Red Robin Gourmet Burgers Inc (RRGB) Reports Mixed Fiscal Year 2023 Results

Revenue: Total revenues increased to $1.3 billion in fiscal 2023, up $37.5 million from the previous year.

Net Loss: Net loss improved by $57.7 million to $21.2 million in fiscal 2023.

Adjusted EBITDA: Adjusted EBITDA saw a 33% increase to $68.9 million.

Comparable Restaurant Revenue: Increased by 1.6% in fiscal 2023.

Debt Repayment and Stock Repurchase: Repaid $24.9 million of debt and repurchased $10.0 million of stock.

Sale-Leaseback Transactions: Generated net proceeds of $58.8 million with a net gain of $29.4 million.

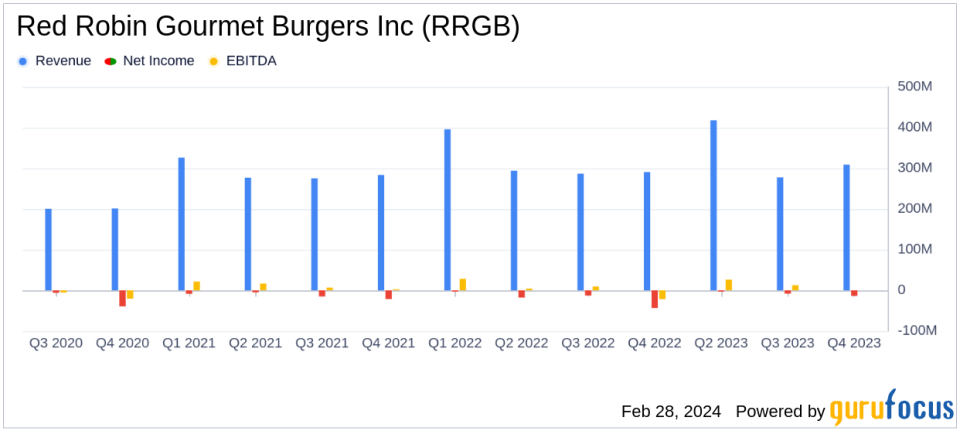

On February 28, 2024, Red Robin Gourmet Burgers Inc (NASDAQ:RRGB) released its 8-K filing, detailing the financial outcomes for its fiscal fourth quarter and the full year ended December 31, 2023. The company, known for its gourmet burgers and family-friendly dining, reported a modest increase in comparable restaurant revenue and a significant improvement in net loss compared to the previous fiscal year.

Red Robin's fiscal 2023 highlights include a total revenue of $1.3 billion, marking an increase from fiscal 2022. This growth was partially attributed to an additional week in the fiscal calendar, contributing $24.5 million in restaurant revenue. The company also reported a net loss of $21.2 million, which, while still a loss, represents a substantial improvement over the previous year's net loss of $78.9 million. Adjusted EBITDA, a key metric for evaluating a company's operating performance, increased by 33% to $68.9 million.

Despite these positive trends, the company faced challenges, including a 2.7% decrease in comparable restaurant revenue in the fourth quarter of fiscal 2023 compared to the same quarter in the previous year. This decline highlights the ongoing challenges in the restaurant industry, such as fluctuating consumer demand and competitive pressures.

Red Robin's financial achievements, including the repayment of debt and stock repurchase, reflect a strategic approach to strengthening the balance sheet and returning value to shareholders. The successful completion of two sale-leaseback transactions further bolstered the company's financial position, allowing for a reduction in long-term debt and generating significant gains.

Fiscal Year 2023 Financial Summary

The company's income statement reveals a net loss per diluted share of $1.34 for fiscal 2023, an improvement from the $4.98 loss per share in the previous year. The balance sheet shows a decrease in total assets from $832.1 million in 2022 to $741.9 million in 2023, while total liabilities also decreased, indicating a reduction in overall debt levels.

Red Robin's liquidity position includes cash and cash equivalents of approximately $23.6 million and available borrowing capacity under its credit facility, providing the company with financial flexibility moving forward.

CEO G.J. Hart commented on the fiscal year's results, stating, "2023 was a successful transformational year for our iconic brand." Hart emphasized the company's operational investments and the positive feedback from guests. He also noted the significant financial progress made, including the increase in comparable restaurant revenue and Adjusted EBITDA, as well as the strengthened balance sheet.

"While we have made significant progress across all points of our North Star Plan, 2023 was only the first step of our multi-year strategy. In 2024 we expect continued operational execution of a great Guest experience, additional marketing support and new campaigns to communicate the upgrades we have made, the launch of our new loyalty program, and aligning incentives under our Partner compensation model, will accelerate our path to achieve our goal - to bring Guests back into our restaurants for connection over craveable food that only Red Robin can provide," Hart concluded.

Looking ahead to fiscal 2024, Red Robin anticipates total revenue between $1.250 billion and $1.275 billion, with a low single-digit percentage decline in comparable restaurant revenue. The company also expects restaurant-level operating profit margins of 12.5% to 13.5% and Adjusted EBITDA of $60 million to $70 million, with capital expenditures projected to be between $25 million and $35 million.

Red Robin's performance in fiscal 2023 demonstrates resilience and strategic financial management in a challenging industry. The company's focus on operational excellence and guest experience, coupled with prudent financial stewardship, positions it for potential growth and improved profitability in the coming year.

For more detailed financial information and the full earnings report, investors and interested parties can access the 8-K filing on the SEC website.

Explore the complete 8-K earnings release (here) from Red Robin Gourmet Burgers Inc for further details.

This article first appeared on GuruFocus.