Do Red River Bancshares' (NASDAQ:RRBI) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Red River Bancshares (NASDAQ:RRBI). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Red River Bancshares

Red River Bancshares' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Red River Bancshares managed to grow EPS by 15% per year, over three years. That's a pretty good rate, if the company can sustain it.

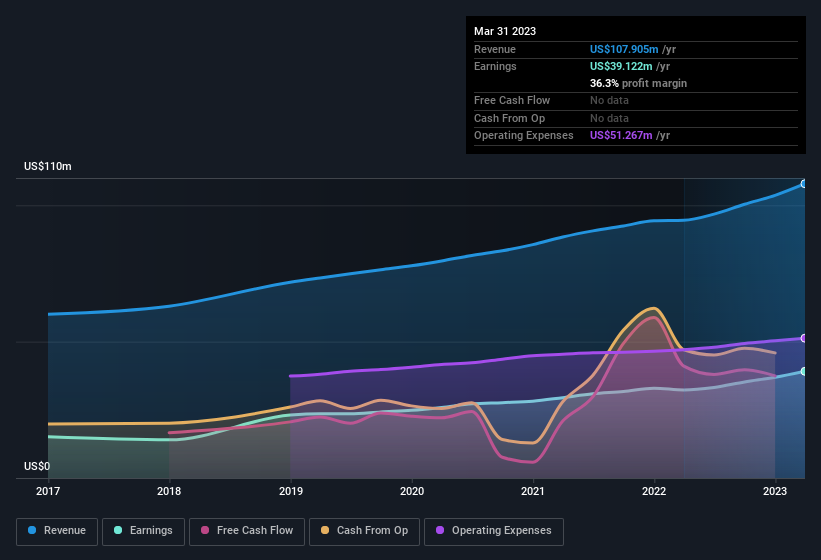

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Red River Bancshares' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note Red River Bancshares achieved similar EBIT margins to last year, revenue grew by a solid 14% to US$108m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Red River Bancshares' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Red River Bancshares Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Red River Bancshares insiders have a significant amount of capital invested in the stock. Notably, they have an enviable stake in the company, worth US$105m. That equates to 33% of the company, making insiders powerful and aligned with other shareholders. Looking very optimistic for investors.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between US$200m and US$800m, like Red River Bancshares, the median CEO pay is around US$2.5m.

The Red River Bancshares CEO received total compensation of just US$794k in the year to December 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Red River Bancshares To Your Watchlist?

As previously touched on, Red River Bancshares is a growing business, which is encouraging. The fact that EPS is growing is a genuine positive for Red River Bancshares, but the pleasant picture gets better than that. Boasting both modest CEO pay and considerable insider ownership, you'd argue this one is worthy of the watchlist, at least. Before you take the next step you should know about the 1 warning sign for Red River Bancshares that we have uncovered.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here