings per share were $1.68, which marked a 20% decline year over year. This follows a 40% plunge in earnings in the first quarter of 2023. The company’s earnings growth rate has been negative since the second quarter of 2022.

Persisting inflationary pressures and high interest rates have weighed on consumer spending. Thus, the company is facing a decline in customer demand in almost every market and product line. While this is expected to hurt its top-line performance, elevated input costs are also anticipated to impact the margins negatively this year.

As a result of higher average outstanding borrowings and higher interest rates, net interest expense is expected to be approximately $400 million in 2023. The figure projects an increase of 49% year over year. This will also weigh on the company's earnings.

Crown Holdings expects adjusted earnings per share in 2023 to be in the range of $6.10 to $6.30, lower than the previous guidance of $6.20 to $6.40. The lower guidance also reflects the impacts of higher transactional foreign exchange expense and lower equity earnings from the previous guidance. The company had reported earnings of $6.75 per share in 2022. Compared to this, the midpoint of the new range suggests an 8% decline.

Reflecting these headwinds, the Zacks Consensus Estimate for the company’s 2023 earnings has been revised 1% downward in the past 30 days.

Despite the odds, Crown Holdings’ focus on disciplined pricing, cost control and capital allocation will help it sail through this uncertainty. The company had undertaken actions in 2022 to negotiate a more comprehensive raw material and other inflationary pass-through of provisions in European Beverage. A significant overhead reduction program was also initiated in Transit Packaging. These are expected to continue to yield benefits through the remaining part of 2023.

Through the current year, the company's primary capital-allocation focus will be to reduce leverage while still investing in its business. Crown Holdings continues to pursue growth opportunities through capacity additions, along with strategic acquisitions in geographic areas and product lines as well as making share repurchases.

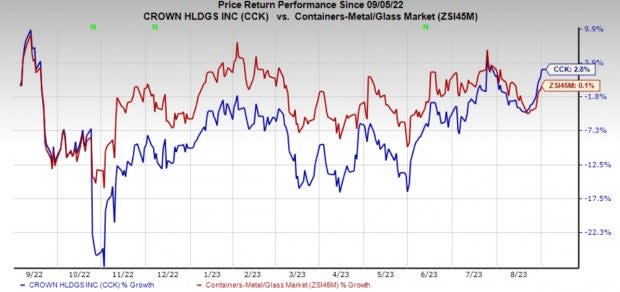

Price Performance

The company’s shares have gained 2.8% over the past year compared with the industry’s 0.1% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the Industrial Products sector are Caterpillar Inc. CAT, Astec Industries, Inc. ASTE and A. O. Smith Corporation AOS. Each of these stocks sport a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has an average trailing four-quarter earnings surprise of 18.5%. The Zacks Consensus Estimate for CAT’s 2023 earnings is pegged at $19.81 per share. The consensus estimate for 2023 earnings has moved 11.4% north in the past 60 days. Its shares have gained 58% in the last year.

Astec has an average trailing four-quarter earnings surprise of 20%. The Zacks Consensus Estimate for ASTE’s 2023 earnings is pegged at $2.81 per share. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. ASTE’s shares have gained 45% in the last year.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings per share is pegged at $3.57. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days. It has a trailing four-quarter average earnings surprise of 10.5%. AOS gained 31% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Crown Holdings, Inc. (CCK) : Free Stock Analysis Report