Reasons Why You Should Avoid Investing in Carlisle (CSL) Now

Carlisle Companies Incorporated CSL has failed to impress investors with its recent operational performance due to weakness in the Carlisle Construction Materials (CCM) segment, high debt level and foreign currency headwinds. These factors are likely to impede the company’s performance in the quarters ahead.

Let’s discuss the factors, which are likely to continue taking a toll on this Zacks Rank #4 (Sell) company.

Business Weakness: Project delays, uncertainty caused by higher interest rates and prolonged distributor destocking are affecting the performance of Carlisle’s CCM segment. The company expects the segment’s sales to decline 3-5% in 2023 from the year-ago period. Lower volumes from a slowdown in the residential construction market and project delays are adversely affecting Carlisle’s Carlisle Weatherproofing Technologies segment. Carlisle expects the segment’s revenues to decline approximately 10% in 2023.

High Debt Level: The company's high debt levels raise concerns. In the last five fiscal years (2018-2022), the company’s long-term debt witnessed a CAGR of 7.5%. Its long-term debt balance at the end of third-quarter 2023 was $2,283.2 million compared with $2,281.1 million reported at the end of 2022.

Southbound Estimate Revisions: In the past 60 days, the Zacks Consensus Estimate for CSL’s 2023 earnings has been revised 13.6% downward.

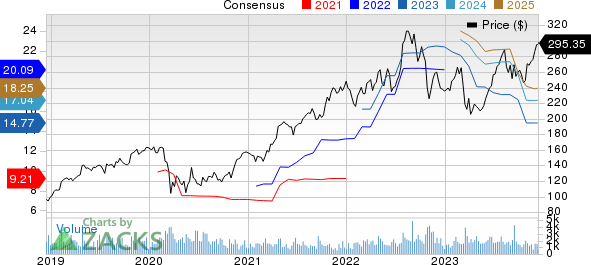

Carlisle Companies Incorporated Price and Consensus

Carlisle Companies Incorporated price-consensus-chart | Carlisle Companies Incorporated Quote

Zacks Rank & Stocks to Consider

General Electric currently carries a Zacks Rank #3 (Hold). Some better-ranked companies have been discussed below.

Federal Signal Corporation FSS presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

FSS delivered a trailing four-quarter average earnings surprise of 8.1%. In the past 60 days, the Zacks Consensus Estimate for Federal Signal’s 2023 earnings has increased 3.3%. The stock has risen 62.1% in the past year.

ITT Inc. ITT presently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter average earnings surprise of 8%.

The consensus estimate for ITT’s 2023 earnings has increased 2% in the past 60 days. Shares of ITT have jumped 39.7% in the past year.

A. O. Smith Corporation AOS currently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 14%.

In the past 60 days, the consensus estimate for A. O. Smith’s 2023 earnings has improved 5%. The stock has risen 35% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Federal Signal Corporation (FSS) : Free Stock Analysis Report