Reasons Why You Should Hold on to Avis Budget (CAR) For Now

Avis Budget CAR has launched an electric vehicle (EV) initiative in major U.S. cities for accessible and professionally managed EVs. Avis Budget, with diverse brands, strategically expands globally, focusing on acquisitions. The company consistently invests in share repurchases, reflecting confidence and bolstering investor trust.

Factors in Favor

Zipcar, one of the offerings by Avis Budget and a leading car-sharing company, has launched an EV initiative in major U.S. cities. Partnering with cities, campuses and businesses, Zipcar aims to provide easy and affordable access to professionally managed EVs. Using proprietary tools, Zipcar optimizes fleet charging, thus gaining insights to double its EV fleet by 2024. Angelo Adams, Zipcar's head, emphasizes the goal of advancing equitable and sustainable transportation for those seeking alternatives to personal cars.

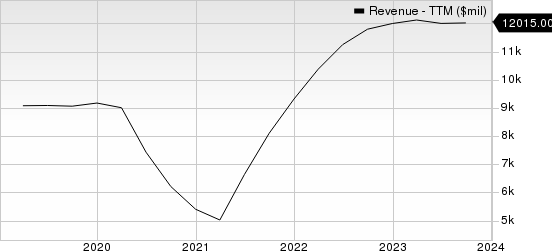

Avis Budget Group, Inc. Revenue (TTM)

Avis Budget Group, Inc. revenue-ttm | Avis Budget Group, Inc. Quote

Avis Budget operates diverse global brands catering to specific market segments. Avis targets premium travelers, Budget serves mid-tier value-conscious customers and Zipcar offers urban mobility alternatives. Other brands like Payless and Apex focus on the value segment. Strategic acquisitions have fueled Avis Budget's global expansion, with recent focuses on re-acquiring licensees. While 2022 saw no acquisitions, 2021 and 2020 witnessed successful strategic acquisitions in Europe and North America, aligning with the company's growth strategy.

Avis Budget has consistently demonstrated its commitment to rewarding shareholders through substantial share repurchases. In 2022, 2021 and 2020, the company repurchased shares amounting to $3.33 billion, $1.46 billion and $119 million, respectively. These actions not only reflect the company's confidence in its business but also enhance investor trust in the stock by positively influencing earnings per share.

Some Risks

Avis Budget encounters seasonal fluctuations in its rental business, with lower demand in fall and winter and heightened demand in spring and summer vacation periods across most operating countries. To address these variations, the company adjusts its fleet size throughout the year. Seasonality results in significant revenue and profit fluctuations, therefore posing challenges for accurate forecasting.

Avis Budget derives 21% of its revenues from the international segment, exposing it to foreign currency exchange rate fluctuations. With operations in North America, Europe, Australia, Asia and collaborations with licensees in about 180 countries, the company's international revenues in 2022 were negatively impacted by $310 million due to currency exchange rate shifts, contributing to a total adverse impact of $327 million from foreign currency fluctuations.

Other Stocks to Consider

The following stocks from the broader Business Services sector are worth consideration:

DocuSign DOCU: The Zacks Consensus Estimate of DocuSign’s 2023 revenues indicates 9.2% growth from the year-ago figure while earnings are expected to grow 41.4%. The company beat the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

DOCU sports a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Gartner IT:TheZacks Consensus Estimate of Gartner’s 2023 revenues indicates 7.9% growth from the year-ago figure while earnings are expected to decline 1.9%. The company beat the consensus estimate in each of the four quarters, with an average surprise of 34.4%.

IT carries a Zacks Rank #2 (Buy).

Broadridge Financial Solutions BR:The Zacks Consensus Estimate of Broadridge’s 2023 revenues indicates 7.7% growth from the year-ago figure while earnings are expected to grow 10.1%. The company beat the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

BR holds a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report