Reasons Why You Should Hold on to Equifax (EFX) Stock Now

Equifax Inc. EFX has performed well in the past three months, growing 30.4% and outperforming its industry’s 9.1% growth and the 8.4% rise of the S&P 500 composite.

Equifax is serving diverse industries and benefits from a broad client base, which helps to cover the shortcomings in one sector by improved performance in the other one. It provides credit information and analytical services, which enable the clients to comprehend, manage and safeguard information, thus facilitating more informed financial decisions.

Factors in Favor

Equifax plays a crucial role for its customers by providing credit information and analytical services, aiding in the processing of credit card, loan and mortgage applications. Utilizing advanced statistical techniques and proprietary tools, the company analyzes extensive data to generate personalized insights, decision-making solutions and processing services. This empowers customers to comprehend, manage and safeguard their clients' information, facilitating more informed financial decisions. We anticipate that Equifax's robust product portfolio and deep industry understanding will maintain its competitive edge.

In 2023, revenues from U.S. Information Solutions are projected to reach $1.7 billion, indicating a 2.7% increase from the previous year. The forecast for 2024 is $1.82 billion, suggesting 7% growth. International revenues are expected to demonstrate nearly 3% growth in 2023 and 8% growth in 2024. The company has witnessed respectable revenue growth in recent years, with a compounded annual growth rate of 7.9% from 2017 to 2021. We attribute this growth to synergies from acquisitions, ongoing consumer credit activity, product innovation, enterprise growth initiatives and efficient business execution.

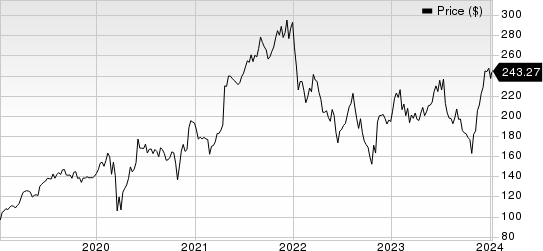

Equifax, Inc. Price

Equifax, Inc. price | Equifax, Inc. Quote

Serving diverse industries such as finance, mortgage, consumer services, telecommunications and more, Equifax benefits from a broad client base that mitigates vulnerabilities in any single sector. The company focuses on expanding and strengthening its customer base through multi-data solutions, combining organic growth, strategic mergers and acquisitions, and collaborative partnerships. Equifax leverages its advanced analytical platforms, incorporating machine learning, Artificial Intelligence and advanced visualization tools to drive innovation and enhance its services.

Factors Against

Equifax's current ratio at the end of third-quarter 2023 was pegged at 1.01, lower than the current ratio of 1.2 reported at the end of the previous quarter. A decreasing current ratio does not bode well for the company.

Seasonality is another concern for the company. Equifax’s revenues are lopsided, with revenues generated from financial wealth asset products and data management services in the company’s Financial Marketing Services business are lower in the first, second and third quarters compared with the fourth quarter of the year, while revenues from the online consumer information services component of the company’s USIS segment are lowest during the first quarter of each year as consumer lending activity is at a seasonal low. Revenues from the Employer Services business unit within the company’s Workforce Solutions segment have been lower in the second, third and fourth quarters compared with the first quarter.

EFX currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Clean Harbors CLH currently holds a Zacks Rank #2 (Buy) and has a VGM Score of A. The Zacks Consensus Estimate for the company’s revenues for 2023 is pegged at $5.42 billion, up 5% from the year-ago figure. The consensus mark for earnings is pegged at $6.81 per share, which indicates a decline of 4.8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

CLH beat the Zacks Consensus Estimate in three of the past four quarters (missed on one instance), with an average of 3.2%.

Broadridge Financial Solutions BR currently holds a Zacks Rank of 2. The Zacks Consensus Estimate for the company’s revenues for 2023 is pegged at $6.53 billion, up 7.7% from the year-ago figure. The consensus mark for earnings is pegged at $7.72 per share, which indicates an increase of 10.1%.

BR beat the Zacks Consensus Estimate in three of the past four quarters (matched on one instance), with an average of 3.2%.

ABM Industries ABM carries a Zacks Rank of 2 at present and a VGM Score of A. The Zacks Consensus Estimate for the company’s revenues for 2023 is pegged at $8.14 billion, slightly higher than the year-ago figure. The consensus mark for earnings is pegged at $3.32 per share, which indicates a decline of 5.1%.

ABM beat the Zacks Consensus Estimate in three of the past four quarters (missed on one instance), with an average of 1.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

ABM Industries Incorporated (ABM) : Free Stock Analysis Report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report