Reasons Why Retaining TransUnion (TRU) Can Be a Wise Decision

TransUnion, Inc. TRU aims to gain through transformation initiatives, targeting cost savings by 2026. Strategic acquisitions and recent collaborations strengthen the company's market position and product offerings.

TRU has gained 6.4% in the year-to-date period compared with its industry’s 21.1% growth.

Factors That Bode Well

TransUnion is undertaking a strategic transformation to optimize its operating model and enhance technology. The initiative involves transitioning roles to Global Capability Centers, leveraging Neustar’s technology for a new integrated platform and completing the Project Rise cloud migration by 2024. The move aims to reduce costs, drive innovation and achieve $120-$140 million in annualized operating expense savings by 2026. Approximately 10% of the workforce will be impacted by relocations and position eliminations. The transformation includes $355-$375 million in one-time expenses, with a focus on maintaining operational continuity and supporting affected employees.

TransUnion's growth in the past five to six years has been due to a successful acquisition strategy, focusing on unique data assets, expanding in vertical markets and global expansion. The recent $515 million acquisition of Verisk Financial Services enhances TransUnion's capabilities in financial solutions, aiding financial inclusion, fraud prevention and risk management. The 2021 acquisition of Neustar strengthened its position in digital marketing and identified fraud markets, thus contributing to market entry and portfolio diversification.

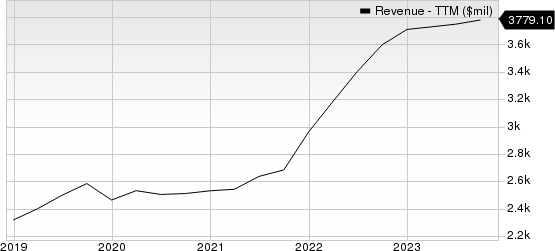

TransUnion Revenue (TTM)

TransUnion revenue-ttm | TransUnion Quote

TransUnion is gaining through its strategic collaboration and partnerships. In recent months, TransUnion expanded its collaboration with FreeWheel, integrating TruAudience Data Marketplace with Audience Manager for improved TV ad audience match rates. A partnership with AdQuick enhances OOH advertising with TruAudience's consumer insights. Shift Technology aligns with TransUnion for insurers to feed TruLookup data into Claims Fraud Detection models. Getaround integrates TransUnion’s TruVision Traditional Auto Insurance Score into its TrustScore AI model, thus improving risk assessment and attracting highly rated drivers.

Factors Against

TransUnion's current ratio (a measure of liquidity) at the end of the third quarter of 2023 was 1.54, lower than the year-ago quarter’s 1.73. Decreasing current ratio does not bode well for the company.

TransUnion faces robust competition across its business segments, geographies and industries, which limits pricing power and impacts profitability. Key rivals include Equifax, Experian, Acxiom, Epsilon, Oracle, LexisNexis and Verisk Analytics. The dynamic market necessitates constant innovation and strategic adaptation for sustained success.

TransUnion currently has a Zacks Rank #3 (Hold).

Stocks to Consider

Here are a few better-ranked stocks from the Business Services sector:

Gartner IT: The Zacks Consensus Estimate of Gartner’s 2023 revenues indicates 7.9% growth from the year-ago reported figure, while earnings are expected to decline 1.9%. The company has beaten the consensus estimate in all four quarters, with an average surprise of 34.4%.

IT sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

DocuSign DOCU: The Zacks Consensus Estimate of DOCU’s 2023 revenues indicates 8.6% growth from the year-ago reported figure, while earnings are expected to grow 29.1%. The company has beaten the consensus estimate in all four quarters, the average surprise being 27.1%.

DOCU currently carries a Zacks Rank #2 (Buy).

Broadridge Financial Solutions BR: The Zacks Consensus Estimate of Broadridge’s 2023 revenues indicates 7.7% growth from the year-ago reported figure, while earnings are expected to grow 10.1%. The company has beaten the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

BR presently has a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

TransUnion (TRU) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report