Red River Bancshares Inc (RRBI) Reports Mixed Annual Results Amidst Economic Challenges

Net Income: Q4 net income increased to $8.3 million, up 3.4% from Q3, but annual net income fell by 5.5% to $34.9 million compared to the previous year.

Earnings Per Share (EPS): Q4 EPS rose to $1.16, while annual EPS decreased to $4.86.

Net Interest Margin: Improved to 2.82% in Q4, reflecting higher yields on securities and loans.

Assets: Total assets grew by 2.0% to $3.13 billion, driven by a $42.0 million increase in deposits.

Loans Held for Investment (HFI): Increased by 2.3% to $1.99 billion due to new loan activity.

Stock Repurchase: Completed the 2023 stock repurchase program and approved a new $5.0 million program for 2024.

Liquidity: Maintained strong liquidity with $305.4 million in cash and cash equivalents and $1.46 billion in additional liquidity sources.

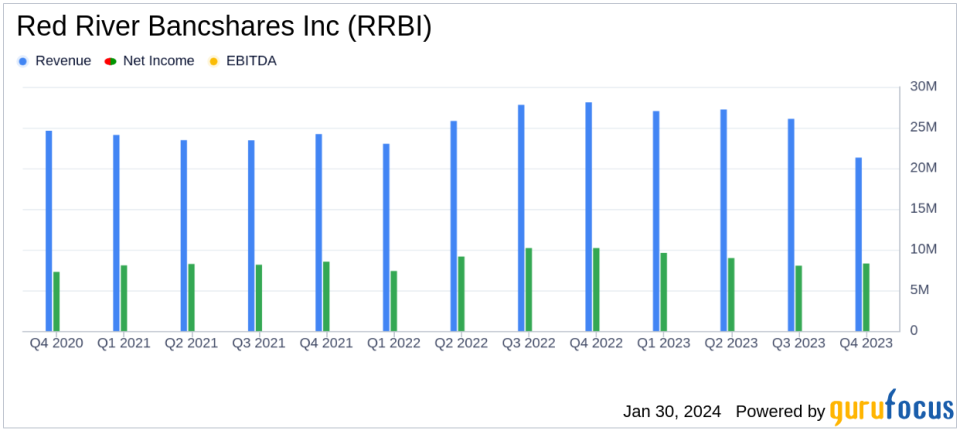

On January 30, 2024, Red River Bancshares Inc (NASDAQ:RRBI) released its 8-K filing, detailing its financial performance for the fourth quarter and year-end of 2023. The bank holding company for Red River Bank reported a mixed set of results, with an increase in quarterly earnings but a decrease in annual net income compared to the previous year.

Red River Bancshares Inc, a community-focused bank, offers a variety of banking services including commercial real estate, residential, and industrial loans. The bank also provides treasury management, private banking, brokerage, and other banking services, catering to a diverse clientele.

The fourth quarter saw an uptick in net income to $8.3 million, a 3.4% increase from the third quarter, attributed to higher net interest income and lower operating expenses. However, the annual net income for 2023 was $34.9 million, a 5.5% decrease from 2022, with a return on assets of 1.15% and a return on equity of 12.44%. The bank's net interest margin improved to 2.82% in the fourth quarter, reflecting higher yields on securities and loans.

Assets grew to $3.13 billion, bolstered by a $42.0 million increase in deposits, primarily from public entity customers. The bank also experienced solid loan growth, with loans HFI reaching $1.99 billion due to new loan activity across Louisiana markets.

Red River Bancshares Inc completed its 2023 stock repurchase program and announced a new $5.0 million stock repurchase program for 2024. The bank's liquidity remained robust, with $305.4 million in cash and cash equivalents and access to $1.46 billion from other liquidity sources.

Despite the challenges faced by the banking industry in 2023, Red River Bancshares Inc maintained a strong capital position and asset quality. The bank's President and CEO, Blake Chatelain, expressed satisfaction with the fourth-quarter results and optimism for the momentum carrying into 2024.

Red River Bancshares Inc's commitment to growth and value for shareholders was further evidenced by the inclusion of Red River Bank in the "2023 Best Banks to Work For" ranking by American Banker publication.

Looking ahead, the bank anticipates the Federal Open Market Committee (FOMC) may lower the federal funds rate in 2024, which could impact net interest income and margin. However, the bank expects to continue redeploying cash flows into higher yielding assets, potentially benefiting net interest income and margin.

For a detailed analysis of Red River Bancshares Inc's financial performance and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Red River Bancshares Inc for further details.

This article first appeared on GuruFocus.