Reasons Why it is Worth Investing in Brady (BRC) Stock Now

Brady Corporation BRC seems to be an attractive option for investors seeking exposure in the security and safety services space. Sound financial performance along with healthy growth opportunities, as evident from upwardly revised earnings estimates, enhances the stock’s attractiveness.

The company is based in Milwaukee, WI, and has a market capitalization of $2.9 billion. It presently carries a Zacks Rank #2 (Buy). The company belongs to the Zacks Security and Safety Services industry, which comes under the ambit of the Zacks Industrial Products sector.

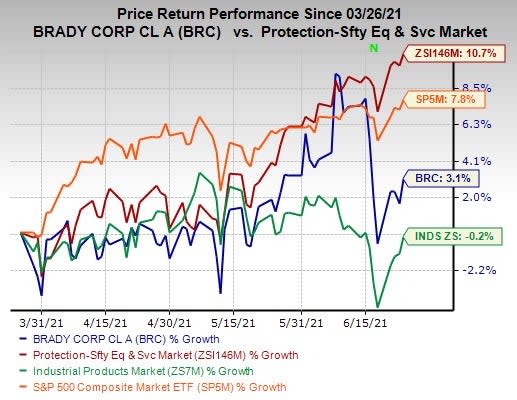

In the past three months, the company’s shares have gained 3.1% compared with the industry’s growth of 10.7%. Notably, the S&P 500 expanded 7.8%, while the sector declined 0.2% in the same timeframe.

Image Source: Zacks Investment Research

Below we discussed why Brady is a worthy investment option.

Earnings Performance and Projections: The company’s results for the third quarter of fiscal 2021 (ended April 2021) were impressive. Its earnings surpassed the Zacks Consensus Estimate by 2.90% and sales surprise was 3.69%. On a year-over-year basis, its earnings grew 173.1%, owing to sales and margin growth.

In the quarters ahead, the company is poised to benefit from the solid product and service offerings as well as improving market conditions, investments in research and marketing, and buyout activities. For fiscal 2021 (ending July 2021), Brady anticipates earnings of $2.58-$2.68 per share, higher than the previously mentioned $2.48-$2.58. Also, the bottom line in the fourth quarter (ending July 2021) is expected to be 64-74 per share, suggesting year-over-year growth of 20-40%.

Diversified Business Structure: Brady has exposure in multiple end-markets, including aerospace, telecommunications, medical, electronics, manufacturing, electrical, and construction. Such diversification helps it offset weakness in one or multiple markets with strength in others.

Improving operating conditions in end-market served boosted the company’s sales performance in the third quarter of fiscal 2021. Revenues increased 11.1%, with organic sales rising 6.5%. Brady anticipates organic revenue growth in low-teen percentages for the fiscal fourth quarter.

Buyouts: Brady follows a policy of acquiring businesses to gain access to new customers, regions and product lines. In June 2021, the company acquired Salt Lake City, UT-based The Code Corporation. The buyout is anticipated to strengthen Brady’s presence in the industrial track-and-trace arena.

Further, Brady acquired the U.K.-based Magicard Limited for $59 million and Finland-based Nordic ID Oyj for $13 million in May 2021. While the Magicard buyout is expected to boost Brady’s offerings related to encoding and rigid-card printing, the Nordic ID acquisition is expected to enhance Brady’s RFID product offerings.

Notably, Brady anticipates Code, Nordic ID and Magicard buyouts to enhance its revenue-generation capabilities by $11 million in the fourth quarter of fiscal 2021. The impacts of the buyouts on earnings are expected to be minimal.

Shareholders’ Rewards: Dividend payouts and share buybacks have been Brady’s preferred way of rewarding its shareholders. In the first nine months of fiscal 2021 (ended April 2021), the company distributed dividends of $34.3 million to its shareholders, reflecting a slight decrease of 0.5% from the year-ago period. Notably, it announced a hike of one cent in its annual dividend rate in September 2020. The annual dividend rate now stands at 88 cents, with the quarter rate at 22 cents.

In addition, the company repurchased shares worth $3.6 million in the first nine months of fiscal 2021, down from $64.1 million worth of shares bought in the year-ago period. A healthy cash flow position will likely help it reward its shareholders.

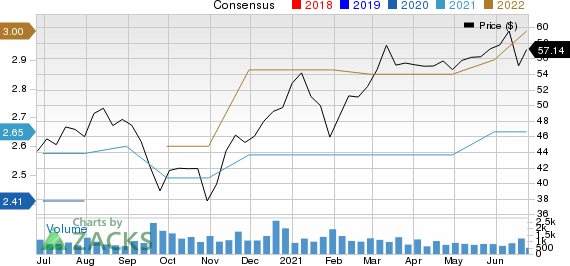

Earnings Estimate Revisions: The company’s earnings estimates have increased in the past 60 days. Currently, the Zacks Consensus Estimate for earnings is pegged at 70 cents for the fourth quarter of 2021, reflecting an increase of 1.4% from the 60-day-ago figure.

Brady Corporation Price and Consensus

Brady Corporation price-consensus-chart | Brady Corporation Quote

Also, earnings estimates are pegged at $2.65 for fiscal 2021 and $3.00 for fiscal 2022 (ending July 2022), reflecting increases of 3.1% and 5.3% from the 60-day-ago figures, respectively.

Other Key Picks

Some other top-ranked stocks in the industry are Verra Mobility Corporation VRRM, Ituran Location and Control Ltd. ITRN and Johnson Controls International plc JCI, each currently carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, earnings estimates for the stocks have improved for the current year. Further, earnings surprise for the last reported quarter was 9.09% for Verra Mobility, 14.29% for Ituran Location and 6.12% for Johnson Controls.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson Controls International plc (JCI) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

Ituran Location and Control Ltd. (ITRN) : Free Stock Analysis Report

VERRA MOBILITY CORP (VRRM) : Free Stock Analysis Report

To read this article on Zacks.com click here.